Laboratory Corp. of America Holdings (NYSE:LH) , or LabCorp, is scheduled to report second-quarter 2017 results before the market opens on Jul 26.

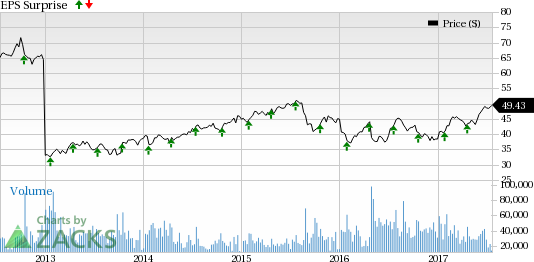

Last quarter, the company reported a positive earnings surprise of 1.37% with an average beat of 0.36% for the trailing four quarters. Let’s see how things are shaping up prior to this announcement.

Factors at Play

The last-reported first quarter 2017 dented LabCorp’s overall top line performance, heavily on dull numbers registered in Covance Drug Development business. This was due to sluggish early development and central lab businesses, affected by a slower revenue conversion from backlog and cancellation by sponsors of two large clinical studies in 2016.

Right now, although the company is trying to execute its strategy to focus more on higher-value therapeutic areas such as oncology and CNS (central nervous system) disorders, this procedure is tied to complex studies which will take time to generate revenue. We believe, the Covance Drug Development will continue to remain a drag for LabCorp’s overall business.

Earlier, the company noted that from a timing perspective, both Covance Drug Development’s revenue and margins will be down on a year-over-year basis in the second quarter of 2017, before showing favorable growth in the second half of 2017.

This apart, unfavorable foreign exchange remains a bother. Previously, the company viewed that it expects an impact of approximately 40 basis points of negative currency on 2017 revenues. Covance Drug Development’s net revenue is estimated to feel the impact of approximately 130 basis points of negative currency while the LabCorp Diagnostics segment will be affected approximately 10 basis points of negative currency in 2017. This should be reflected in the numbers of the quarter yet to be reported.We are also highly disappointed with the CMS proposal related to the Protecting Access to Medicare Act.

On a positive note, we are upbeat about the company’s ongoing cost-reduction initiatives related to project LaunchPad, which currently has over 100 projects at various stages of implementation. Recently, the company has expanded the LaunchPad initiative to now include Covance Drug Development. This initiative will be a three-year program for Covance that consists of two phases. The company has already initiated the first phase to ‘right-size’ Covance Drug Development’s resources, primarily head count and facility footprint.

This phase is projected to generate pre-tax savings of approximately $20 million in 2017 and approximately $45 million on an annualized basis thereafter. The pre-tax cost to achieve these savings is estimated to be approximately $30 million in 2017, of which, around $20 million is presumed to be cash expenditures.This should get reflected in the second-quarter results as well.

The company’s companion diagnostics portfolio, which grew a robust 35% in the last couple of years, should also maintain its momentum in 2017. Notably, within immuno-oncology drug development, it doubled the number of study awards from 2015 to 2016 and also performed a number of PD-L1 tests through Diagnostic and Drug Development segments.

Earnings Whispers

Our proven model does not conclusively show that LabCorp is likely to beat on earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below.

Zacks ESP: LabCorp has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate stand at $2.38. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: LabCorp has a Zacks Rank #4 which lowers the predictive power of ESP. Note that we caution against the Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are a few companies you may want to consider, as our proven model shows that these have the right combination of elements to post an earnings beat this quarter:

Thermo Fisher Scientific Inc. (NYSE:TMO) has an Earnings ESP of +0.44% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dextera Surgical Inc. (NASDAQ:DXTR) has an Earnings ESP of +9.09% and a Zacks Rank #2.

Telefex Inc. (NYSE:TFX) has an Earnings ESP of +1.06% and a Zacks Rank #2.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Thermo Fisher Scientific Inc (TMO): Free Stock Analysis Report

Teleflex Incorporated (TFX): Free Stock Analysis Report

Dextera Surgical Inc. (DXTR): Free Stock Analysis Report

Laboratory Corporation of America Holdings (LH): Free Stock Analysis Report

Original post

Zacks Investment Research