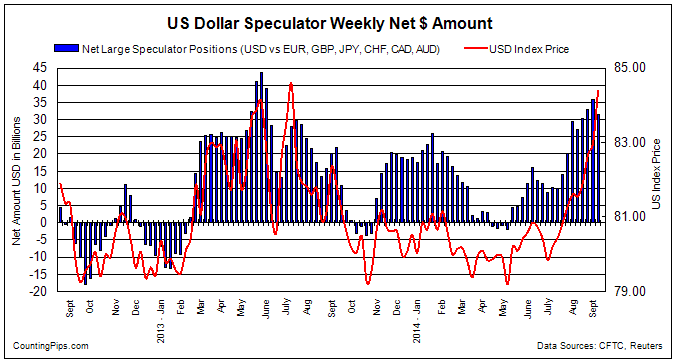

The latest data for the weekly Commitment of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and forex speculators pulled back on their overall US dollar bullish bets last week after three straight weeks of rises that brought bullish levels to the highest level since the middle of 2013.

Non-commercial large futures traders, including hedge funds and large speculators, had an overall US dollar long position totaling $31.63 billion as of Tuesday September 9th, according to the latest data from the CFTC and dollar amount calculations by Reuters. This was a weekly change of -$4.25 billion from the $35.88 billion total long position that was registered on September 2nd, according to the Reuters calculation that totals the US dollar contracts against the combined contracts of the euro, British pound, Japanese yen, Australian dollarD, Canadian dollar and the Swiss franc.

The aggregate US dollar bullish position had gained for three consecutive weeks and for six out of the previous seven weeks before last week’s retreat in positions. The US dollar index, meanwhile, reached the highest level since July 2013 when it crossed over the 84.00 threshold this week.

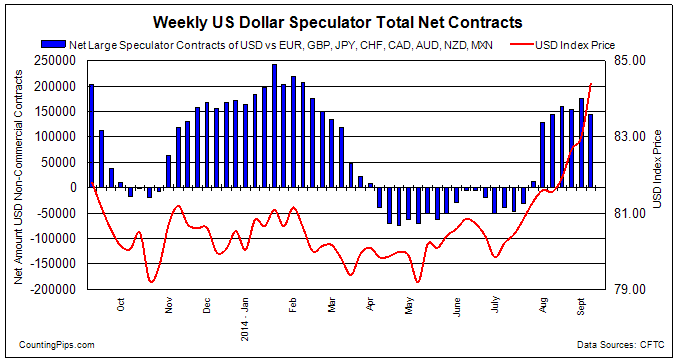

Overall Speculative Net Contracts

In terms of total speculative contracts, overall US dollar contracts also retreated last week to +144,377 contracts as of Tuesday September 9th. This was a change by -30,499 contracts from the total of +174,876 contracts as of Tuesday September 2nd. This total US dollar contracts calculation takes into account more currencies than the Reuters dollar amount total and is derived by adding the sum of each individual currencies net position versus the dollar. Currency contracts used in the calculation are the euro, British pound, Japanese yen, Swiss franc, Canadian dollar, Australian dollar, New Zealand dollar and the Mexican peso.

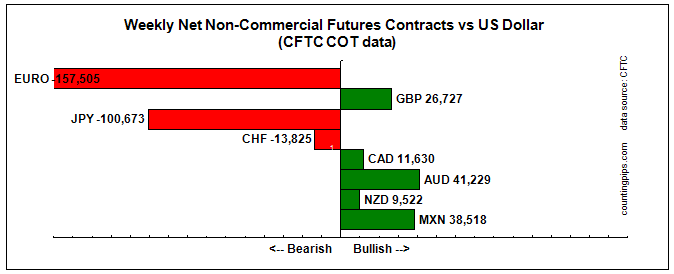

Major Currency Weekly Levels & Changes:

Overall changes on the week for the major currencies showed that large speculators raised their bets last week in favor of the euro, British pound sterling, Japanese yen and the Canadian dollar while decreasing weekly bets for the Swiss franc, Australian dollar, New Zealand dollar and the Mexican peso.

