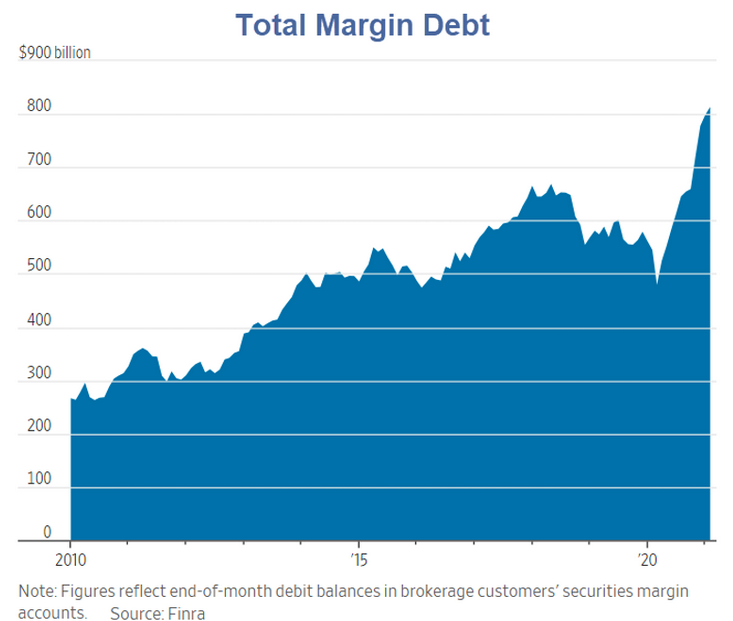

Margin debt is rising at the fastest rate since 2007 and before that, 1999, right before the dotcom bubble burst.

Everything Rally

The "Everything Rally" is underway, fueled by borrowed money.

As of late February, investors had borrowed a record $814 billion against their portfolios, according to data from the Financial Industry Regulatory Authority, Wall Street’s self-regulatory arm. That was up 49% from one year earlier, the fastest annual increase since 2007, during the frothy period before the 2008 financial crisis. Before that, the last time investor borrowings had grown so rapidly was during the dot-com bubble in 1999.

Best Quotes

- “It fuels bull markets and it exacerbates bear markets and to a certain extent you put it on the list of irrational exuberance,” said Edward Yardeni, president of consulting firm Yardeni Research. “The further that this stock market goes, the higher that margin debt will go, and when something blows up that will be one of the factors for why stocks are going down.”

- “Speculative short-term trading is always risky, but mixing it with unfamiliar products and markets, leverage, and advice from anonymous individuals is a recipe for disaster,” the CFTC said.

- “The lack of transparency in this market makes it not possible for the average market participant to know what is going on,” said Josh Galper, managing principal of Finadium, a research and advisory firm.

The article points out that some of the borrowing may be for other things such as vacations.

Regardless, it's very risky business.

Once again people have been trained that stocks only go up.