• Nationwide, large private-sector businesses have outperformed their smaller counterparts in terms of job creation since 2007Q1. However, this big picture hides

considerable regional disparities. In Canada’s two largest provinces, Ontario and Quebec, large firms have contributed very little to this employment recovery.

• This weakness in large-business employment is all the more worrisome for Ontario where it constitutes the dominant segment. Quebec, it should be noted, is also struggling in its dominant segment–small businesses. In the other provinces, instead, large businesses are the ones to have demonstrated the most resilience since 2007.

• Is this a temporary phenomenon in central Canada or does it reflect, instead, a long-range trend? A study by two researchers gives us reason to be less pessimistic.

According to their findings, large businesses destroy proportionally more jobs in times of recession but also create more jobs late into the expansion phase.

• Thus, it is perhaps just a matter of time before large companies contribute to job creation in Ontario and in Quebec. This is to be monitored. The fact remains that a strategy focused on small and midsize businesses is essential given that these jobs represent 63% of total privatesector employment.

Change In Employment By Size Of Business

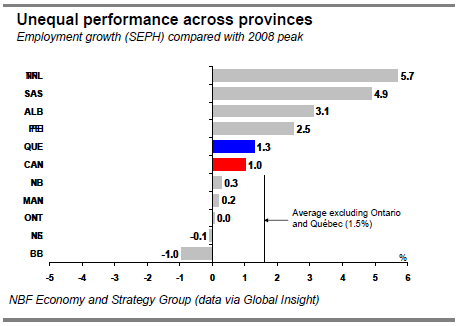

Relative to those of other advanced countries, Canada’s labour market showed considerable resilience during the recent crisis that struck the four corners of the globe. Indeed, the Canadian economy has regained all of the jobs lost during the recession (Chart 1). However, the Canadian provinces vary in how they have fared over this period. Ontario has underperformed Quebec, which in turn has underperformed the rest of Canada as a whole. In this issue of the Weekly Economic Letter, we will seek to evaluate to what degree change in private employment by size of business might explain these different performances.

In order to analyze change in employment by size of business, we must turn to Statistics Canada’s Survey of Employment, Payrolls and Hours (SEPH). This survey, which is akin to the Establishment Survey in the United States, is not as widely known as the Labour Force Survey (LFS), largely because its results are published with some lag.

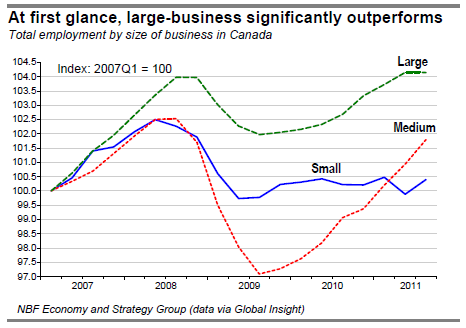

For estimates by size of business, data are presently available up until 2011Q3. In this paper, firms are grouped by the following criteria: large firms employ 500 or more employees, middle firms employ 50 to 499 and small firms are those with less than 50 employees. We removed seasonal variations by applying seasonal adjustments. At first glance, large businesses in Canada appear to have outperformed by far both small and midsize businesses in the past five years (Chart 2).

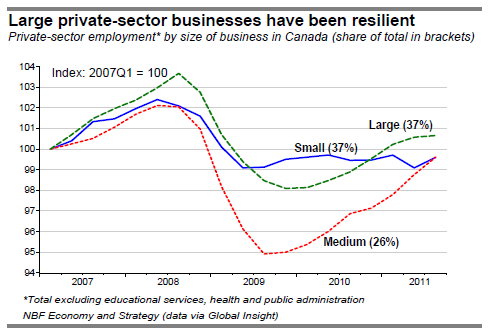

However, it is important to remove public-sector jobs from the SEPH to get a better understanding of what is going on in the private sector. To this end, we excluded three sectors: educational services, health and social services, and public administration. Their inclusion definitely embellished the picture of large firm’s employment. Despite this adjustment, large private-sector businesses in Canada have outperformed the others in terms of employment since 2007Q1 (Chart 3). It is interesting to note, that small firms in Canada showed greater resilience during the recession but they have stagnated since 2009 in terms of employment.

