The latest cover of Barron’s rightly proclaims, “It’s a boom time for doomsayers.”

But I’m here to tell you that the paranoia-inducing prognostications are only going to get bolder and more frequent.

Why? Blame billionaire George Soros.

On Friday, it became a matter of public record that his hedge fund firm increased its bearish bet on stocks – a put position on the S&P 500 Index – by a staggering 154% in the most recent quarter.

At $1.3 billion, the investment now accounts for 11.13% of his holdings. That’s way too high to be merely dismissed as a hedge. A bet this big implies that an investor thinks the stock market is, indeed, headed for a nasty fall.

And as MarketWatch points out, “George [has] made some big, crazy, winning bets in the past.”

Like I said, the doom-and-gloom crowd is going to feast on this new information to try to scare you stockless.

The only problem? The market isn’t going to cooperate. Not anymore, at least. And here’s why…

Back in Rally Mode

After throwing an emerging markets-inspired temper tantrum in January, U.S. stocks are back in rally mode.

Consider: The Nasdaq just hit a new all-time high, thanks to a seven-day winning streak. The Dow and S&P 500 Index are within striking distance of hitting highs, too.

This isn’t some dead cat bounce, either. The rebound is legitimate. How can I be so sure?

Well, two weeks ago, I informed you about the growing disconnect between stock prices and earnings growth.

But I told you it was “only a matter of time” before stocks started trading based on the underlying strength in earnings. And that time has come.

With nearly 90% of S&P 500 companies reporting results, fourth-quarter profits are on track for a 9.3% increase, according to RBC Capital Markets. That’s three full points higher than analysts expected.

This solid outperformance materialized over the last two weeks, as well, which coincides with the market turnaround.

Now, a few days ago, Reuters’ Ryan Vlastelica noted that investors remain “unsure about the economy and earnings.”

Well, at this point, we can go ahead and cross earnings off that list. They continue to impress, which is materializing in rising stock prices.

Strength on the Top Line

It’s not just earnings that are surprising to the upside. Sales figures are coming in uncharacteristically strong, too.

“We’re starting to see revenue growth in a lot of companies,” says Dan Veru, Chief Investment Officer at Palisade Capital Management.

And it’s about time!

For the majority of this bull market, corporate profits increased on the backs of cutting costs to expand margins. Yet, as many bemoaned (including yours truly), that’s not a sustainable trend.

Especially when profit margins stand at record levels, like they do now.

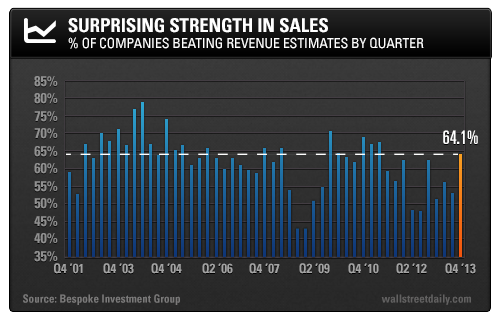

In terms of quantifying the sales strength, Bespoke Investment Group captures it best. They report that the revenue “beat rate” – the percentage of companies reporting better-than-expected sales figures – rests at 64.1%.

It’s been ages since we’ve witnessed such a high reading. Not since the second quarter of 2011, to be exact.

What’s more, we could be in store for even stronger sales growth.

I say that because analysts currently estimate that sales for S&P 500 companies will come in at 1.1 times the GDP growth rate this year. However, historically, sales rise about 2.5 times faster than GDP, according to Bloomberg.

In other words, the current sales estimates are way too low. And we all know what happens when companies beat expectations… stocks rise.

Bottom line: For corporate profits – and, in turn, stock prices – to keep climbing, sales need to start growing. And that’s finally happening. (Sorry, doomsayers.)

Of course, we’re no longer in a “rising tide” market, whereby all stocks promise to rise in lockstep with one another. As I’ve shared before, we’re in a stock picker’s market, instead. And that means we need to choose our investments much more wisely.

With that in mind, yesterday I shared why I wouldn’t dare invest in retail stocks right now. Come tomorrow, I’ll share the one sector I’m most optimistic about investing in, as well as several specific opportunities.