Koninklijke Philips NV (NYSE:PHG) recently announced that its IntelliSite Pathology Solution has successfully upgraded two fully digital pathology labs in Austria.

In fact, the Pathology Institute in Hall and the Pathology Institute at the University Innsbruck successfully digitized their diagnostic process along with the Philips IntelliSite Pathology Solution to enhance efficiency and productivity of diagnosis.

The digitization of the labs would help to enhance collaboration across care teams and improve the timings of diagnosis, which in turn would lead to increase in efficiency and quality of diagnostics.

Notably, the solution implements a fully-digital workflow enabling healthcare organizations to improve workflows and attain right decision-making, allowing organizations to offer better patient care services. Earlier, this technology solution has helped other leading pathology sites across the world including LabPON, Hospital Campus de la Salud and The AZ Sint Jan to successfully transform into a fully digital workflow centers.

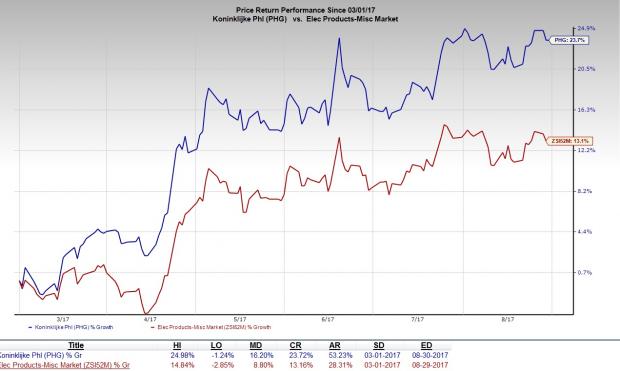

Over the past couple of years, the company has successfully morphed from a lighting company into a healthcare technology provider. Also, the company's transformation from a hardware-oriented to a software-driven business, with a higher-margin and recurring-revenue model is impressive. In fact, the stock has rallied 23.7% in the last six months, outperforming the industry’s gain of 13.2%.

Currently, this Zacks Rank #3 (Hold) company is focusing on key opportunities in population health management, while improving its enterprise wide solutions for health systems, and collaborating with health care organizations to fortify its foothold in the healthcare industry. Going forward, the company believes that increased spending on healthcare and fitness might drive growth.

Despite the growing foothold in the healthcare domain, the company continues to grapple with escalating taxes and restructuring charges, which are proving to be a drag on the company’s financials.

Moreover, the industry in which the company operates is highly dynamic, which indicates that failure to accelerate the company’s innovation-to-market processes may lead to materially adverse effects on its financial condition as well as operating results.

Stocks to Consider

Better-ranked stocks in the same industry include Control4 Corporation (NASDAQ:CTRL) , Daktronics, Inc. (NASDAQ:DAKT) and Garmin Ltd. (NASDAQ:GRMN) . While Control4 and Daktronics hold a Zacks Rank #2 (Buy), Garmin sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Control4 came up with an average positive earnings surprise of 98.0% for the last four quarters, having beaten estimates every time over the last four quarters.

Daktronics has an average positive earnings surprise of 42.1%, having surpassed estimates thrice over the trailing four quarters.

Garmin delivered an average positive earnings surprise of 22.9% for the last four quarters, having beaten estimates every time in the last four quarters.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Garmin Ltd. (GRMN): Free Stock Analysis Report

Koninklijke Philips N.V. (PHG): Free Stock Analysis Report

Daktronics, Inc. (DAKT): Free Stock Analysis Report

Control4 Corporation (CTRL): Free Stock Analysis Report

Original post

Zacks Investment Research