Ontario: Jobs Rebound Sharply In Midsize Firms

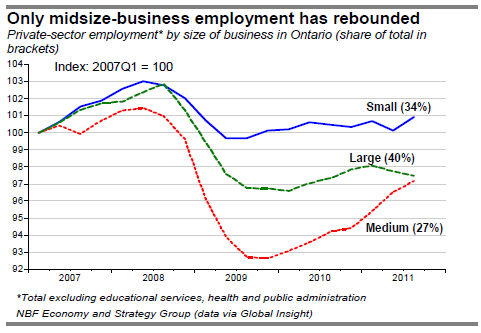

As nationally, job destruction was more limited among small firms in Ontario compared with other businesses. However, since bottoming out in 2009, job creation has been contained for businesses of this size (Chart 4). What is more worrisome about Ontario is that no more than a very modest rebound has also been observed for large businesses, which account for the largest share of the jobs in this province (40% versus 35% for the rest of Canada). Midsize firms, for their part, have registered the sharpest rebound since 2009 but are nevertheless struggling to return to pre-recession levels as the job destruction was much more drastic in businesses of this size.

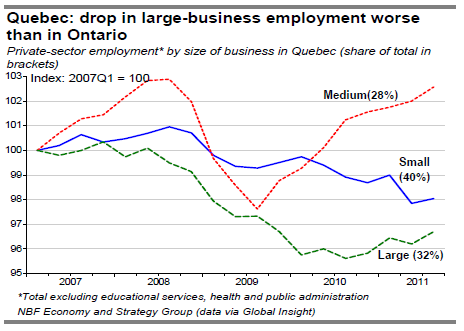

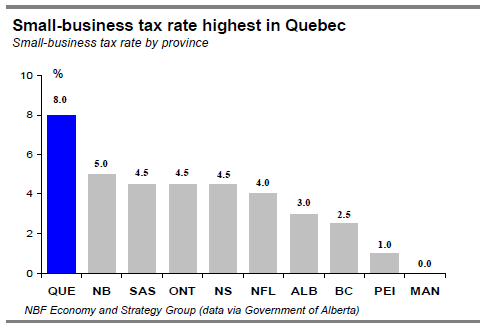

In Quebec, as in Ontario, midsize businesses are the ones to have rebounded best since 2009 (Chart 5). However, Quebec differs from Ontario in that small-business employment has continued to trend down since 2009. This is all the more cause for concern in that this segment accounts for a large portion (40%) of the jobs in Quebec. In this regard, Quebec will need to address its important differential in regards to its small-business tax rate, the highest of all the provinces (Chart 6).

Furthermore, since 2007Q1, the decline in large-business employment has been steeper in Quebec (-3.3%) than in Ontario (-2.5%). In light of these results, it is clear that large private-sector firms have done very little to help employment recover in Canada’s central provinces.

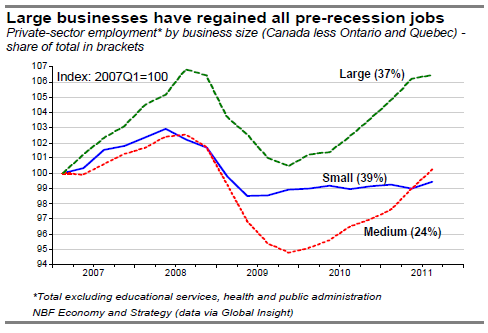

Other Provinces Tell A Different Story

Recuperating all private-sector jobs is proving particularly difficult in Ontario and Quebec, as evidenced by the fact that both provinces in 2011Q3 were still 3.7% and 2.2% below their respective pre-recession employment peaks. In this regard, the other Canadian provinces on the whole are faring relatively better, presenting a smaller shortfall of 1.7%. Large-business employment is the key factor in the disparity (Chart 7). Indeed, in the other provinces, large firms have essentially recouped all their pre-recession jobs, unlike small and medium-size businesses, which continue to lag.

Cyclical Phenomenon Or Long-Range Trend?

How do we explain, then, the weakness in large-business employment in Ontario and Quebec? Might it be that, because of the tentativeness of the recovery, large firms have turned to the self-employed rather than hire employees directly? We believe that the extent of this phenomenon remains limited. According to the LFS, there were 40k more self-employed nationwide in 2011 Q3 relative to 2008 Q3 whereas the shortfall in terms of private-sector jobs in large businesses for this period amounted to 119K.

So is the weakness in large-business employment in Canada during this recovery a temporary phenomenon or a long-range trend? In their study of change in employment by size of business across economic cycles, Moscarini and Postel-Vinay (2009), reached conclusions that give us reason to be less pessimistic. Their research, which covered four cycles in the United States, showed that large firms destroyed proportionally more jobs in times of recession but that they also created more jobs late into the expansion phase.

The same phenomenon had been observed also in Brazil and Denmark, among other places. According to these authors, early in the cycle, businesses hire mostly unemployed workers at a discount. Small businesses normally take advantage of these conditions to do some hiring. Large firms, which are more productive and generally offer better work conditions, do not worry about possible labour shortages later on down the cycle because they know they can always snatch workers away from less productive companies.

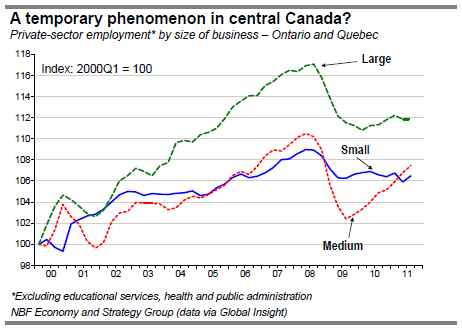

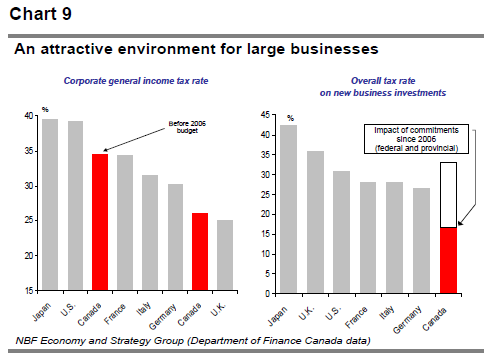

In central Canada, during the expansion period from 2000 to 2008, large firms were the ones to make the greatest progress in terms of employment (Chart 8). There is reason to believe that Canada’s corporate tax strategy provides an attractive environment for large firms. The corporate income tax rate in Canada went from being ranked 5th to 2nd within the G7 since 2006 (chart 9). Meanwhile, Canada’s overall tax rate on new business investments is now the lowest among the G7 countries. These elements contribute to mitigate the adverse impact of the Canadian dollar on large firms.

Conclusion

Nationwide, large private-sector businesses have outperformed their smaller counterparts in terms of job creation since 2007Q1. However, this big picture hides considerable regional disparities. In Canada’s two largest provinces, Ontario and Quebec, large firms have contributed very little to this employment recovery.

This weakness in large-business employment is all the more worrisome for Ontario where it constitutes the dominant segment. Quebec, it should be noted, is also struggling in its dominant segment–small businesses. In the other provinces, instead, large businesses are the ones to have demonstrated the most resilience since 2007.

Is this a temporary phenomenon in central Canada or does it reflect instead a long-range trend? A study by two researchers gives us reason to be less pessimistic. According to their findings, large businesses destroy proportionally more jobs in times of recession but also create more jobs late into the expansion phase. Thus, it is perhaps just a matter of time before large companies contribute to job creation in Ontario and in Quebec. This is to be monitored. The fact remains that a strategy focused on small and midsize businesses is essential given that these jobs represent 63% of total private-sector employment.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Large-Business Employment: Still No Rebound In Ontario And Quebec

Published 04/05/2012, 03:52 AM

Updated 05/14/2017, 06:45 AM

Large-Business Employment: Still No Rebound In Ontario And Quebec

Summary

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.