The US dollar came under pressure during the week on doubts about what the Fed will do this week and the euro took full advantage. The week ahead will be all about the Fed and nothing else. Will they raise interest rates for the first time in 9 years, or will they disappoint the market once again?

The euro continued its run higher after the ECB decision the prior week as the looming FOMC decision draws ever closer. The US dollar was sold off as doubts creep into the market about whether the Fed will raise or not. This put further pressure on euro short positions and a squeeze developed which pushed through the resistance and the 100 day MA.

EU GDP remained solid at 1.6% y/y and US unemployment claims ticked higher which aided in the US dollar sell off. The jitters creeped into the US Equity markets, starting with selling in the Tech sector which led to general volatility and a flight of capital from US dollar positions.

The week ahead is going to be all about the US FOMC. Draghi is due to speak early this week and EU PMI results are due, but these will be largely irrelevant with the FOMC making a decision on US interest rates. The market expects the first hike in 9 years, so will they follow through, or will they disappoint the market? Even though the Fed is expected to raise rates, it is so heavily priced in that the market response will be unpredictable. The only thing forecastable is plenty of volatility.

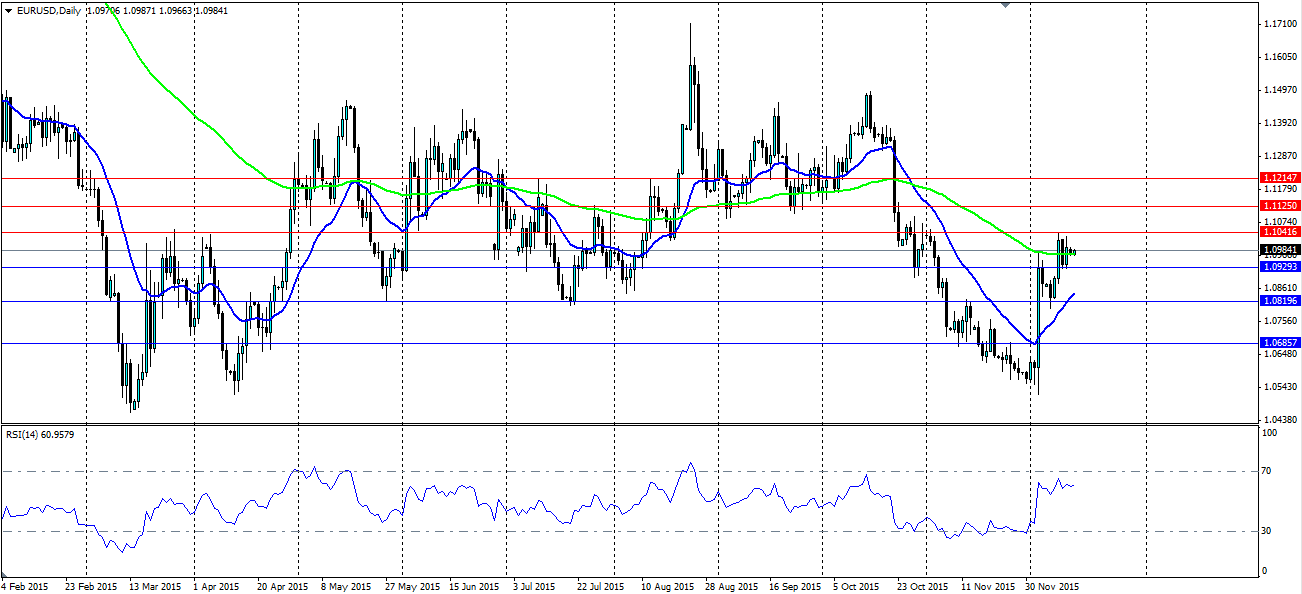

Technicals show the levels the pair is playing off as it climbs up the chart. Price has climbed over the 100 day MA which would generally be a bullish signal, but we are staying neutral simply because of the biggest risk event of the year (bar the SNB black swan event) the FOMC meeting on Wednesday. Volatility is likely to be extreme, but nevertheless look for resistance at 1.1041, 1.1125 and 1.1214 while support is found at 1.0929, 1.0819 and 1.0685.