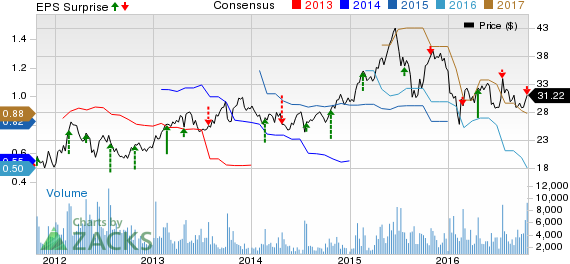

IMAX Corp. (NYSE:IMAX) reported modest numbers in the third quarter of 2016. Quarterly earnings per share of 1 cent edged past the Zacks Consensus Estimate of a breakeven. However, earnings were way below the year-ago figure of 12 cents per share. Disappointing box office revenues in the quarter as well as adverse foreign currency movements hurt results.

Total revenue of $86.6 million inched up 2.3% year over year and also beat the Zacks Consensus Estimate of $74 million. Gross margin was 51.9% compared with 49.8% in the year-ago quarter. Adjusted EBITDA margin in the quarter under review was 38.1% as against 37.4% in the second quarter of 2016. The company bought back 500,000 shares in the reported quarter.

Segment-wise Results

Sales and sales-type leases: Total revenue was $21.8 million, down 18.1% year over year.

Joint-revenue sharing arrangement: Quarterly revenues were flat at $19.7 million.

The Film segment recorded $26 million in revenues, up 15%.

Production and IMAX DMR (Digital Re-Mastering): Total revenue was $21.5 million, up 3.2% year over year. The average global DMR box-office revenues per screen were $184,700 in the third quarter, down 35% sequentially.

Category-wise Results

In the quarter under review, revenues from Equipment and product sales totaled $30.8 million, down more than 6% year over year. Services revenues improved 12.7% from the prior-year quarter to $37.2 million. Rental revenues were $16 million, down 4% year over year. Finance income remained flat year over year at $2.3 million.

Network Growth Statistics

At the end of the third quarter, IMAX installed 50 theaters (including two upgrades) as against 44 in the prior-year quarter. The company has signed 293 theatre agreements in the first nine months of 2016, including 162 in the third quarter. The comparable figure in 2015 was 138. As of Sep 30, 2016, the total theater count in backlog was 547 compared with 384 as of Sep 30, 2015.

Zacks Rank & Stocks to Consider

IMAX currently carries a Zacks Rank #4 (Sell). Some better-ranked stocks in the broader consumer discretionary sector are Vail Resorts (NYSE:MTN) and Sirius XM Holdings (NASDAQ:SIRI) . Vail Resorts sports a Zacks Rank # 1 (Strong Buy) while Sirius XM Holdings carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks consensus Estimate for the current year has increased 32 cents to $5.24 per share for the current year for Vail.

Sirius XM Holdings’ 2016 earnings are projected to grow by a healthy 43% year over year.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

SIRIUS XM HLDGS (SIRI): Free Stock Analysis Report

VAIL RESORTS (MTN): Free Stock Analysis Report

IMAX CORP (IMAX): Free Stock Analysis Report

MSG NETWORKS (MSGN): Free Stock Analysis Report

Original post

Zacks Investment Research