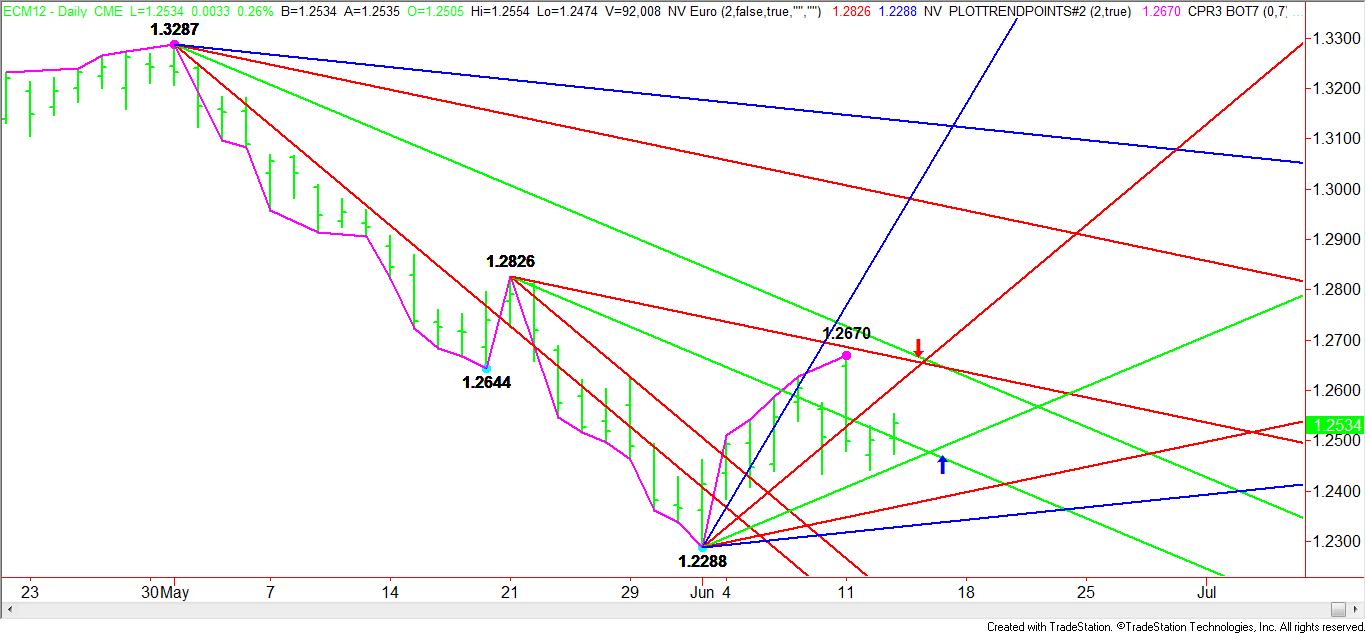

The Daily June euro chart continues to reflect the uncertainty in the single currency with the market currently bounded by a closing price reversal bottom at 1.2288 and a closing price reversal top at 1.2670. In addition, the euro is also “ping-ponging” between a pair of retracement zones. The current set-ups show a developing balance between the bulls and the bears although the daily swing chart indicates that the main trend is still down.

From the chart, one can see that prices have been jammed up since bottoming at 1.2288 on June 1 and topping at 1.2670 on June 11. This range has created a retracement zone at 1.2479 to 1.2434. This zone is currently proving support.

On the upside, a retracement zone has been created by the main range of 1.2826 to 1.2288. This range has formed a retracement zone at 1.2557 to 1.2620. Although the euro traded through this range during its surge to 1.2670 on June 11, this move failed to hold and the market fell back into support.

On the upside, a retracement zone has been created by the main range of 1.2826 to 1.2288. This range has formed a retracement zone at 1.2557 to 1.2620. Although the euro traded through this range during its surge to 1.2670 on June 11, this move failed to hold and the market fell back into support.

As long as there is uncertainty, expect the Daily June euro to continue to move sideways.

