Weekly options traders were active on Kroger Company (NYSE:KR) ahead of the grocery name's earnings report, released earlier this morning. Puts were especially in favor over the last two weeks, and today's post-earnings swing higher could be catching some of these bears off guard.

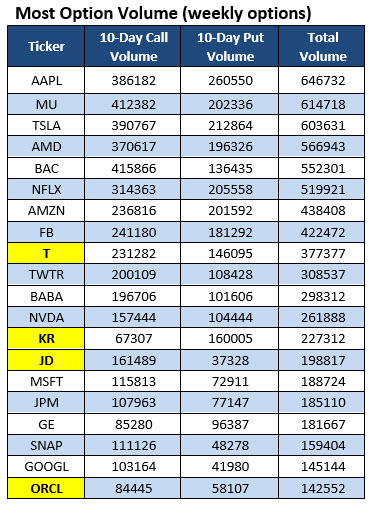

Taking a quick step back, Kroger popped up on Schaeffer's Senior Quantitative Analyst Rocky White's list of 20 stocks that have attracted the highest weekly options volume during the past 10 trading days. Names highlighted in yellow, such as KR, are new to the list, and as you can see, weekly put volume has more than tripled call volume.

Looking closer, the weekly 6/22 27-strike put has seen the biggest increase in open interest over this 10-day time frame, with 50,043 contracts added. The bulk of this activity occurred last Wednesday, June 13, when a 38,165-contract block crossed for $1.62 apiece. While it's not entirely clear if these puts were bought or sold, KR stock was trading below the strike price at the time -- at $26.06 -- so it's likely they were purchased to open.

If this is the case, the speculator paid an initial cash outlay of $6.2 million (number of contracts * $1.62 premium paid * 100 shares per contract) to bet on Kroger extending its stay below $27 through expiration at week's end. More specifically, breakeven for the put buyer at tomorrow's close is $25.38 (strike less premium paid).

However, this appears to be a losing bet, with Kroger stock rallying hard after this morning's earnings report (though the most the options buyer has risked is 100% of the premium paid). At last check, KR shares are up 9.3% at $28.61 -- easily filling their March bear gap to trade at their highest level since early February.

Sparking the upside is Kroger's better-than-expected first-quarter adjusted profit of 73 cents per share on a slight revenue beat of $37.5 billion. The Cincinnati-based grocer also said same-store sales rose 1.4% over the three-month period, and raised the low-end of its full-year earnings-per-share (EPS) forecast.

Against this backdrop, today's options trading has a distinctly bullish tilt. At last check, 32,077 calls were on the tape -- 11 times what's typically seen at this point in the day, and more than double the number of puts traded. Buy-to-open activity is detected at the July 28.50 call, indicating speculators expect KR stock's post-earnings momentum to continue over the next four weeks.