Notable changes on the week for the Major Currencies:

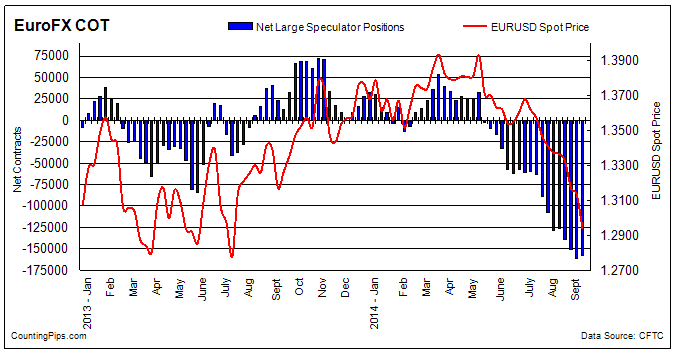

- Euro positions rebounded ever so slightly last week after three weeks of decreases. The spec positions were at the lowest level since 2012 before the small turnaround last week while the EURUSD exchange rate is trading below the major 1.3000 level

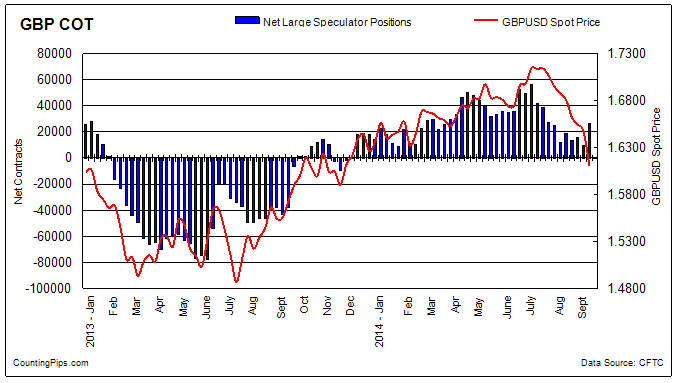

- British pound sterling positions rebounded last week to over the +20,000 contracts for the first time in six weeks. Expect views of this currency to be volatile this week with the Scottish independence vote approaching on Sept 18th

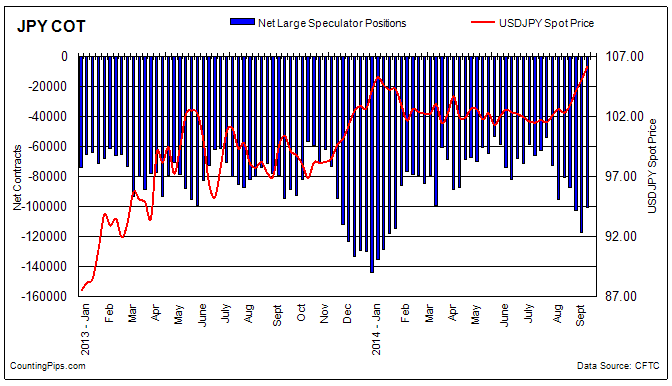

- Japanese yen bets gained last week (+16,635) after dropping for three straight weeks. Yen bets remain heavily bearish and weakness in the yen picked up later this week as the USDJPY surpassed the 107 exchange rate

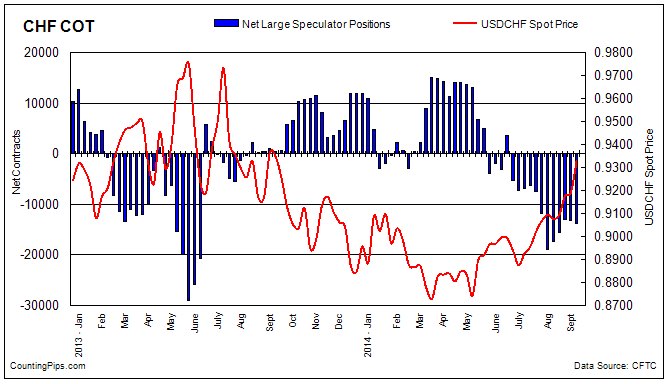

- Swiss franc bets edged slightly lower last week for a 2nd week. Franc positions have been on the bearish side now for twelve straight weeks

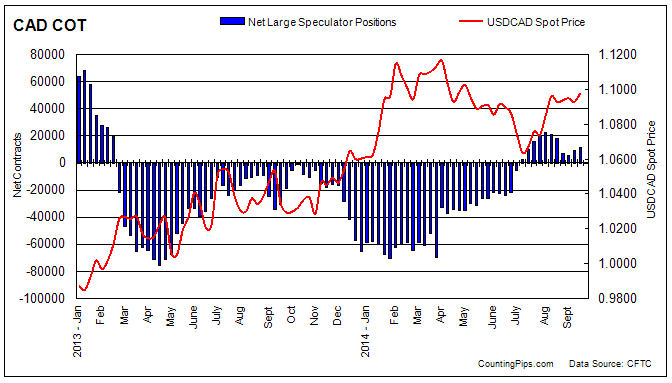

- Canadian dollar positions gained slightly for a second week. However, the US dollar strength last week pushed the USDCAD exchange rate above the 1.1000 major level