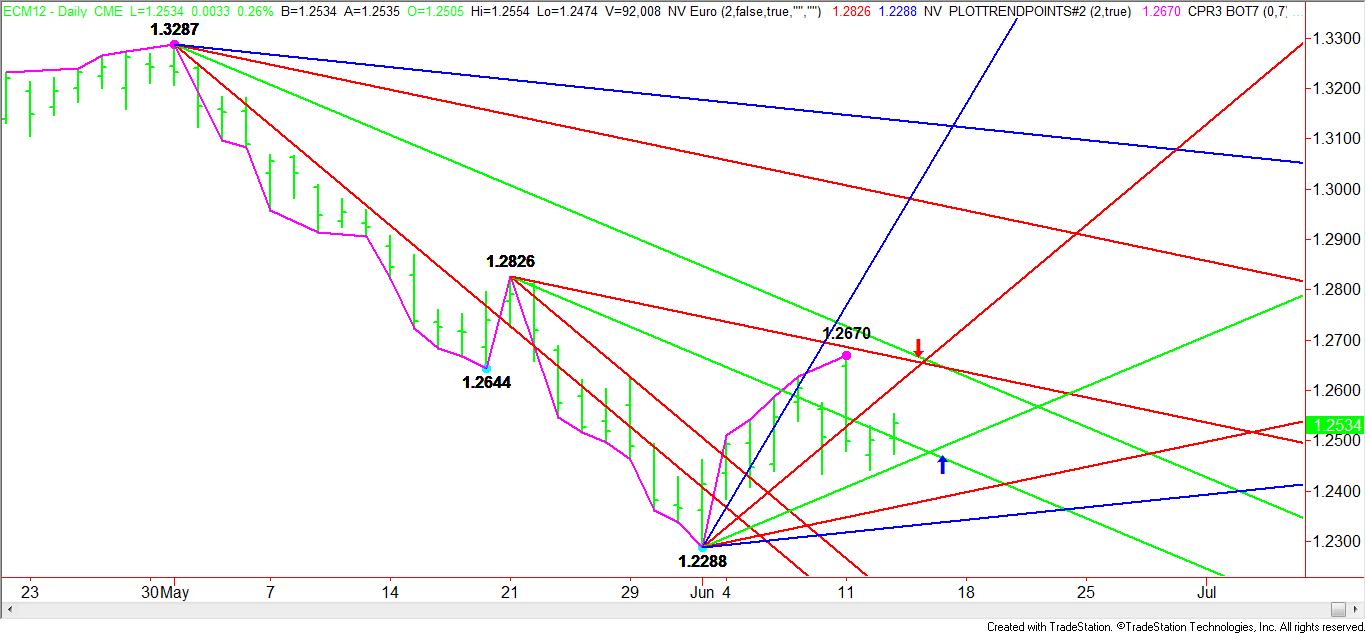

The Gann angles chart also reflects a tight range. Uptrending support today is at 1.2448. Downtrending resistance comes in at 1.2647. Additional Gann angle resistance is at 1.2687.

On June 14, a pair of Gann angles nearly cross at 1.2486 and 1.2468, making this area an important support cluster to watch. At the same time, a resistance cluster forms between a pair of downtrending angles and an uptrending Gann angle. This prices are at 1.2648, 1.2656 and 1.2667.

The uncertainty in the euro that is triggering the sideways trading action is being caused by the lack of clarity regarding the Spanish banking system bailout and the June 17 Greece elections. It seems at this time that traders are taking a “wait and see” approach to the market at this time.

While optimism exists that the european community has a plan in mind for Spain, the lack of details regarding this plan is understandably holding the euro in check. Additionally, traders appear to be more willing to wait for the result of the election in Greece rather than take a sizable position ahead of it. Until there is more clarity, traders seem content with holding the euro in a range.

From the chart, one can see that prices have been jammed up since bottoming at 1.2288 on June 1 and topping at 1.2670 on June 11. This range has created a retracement zone at 1.2479 to 1.2434. This zone is currently proving support.

On the upside, a retracement zone has been created by the main range of 1.2826 to 1.2288. This range has formed a retracement zone at 1.2557 to 1.2620. Although the euro traded through this range during its surge to 1.2670 on June 11, this move failed to hold and the market fell back into support.

On the upside, a retracement zone has been created by the main range of 1.2826 to 1.2288. This range has formed a retracement zone at 1.2557 to 1.2620. Although the euro traded through this range during its surge to 1.2670 on June 11, this move failed to hold and the market fell back into support.As long as there is uncertainty, expect the Daily June euro to continue to move sideways.

The Gann angles chart also reflects a tight range. Uptrending support today is at 1.2448. Downtrending resistance comes in at 1.2647. Additional Gann angle resistance is at 1.2687.

On June 14, a pair of Gann angles nearly cross at 1.2486 and 1.2468, making this area an important support cluster to watch. At the same time, a resistance cluster forms between a pair of downtrending angles and an uptrending Gann angle. This prices are at 1.2648, 1.2656 and 1.2667.

The uncertainty in the euro that is triggering the sideways trading action is being caused by the lack of clarity regarding the Spanish banking system bailout and the June 17 Greece elections. It seems at this time that traders are taking a “wait and see” approach to the market at this time.

While optimism exists that the european community has a plan in mind for Spain, the lack of details regarding this plan is understandably holding the euro in check. Additionally, traders appear to be more willing to wait for the result of the election in Greece rather than take a sizable position ahead of it. Until there is more clarity, traders seem content with holding the euro in a range.