Las Vegas Sands Corp. ( (NYSE:LVS) ) just released its second quarter fiscal 2017 financial results, posting earnings of $0.73 per share and revenues of $3.14 billion. Currently, LVS is a Zacks Rank #2 (Buy) and is up 1.38% to $62.50 per share in trading shortly after its earnings report was released.

Las Vegas Sands:

Beat earnings estimates. The company posted earnings of $0.73 per share (excluding four cents from non-recurring items), defeating the Zacks Consensus Estimate of $0.61.

Beat revenue estimates. The company saw revenue figures of $3.14 billion, beating our consensus estimate of $3.02 billion.

Net revenue for the second quarter of 2017 increased 18.6% to $3.14 billion, compared to $2.65 billion in the second quarter of 2016. Net income increased 61.9% to $638 million in the second quarter, compared to $394 million in the year-ago quarter.

Gross gaming revenues in Macau increased 21.9% year-over-year, while premium mass revenues jumped 40%.

On a GAAP basis, operating income in the second quarter of 2017 increased 57.5% to $816 million, compared to $518 million in the second quarter of 2016. Adjusted net income attributable to Las Vegas Sands (a non-GAAP measure) increased 36.8% to $576 million.

“We are pleased to have delivered a strong set of financial results during the quarter, led by another quarter of growth in Macao and a record-setting performance in Singapore.,” said CEO Sheldon Adelson. “The benefits of our convention-based Integrated Resort business model remain evident in our financial results, with adjusted property EBITDA increasing 26.5% compared to the second quarter of 2016, reaching $1.21 billion. We also continued to return excess capital to shareholders during the quarter.”

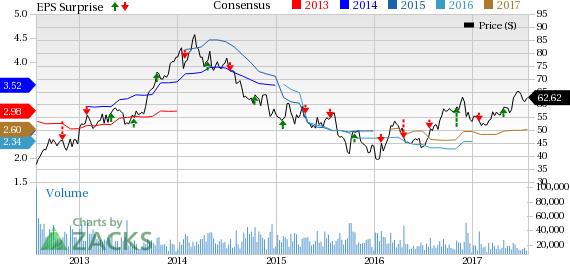

Here’s a graph that looks at LVS’s recent earnings performance:

Las Vegas Sands Corp. is a hotel, gaming, and retail Mall Company headquartered in Las Vegas, Nevada. The company owns The Venetian Resort Hotel Casino, the Sands Expo and Convention Center, Venetian Interactive, an internet based venture, and Venetian Macao Limited.

Check back later for our full analysis on LVS’s earnings report!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Las Vegas Sands Corp. (LVS): Free Stock Analysis Report

Original post

Zacks Investment Research