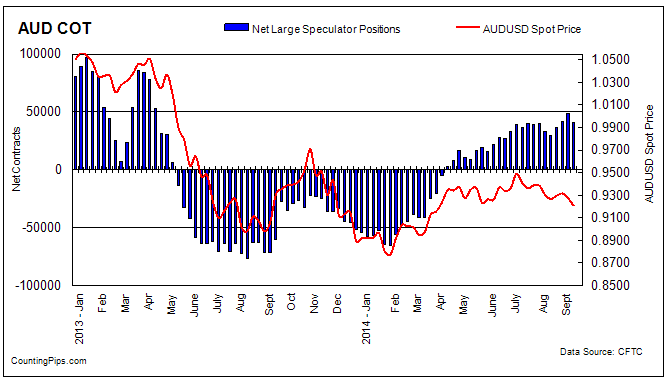

- Australian dollar net positions retreated last week after rising for three straight weeks and to the highest bullish level since April 2013. The AUDUSD pair dropped rather sharply last week to close the week just above the 0.9000 major level

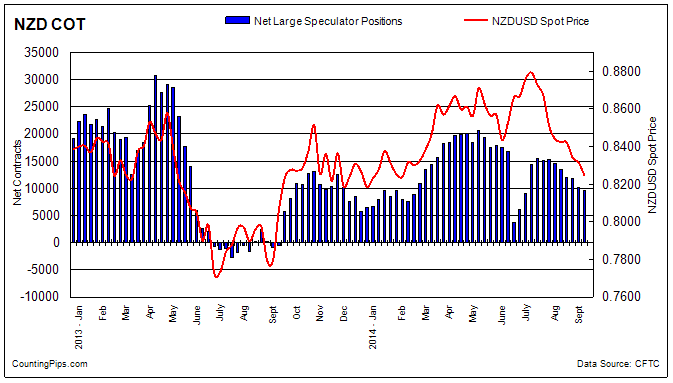

- New Zealand dollar net positions fell for a sixth straight week as the NZDUSD exchange rate continued its recent downtrend last week

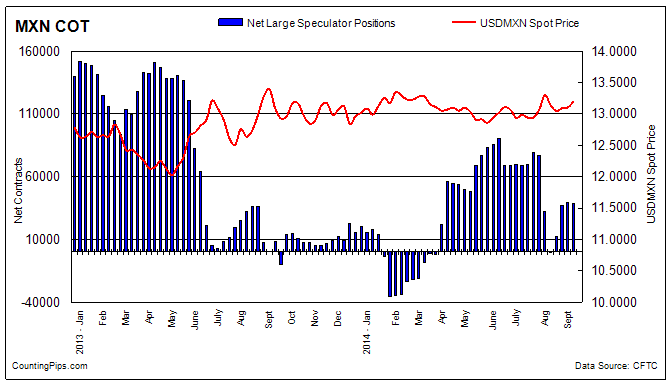

- Mexican peso positions dipped slightly last week after gaining for three weeks. The peso spec positions fell into bearish territory on August 12th but have rebounded since to a position above +30,000 contracts for the past three weeks

This latest COT data is through Tuesday September 9th and shows a quick view of how large speculators and for-profit traders (non-commercials) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Please see the individual currency charts and their respective data points below.

Weekly Charts: Large Speculators Weekly Positions vs Currency Spot Price

EuroFX:

Last Six Weeks data for EuroFX futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 08/05/2014 | 379004 | 55179 | 183926 | -128747 | -20672 |

| 08/12/2014 | 376424 | 51596 | 177613 | -126017 | 2730 |

| 08/19/2014 | 396460 | 56774 | 195599 | -138825 | -12808 |

| 08/26/2014 | 402709 | 53989 | 204646 | -150657 | -11832 |

| 09/02/2014 | 419850 | 59398 | 220821 | -161423 | -10766 |

| 09/09/2014 | 484306 | 59376 | 216881 | -157505 | 3918 |

British Pound Sterling:

