Grocery chain Kroger Co (NYSE:KR) was slightly lower in Thursday afternoon trading, last seen down 1.6% at $31.85. However, early this morning KR landed a price-target hike to $36 from $33 at Wells Fargo (NYSE:WFC). This comes mere days before the company's second-quarter earnings release, scheduled for before the market opens Thursday, Sept. 13.

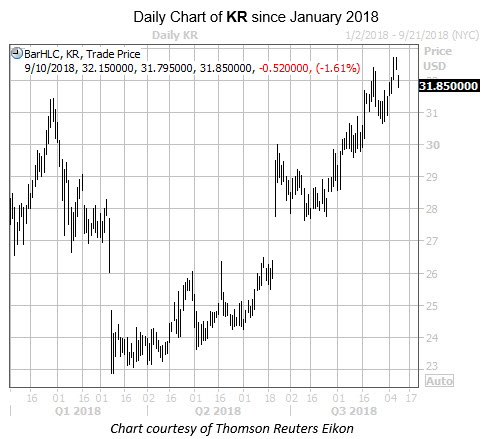

On the charts, Kroger stock has been on a long-term uptrend, specifically seeing a post-earning bull gap in late June, lifting the stock from its March 8 post-earnings bear gap, and paved the way for its fresh annual peak of $32.74 this past Thursday, Sept. 6. From a broader perspective, KR has picked up over 50% during the past 12 months.

Looking at the stock's earnings history, it has closed higher the day after the company reported in four of the past eight quarters, including the aforementioned 9.7% late-June surge. The shares have averaged a 7.9% move the day after earnings over the last two years, regardless of direction. This time around, the options market is pricing in a larger-than-usual 11.5% swing for Thursday's trading.

Options traders have been leaning bearish in the long term on Kroger stock. This is per data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which shows a 50-day put/call volume ratio of 1.60, ranking in the 79th annual percentile. In other words, puts have been purchased over calls at a quicker-than-usual clip during the past 10 weeks.

Meanwhile, short interest fell over 14% in the two most recent reporting periods, yet the 41.5 million shares still sold short account for a healthy 5.3% of the available float, or 5.6 times the average daily pace of trading. Continued covering could create bigger tailwinds for Kroger stock.

Lastly, looking toward analyst sentiment, a majority of those covering the equity have moved to the sidelines, with over half sporting tepid "hold" recommendations. Paired with the stock's average 12-month target price carrying a 2.5% downside to current levels, a fresh round of upgrades is seemingly overdue for KR.