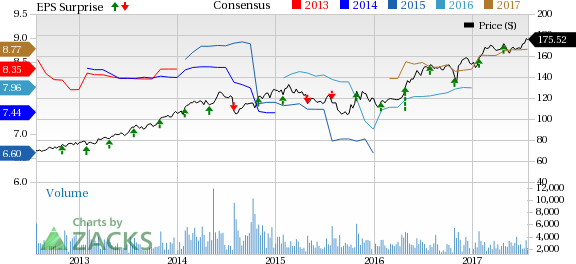

Defense contractor, L3 Technologies, Inc. (NYSE:LLL) , posted second-quarter 2017 earnings of $2.21 per share from continuing operations, beating the Zacks Consensus Estimate of $2.03 by 8.9%. Earnings also improved 17.6% from the year-ago figure of $1.88.

The company reported earnings of $2.54 per share excluding a pre-tax gain of 33 cents related to a sale of the company’s property in San Carlos, CA.

Total Revenue

Total revenue of $2.73 billion in the quarter surpassed the Zacks Consensus Estimate of $2.70 billion by 1.1%. Revenues were also up 2.6% year over year.

Organic sales to the U.S. government increased 5%, while that to international and commercial customers declined 8%. Overall, organic sales increased 1% in the quarter.

Orders & Margin

Funded orders in the reported quarter were $2.36 billion, reflecting a 10% year-over-year rise. Funded backlog was $8.51 billion as of Jun 30, down 4% from $8.86 billion as of Mar 31.

Operating margin contracted 210 basis points (bps) to 11.4% in the quarter.

Segmental Performance

Electronic Systems: Net sales at the segment increased 16% to $768 million from the prior-year figure of $662 million, mainly on account of significant organic sales growth.

Operating income was $105 million compared with the year-ago figure of $83 million, while operating margin expanded 120 bps to 13.7%.

Aerospace Systems: The segment recorded net sales of $1,026 million in the reported quarter, down 10.6%. The downside was driven by lower sales of Aircraft systems and ISR Systems.

Operating income remained flat at $70 million, while operating margin expanded 70 bps to 6.8%.

Communication Systems: Net sales at the segment improved 10.9% to $549 million, primarily owing to increased volume and deliveries of secure networked communication systems to the U.S. Department of Defense (DoD).

Operating income improved 63.5% to $85 million and operating margin expanded 500 bps to 15.5%.

Sensor Systems: Net sales at the segment grew 8.4% to $389 million, primarily buoyed by organic sales growth.

Operating income rose 23.8% to $52 million and operating margin expanded 170 bps to 13.4%.

Financial Position

As of Jun 30, L3 Technologies had $385 million in cash and cash equivalents compared with $363 million as of Dec 31, 2016.

Long-term debt as of Jun 30 was $3,327 million compared with $3,325 million as of Dec 31, 2016.

Net cash from operating activities was $351 million at the end of the quarter, down 6.6% from the year-ago figure. Capital expenditure totaled $98 million compared with $75 million in the prior year.

2017 Guidance

L3 Technologies has raised its 2017 outlook again. The company now expects earnings in the range of $8.65−$8.85 per share (versus the prior range of $8.50−$8.70) and revenues of $10,800−$11,000 million (the prior range being $10,750−$10,950 billion) for 2017.

However, the company expects cash from operations of around $1,030 million compared with the prior guidance of $1,085 million, and resultant free cash flow of $875 million compared with $865 million, guided earlier.

Peer Earnings Review

Lockheed Martin Corp. (NYSE:LMT) reported second-quarter 2017 earnings from continuing operations of $3.23 per share, beating the Zacks Consensus Estimate of $3.10 by 4.2%. Earnings also surpassed the year-ago period’s bottom-line figure by 10.2%.

Textron Inc. (NYSE:TXT) reported second-quarter 2017 adjusted earnings from continuing operations of 60 cents per share, beating the Zacks Consensus Estimate of 55 cents by 9.1%.

The Boeing Company (NYSE:BA) reported adjusted earnings of $2.55 per share for second-quarter 2017, beating the Zacks Consensus Estimate of $2.32 by 9.9%. In the year-ago quarter, the company had incurred a loss of 44 cents.

Zacks Rank

L3 Technologies currently sports a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Boeing Company (The) (BA): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Textron Inc. (TXT): Free Stock Analysis Report

L-3 Communications Holdings, Inc. (LLL): Free Stock Analysis Report

Original post

Zacks Investment Research