Last Six Weeks data for Pound Sterling futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 08/05/2014 | 230801 | 66437 | 54316 | 12121 | -12789 |

| 08/12/2014 | 223719 | 65348 | 46549 | 18799 | 6678 |

| 08/19/2014 | 237291 | 72230 | 58943 | 13287 | -5512 |

| 08/26/2014 | 233435 | 71002 | 55535 | 15467 | 2180 |

| 09/02/2014 | 238973 | 67538 | 58090 | 9448 | -6019 |

| 09/09/2014 | 256591 | 81330 | 54603 | 26727 | 17279 |

Japanese Yen:

Last Six Weeks data for Yen Futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 08/05/2014 | 192906 | 9896 | 105295 | -95399 | -22330 |

| 08/12/2014 | 192140 | 12518 | 93615 | -81097 | 14302 |

| 08/19/2014 | 203180 | 17976 | 105247 | -87271 | -6174 |

| 08/26/2014 | 218009 | 19512 | 122403 | -102891 | -15620 |

| 09/02/2014 | 230937 | 15485 | 132793 | -117308 | -14417 |

| 09/09/2014 | 255624 | 17280 | 117953 | -100673 | 16635 |

Swiss Franc:

Last Six Weeks data for Franc futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 08/05/2014 | 57238 | 9247 | 28100 | -18853 | -7089 |

| 08/12/2014 | 51981 | 5247 | 22606 | -17359 | 1494 |

| 08/19/2014 | 50414 | 6174 | 21666 | -15492 | 1867 |

| 08/26/2014 | 53761 | 7466 | 20505 | -13039 | 2453 |

| 09/02/2014 | 60436 | 9166 | 22333 | -13167 | -128 |

| 09/09/2014 | 77317 | 9856 | 23681 | -13825 | -658 |

Canadian Dollar:

Last Six Weeks data for Canadian dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 08/05/2014 | 115261 | 48944 | 27489 | 21455 | -1236 |

| 08/12/2014 | 108979 | 44053 | 26055 | 17998 | -3457 |

| 08/19/2014 | 113301 | 41844 | 34563 | 7281 | -10717 |

| 08/26/2014 | 108441 | 38522 | 32859 | 5663 | -1618 |

| 09/02/2014 | 105984 | 35333 | 26142 | 9191 | 3528 |

| 09/09/2014 | 102951 | 33400 | 21770 | 11630 | 2439 |

Australian Dollar:

Last Six Weeks data for Australian dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 08/05/2014 | 98196 | 60860 | 27560 | 33300 | -6306 |

| 08/12/2014 | 94030 | 54691 | 25145 | 29546 | -3754 |

| 08/19/2014 | 103432 | 65747 | 29173 | 36574 | 7028 |

| 08/26/2014 | 107819 | 71658 | 29720 | 41938 | 5364 |

| 09/02/2014 | 114146 | 77050 | 28003 | 49047 | 7109 |

| 09/09/2014 | 126831 | 73321 | 32092 | 41229 | -7818 |

New Zealand Dollar:

Last Six Weeks data for New Zealand dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 08/05/2014 | 25603 | 18949 | 4449 | 14500 | -789 |

| 08/12/2014 | 25214 | 17913 | 4484 | 13429 | -1071 |

| 08/19/2014 | 24048 | 16796 | 4764 | 12032 | -1397 |

| 08/26/2014 | 23619 | 16405 | 4564 | 11841 | -191 |

| 09/02/2014 | 23319 | 15623 | 5451 | 10172 | -1669 |

| 09/09/2014 | 24920 | 14369 | 4847 | 9522 | -650 |

Mexican Peso:

Last Six Weeks data for Mexican Peso futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 08/05/2014 | 143236 | 77535 | 45102 | 32433 | -44682 |

| 08/12/2014 | 154694 | 51933 | 51974 | -41 | -32474 |

| 08/19/2014 | 141175 | 56207 | 43800 | 12407 | 12448 |

| 08/26/2014 | 141665 | 71680 | 35010 | 36670 | 24263 |

| 09/02/2014 | 144255 | 75444 | 36280 | 39164 | 2494 |

| 09/09/2014 | 155265 | 71021 | 32503 | 38518 | -646 |

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

The Commitment of Traders report is published every Friday by the Commodity Futures Trading Commission (CFTC) and shows futures positions data that was reported as of the previous Tuesday (3 days behind).

Each currency contract is a quote for that currency directly against the U.S. dollar, a net short amount of contracts means that more speculators are betting that currency to fall against the dollar and a net long position expect that currency to rise versus the dollar.