Another strong year

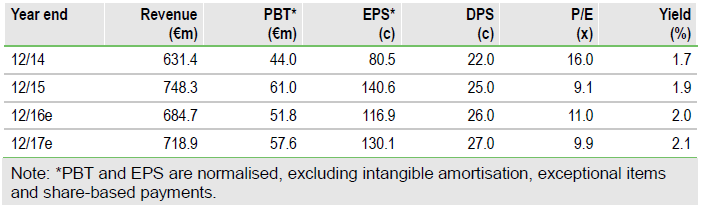

La Doria has reported yet another strong set of results. The updated threeyear plan provides strategic continuity. As previously highlighted, due to the unfounded fears of tomato overproduction at the start of the campaign, lower sales prices were achieved for new contracts. Following the FY results and updated business plan, we have cut our sales forecasts to reflect the lower 2016 base, left our EBITDA forecasts broadly unchanged, and increased our PBT and net profit estimates in line with the new guidance.

Strong full-year results

EBITDA came in at €77.5m, a 10% beat versus our forecast and the company’s own target. This implies an even greater level of outperformance for Q4, with EBITDA over double our forecast. All other P&L metrics beat both our forecasts and company targets. The acquisition of Pa.fi.al contributed around half the growth in net profit, but the base business also performed well. We have upgraded our group net profit forecasts for 2016 and 2017 by c 27%, as a result of lower tax charges, but mainly due to a change of accounting treatment for minorities. Our EBITDA forecasts remain broadly unchanged. We have rolled forward our model to 2018; our profit forecasts are broadly in line with the company targets.

To read the entire report Please click on the pdf File Below