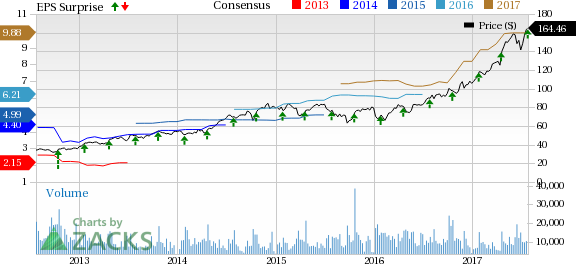

Lam Research Corporation (NASDAQ:LRCX) reported fourth-quarter fiscal 2017 non-GAAP earnings of $3.11 per share, surpassing the Zacks Consensus Estimate of $3.02. Earnings increased 18.9% sequentially and 84.1% year over year.

The stock jumped 2.36% driven by better-than-expected fourth-quarter revenues and earnings figures.

Also, on a year-to-date basis, the stock has outperformed the industry it belongs to. It has gained 50.1% compared with the industry’s gain of 41.0%.

Revenues

Revenues of $2.34 billion increased 8.9% sequentially and 51.7% year over year. Also, revenues were above the Zacks Consensus Estimate of $2.31 billion.

Revenues by Geography

Region wise, Korea contributed 38%, Japan accounted for 17% and Taiwan and China contributed 16% each of fourth-quarter revenues. The U.S., Europe and Southeast Asia generated 9%, 3% and 1%, respectively.

Shipments

Total system shipments were $2.54 billion during the reported quarter, up 5% from $2.41 billion reported last quarter.

Margins

Non-GAAP gross profit was $1,090.2 million or 46.5% of revenues, reflecting an increase of 40 bps sequentially.

Total adjusted operating expenses were $440.1 million, reflecting an increase of 6.3% sequentially. Operating margin was 27.7%, reflecting an increase of 80 bps from the prior quarter.

Net Income

GAAP net income was $526.4 million compared with $574.7 million in the last quarter and $258.9 million in the year-ago quarter.

Non-GAAP net income was $565.5 million compared with $507.8 million in the last quarter.

Balance Sheet

Exiting fourth-quarter fiscal 2017, cash and cash equivalents, short-term investments, and restricted cash and investment balances were $6.04 billion compared with $5.9 billion at the end of third-quarter fiscal 2017.

Cash flow from operating activities was $729.2 million against $422.7 million in the previous quarter. Capital expenditures amounted to $34.8 million. The company paid $73.7 million in cash dividends to stockholders during the Jun 2017 quarter.

Guidance

Lam Research provided guidance for first-quarter fiscal 2018.

On a non-GAAP basis, the company expects revenues of approximately $2.45 billion (+/- $100 million). Shipments are projected to be roughly $2.35 billion (+/- $100 million). Gross margin is predicted at around 46.5% (+/-1%), while operating margin is likely to be about 28% (+/-1%).

Earnings per share are projected at $3.25 (+/- 12 cents) on a share count of nearly 183 million. The Zacks Consensus Estimate is pegged at $2.76 per share, which makes guidance better than expected. GAAP earnings per share are projected at $2.98 (+/- 12 cents).

Our Take

Lam Research delivered strong fourth-quarter fiscal 2017 results with both earnings and revenues outperforming our estimates.

The company is doing well and continues to see strong success in the areas of device architecture, process flow and advanced packaging technology inflections.

The company has been improving on the WFE market share significantly since 2013 and expects to continue making gains.

Lam Research continues to see increased adoption rates of 3D NAND technology, FinFETs and multi-patterning. The company has taken cost-reduction activities and density scaling for 3D NAND and new memory technologies.

The company is likely to remain the market leader in dielectric etches as VECTOR Strata and ALTUS deposition, and its Flex and Kiyo etch products have been extremely successful. It anticipates continued strong demand for leading-edge silicon in the enterprise market courtesy of the long-term move to the cloud, storage and networking applications.

Moreover, Lam Research is making good progress with its customer support business and anti-trust agency reviews.

However, concerns persist in the form of volatility and lower growth expectations globally, with slow-but-steady improvement in some developed markets balancing the weakness in certain emerging economies.

Zacks Rank & Stocks to Consider

Currently, Lam Research has a Zacks Rank #1 (Strong Buy).Other stocks worth considering in the same space are KLA-Tencor (NASDAQ:KLAC) , carrying a Zacks Rank #1, and Applied Materials (NASDAQ:AMAT) and Fortive Corporation (NYSE:FTV) carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

KLA-Tencor delivered a positive earnings surprise of 11.55%, on average, in the last four quarters.

Applied Materials delivered a positive earnings surprise of 3.35%, on average, in the trailing four quarters.

Fortive Corporation delivered a positive earnings surprise of 5.90%, on average, in the trailing four quarters.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

KLA-Tencor Corporation (KLAC): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Fortive Corporation (FTV): Free Stock Analysis Report

Original post

Zacks Investment Research