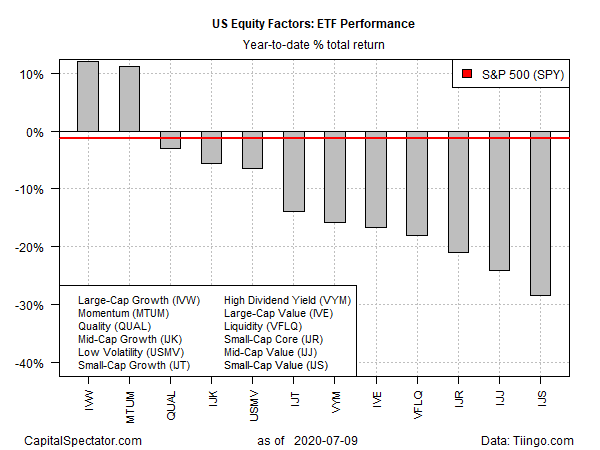

If your US equity strategy is posting a gain this year there’s a good chance that the key driver is a hefty allocation to either the large-cap growth, or momentum factors. These are the only two factor strategies posting gains so far in 2020, based on a set of exchange-traded funds. Otherwise, red ink rules, based on numbers through July 9.

Large-cap growth is the top-performing equity factor via iShares S&P 500 Growth (NYSE:IVW). The fund is up a bit more than 12% so far in 2020. After yesterday’s rally, IVW ended the trading session at a record high.

A close second-place performer: iShares Edge MSCI USA Momentum Factor (NYSE:MTUM), which posted an 11.2% total return through Thursday’s close.

The rest of the factor field continues to suffer varying degrees of loss, ranging from a mild 3.0% year-to-date decline for iShares Edge MSCI USA Quality Factor (NYSE:QUAL) to a deep 28.4% tumble in iShares S&P Small-Cap 600 Value (NYSE:IJS).

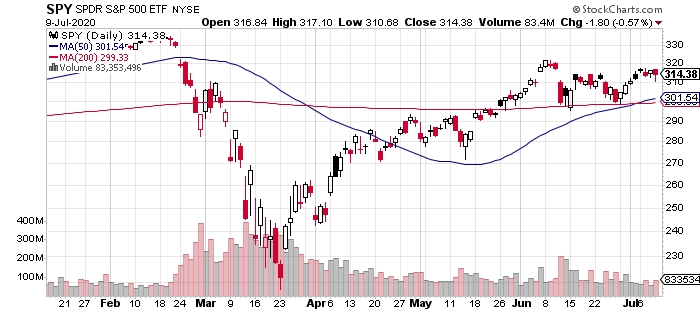

The broad market is also slightly underwater year to date, based on SPDR S&P 500 (NYSE:SPY). At yesterday’s close, SPY was down 1.3% for the year. Although the fund has bounced back sharply after the March correction, SPY has been in a trading range in recent weeks and has yet to fully recover from the previous drawdown.

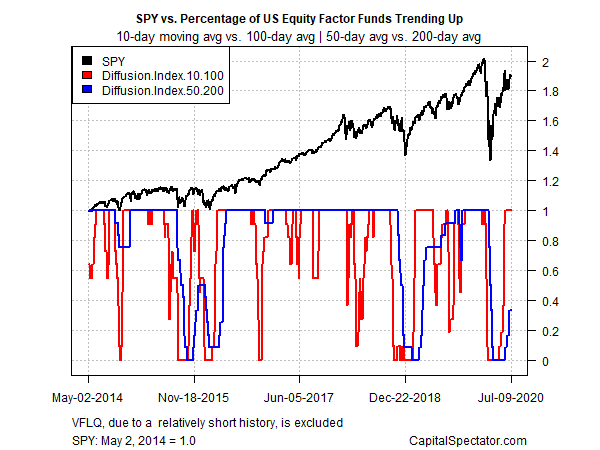

Profiling the factor ETFs listed above continues to show a strong rebound in the short-term trend bias for all the funds. By contrast, the medium-term trend is still struggling to recover from the previous correction. This profile is based on two sets of moving averages. The first measure compares the 10-day average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represent an intermediate measure of the trend (blue line). The key question: Will the relatively weak medium-term trend indicator confirm the bullish shift in the short-term profile?