Hey, guess what – – – I’m bearish on equities. Surprise, surprise, surprise! Allow me to share a few charts to support my point of view.

First up is the Russell 2000, which has broken the midline of its channel. It seems to me a trek down to the supporting (lower) trendline is the next logical step.

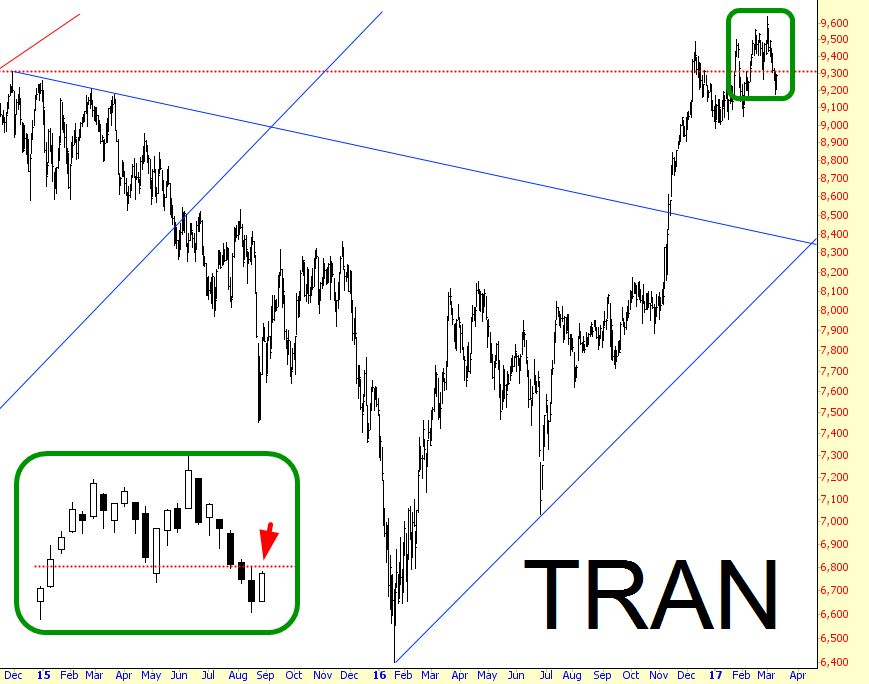

Augmenting this theory of weakness is the Dow Transports, which broke out above an important baseline (red horizontal) but have been flailing around it ever since. I’ve made an inset chart which shows you how Friday’s rally did only one thing: push it up against the underside of the failed horizontal once more.

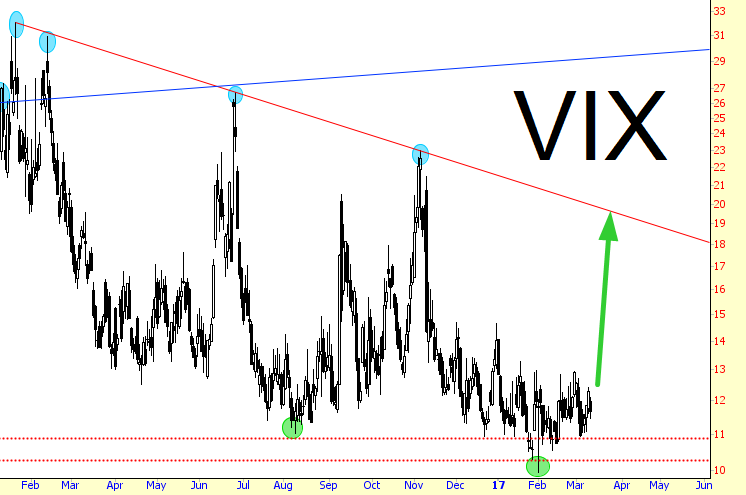

There’s also the volatility index, which is still in the laughable 11.xx zone. Examining the rhythm of “explosions” we’ve seen, I’d say we’re just about due (hence the green arrow).

Lastly, our dear friend energy had a crucial breakdown this week, and my view is that the white space I’ve enveloped with a rounded rectangle is going to be the playground of the bears in the weeks ahead.