Investing.com’s stocks of the week

Talking Points

- Riksbank cuts Repo Rate to -0.25% in conjunction with a SEK 30 billion QE program

- Rates are expected to remain at this level until mid-2016, then slowly rise

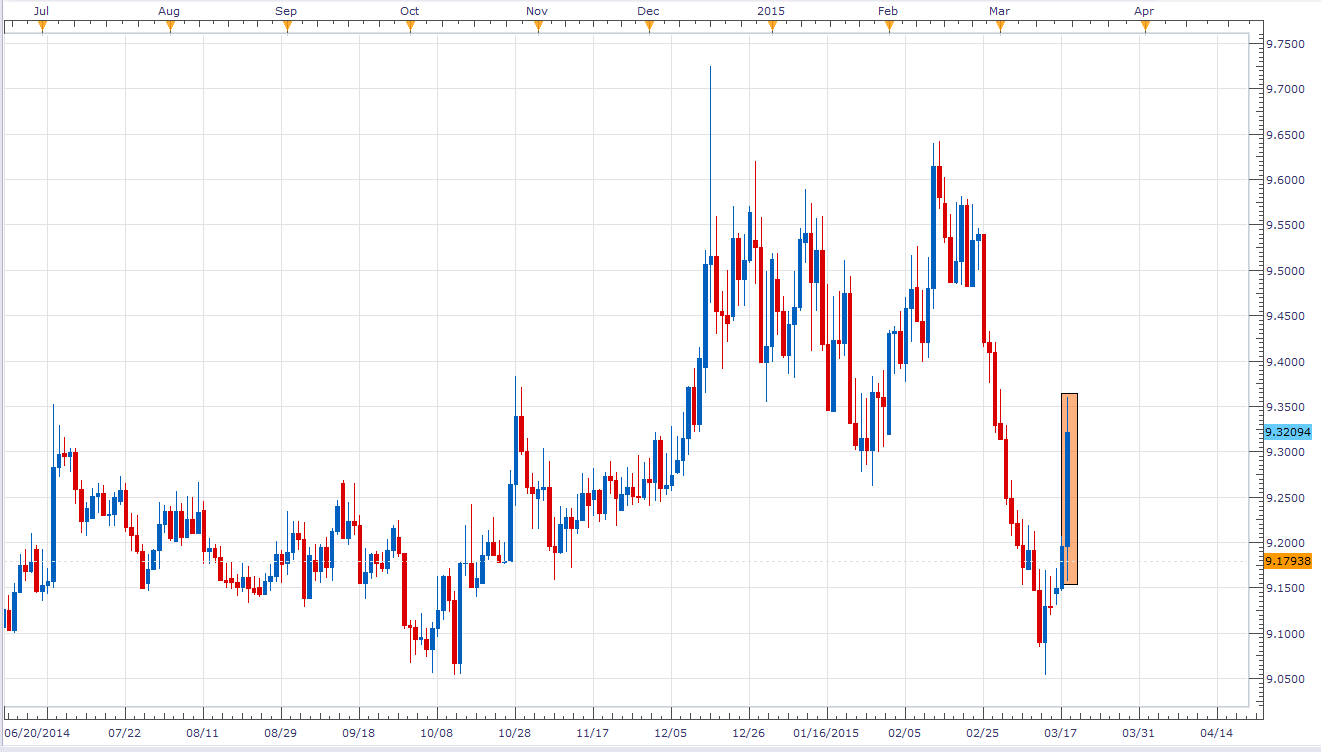

- EUR/SEK pair advances 2.2% on Wednesday, reaching a high of 9.36041

While inflation looks to have bottomed out, the recent appreciation of the krona imposes a risk; such that, inflation’s current upward course could be reversed. Bearing this in mind, the Riksbank further deepened the Repo rate Wednesday, lowering it by 15 bps to -0.25%. Taking effect on March 25th, the overnight rate will be accompanied by a bond purchase program in the amount of SEK 30 billion.

The decision was designed to encourage an upward movement in inflation and was motivated by fluctuations in the FX market. Particularly, in reaction to the slide in oil prices, the commencement of the ECB’s asset purchase program and the Federal Reserve’s potential change in forward guidance.

The rate is expected to remain at this level until mid-2016 and rise thereafter at a slower rate than initially envisioned with the release of February’s Monetary Policy Report. Furthermore, the central bank is prepared to engage in additional easing measures if deemed necessary, in order to maintain inflation’s role as the nominal anchor for price and wage setting.

Chart Created Using MarketScope2.0