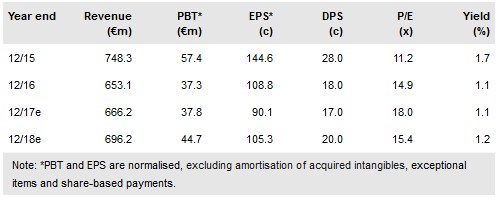

Following a significant improvement in the pulses and vegetables line and the sauces business, La Doria (MI:LDO) has reported an impressive 7.6% growth in revenue at constant currency for 9M17, which implies 8.0% growth during the latest quarter. The growth was mainly volume-driven, which is positive. As expected, group margins were lower during the period. Overall guidance, however, has been raised as volume growth is ahead of management expectations and the margin contraction has been less than feared. We raise our FY17 forecasts again in light of the positive 9M17 results. Our fair value increases to €16.90 from €15.54/share.

Good 9M17 results

While the overall trading environment remains tough, with continued pressure from the supermarkets amid heightened competition and continued sterling weakness, La Doria’s businesses are witnessing an improvement in performance. The pulses and vegetables line and the sauces business both posted revenue growth of over 10% at constant currency, which was mainly volume-driven. In terms of geographies, the overseas markets fared better than the domestic market, and exports now account for 79% of group sales.

To read the entire report Please click on the pdf File Below: