Arch Capital Group Ltd. (NASDAQ:ACGL) reported third-quarter 2017 loss per share of 79 cents, wider than the Zacks Consensus Estimate of a loss of 59 cents. Loss compared unfavorably with $1.14 million earned in the year-ago quarter.

The third quarter benefited from a sturdy performance at the Mortgage segment. Positive impact of the United Guaranty Corporation (“UGC”) buyout and higher net investment income added to the upside.

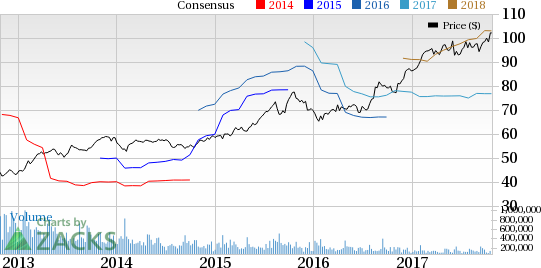

Arch Capital Group Ltd. Price and EPS Surprise

Including net realized gain of 48 cents, net impairment losses recognized in earnings of 2 cents, equity in net income loss of investment funds accounted for using the equity method of 23 cents, net foreign exchange losses of 21 cents, UGC transaction costs of 2 cents, loss on redemption of preferred shares of 5 cents and income tax charge of 1 cent, net loss came in at 39 cents per share in the reported quarter versus earnings of $1.98 in the year-ago quarter.

Behind the Headlines

Gross premiums written surged 28.9% year over year to $1.6 billion. This improvement was largely fueled by higher premiums written in the Mortgage segment. Improved premiums at Insurance as well as Reinsurance added to the upside.

Net investment income jumped 24.5% to $116.5 million. This upside was supported by income from the acquired United Guaranty portfolio, partially offset by high investment expenses.

Arch Capital Group’s underwriting loss was $142.2 million, comparing unfavorably with $127.6 million earned in the year-ago quarter. Combined ratio deteriorated 2430 basis points (bps) to 111.8%.

Segment Results

Insurance: Gross premiums written increased 3.8% year over year to $787.4 million owing to improved program and travel businesses.

Underwriting loss of $207.1 million compared unfavorably with income of $22.5 million in the year-ago quarter. Combined ratio deteriorated 120 bps to 98.9%.

Reinsurance: Gross premiums written in the quarter surged 30.1% year over year to $422 million on the back of higher premiums in casualty business.

Underwriting loss of $86.9 million compared unfavorably with $62.6 million in the year-ago quarter. Combined ratio deteriorated 50 bps year over year to 96.9%.

Mortgage: Gross premiums written in the quarter skyrocketed 164.1% year over year to $347.9 million, primarily reflecting growth in insurance force, driven by the acquisition of UGC.

Underwriting income increased more than fourfold to $186.3 million. Combined ratio improved 1460 bps year over year to 41.2%.

Financial Update

Arch Capital Group exited the third quarter with total capital of $11.04 billion compared with $10.49 at year-end 2016.

As of Sep 30, 2017, diluted book value per share was $59.61, up 11.8% year over year.

Operating return on equity was 5.3% in the quarter compared with 9.3% in the same year-ago period.

Zacks Rank

Arch Capital Group presently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported third-quarter earnings so far, the bottom lines at The Progressive Corporation (NYSE:PGR) , The Travelers Companies, Inc. (NYSE:TRV) and RLI Corp. (NYSE:RLI) beat the respective Zacks Consensus Estimate.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL): Free Stock Analysis Report

Original post

Zacks Investment Research