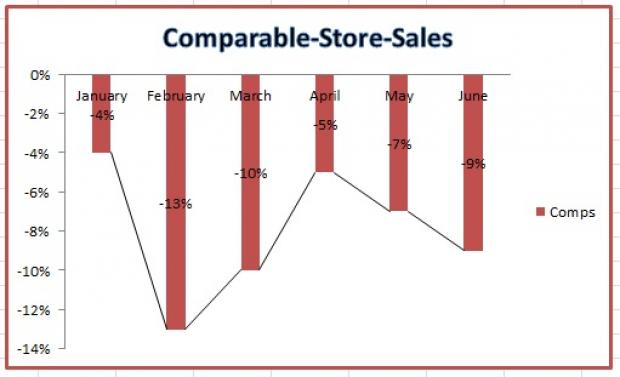

L Brands, Inc. (NYSE:LB) continues to disappoint investors with dismal comparable sales for the seventh straight month as the company posted June sales. This specialty retailer of women’s intimate and other apparel, beauty and personal care products reported 9% decline in comps for the five-week ended Jul 1 after registering a decline of 7%, 5%, 10%,13%, 4% and 1% in May, April, March, February, January and December, respectively.Moreover, net sales for June decreased 6% to $1.213 billion.

L Brands’ comps declined 17% at Victoria’s Secret, while increased 8% at Bath & Body Works. The exit from the swim and apparel categories had a 7 percentage points and 10 percentage points adverse impact on overall company and Victoria’s Secret comparable sales, respectively. Decrease in semi-annual sales also negatively impacted Victoria’s Secret. Moreover, for the 22-weeks ended Jul 1, the company’s comps had declined 9% while sales decreased 6% to $4.424 billion.

Merchandise margins

Victoria’s Secret margins in June increased year over year driven by improvement in lingerie business, exit from non-core business and favorable impact of less aggressive pricing strategy. The company announced that in July it will concentrate on providing T-shirt bra and wear-everywhere bras.

However, in case of Bath & Body Works merchandise margin was flat in June compared with last year. In July, the company will focus on new seasonal collections like body care, home fragrance and soap as well as sanitizer businesses.

July Projections & Stock Performance

L Brands expects comps to decline by mid-single digits in the month of July. The exit from the swim and apparel categories will impact the comps by nearly 4%. Management had earlier projected comparable sales (excluding Victoria's Secret swim and apparel) to decline in the mid-single digit range in the second quarter.

Following, dismal comps the company’s shares tanked 14.1% yesterday. We noted that soft comps performances in the past seven months and weaker-than-expected sales in the trailing three quarters have hurt the company’s shares in the past one year. We noted that the stock has plunged 32.8%, wider than the Zacks categorized Retail-Apparel/Shoe industry’s fall of 22.4%.

However, we believe that the company’s operational efficiencies, together with its new and innovative collections may help boost sales. Further, its foray into international markets is likely to provide long-term growth opportunities and generate increased sales volumes.

Apart from L Brands, Costco Wholesale Corporation (NASDAQ:COST) , Zumiez Inc. (NASDAQ:ZUMZ) and The Buckle, Inc. (NYSE:BKE) came out with comparable sales results for the month of June. While comparable sales for Costco and Zumiez increased 6% and 5.3%, respectively, that of Buckle declined 5.8%.

L Brands currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Buckle, Inc. (The) (BKE): Free Stock Analysis Report

L Brands, Inc. (LB): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Original post

Zacks Investment Research