Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Eastman Kodak Company (NYSE:KODK) which was founded in 1888, was a dominant company in the photography industry for about 100 years before you could take pictures on your phone.

As photography shifted to digital, Kodak became increasingly irrelevant and filed for Chapter 11 bankruptcy protection in January 2012. After selling various business units and many of its patents, Kodak emerged from bankruptcy in September 2013.

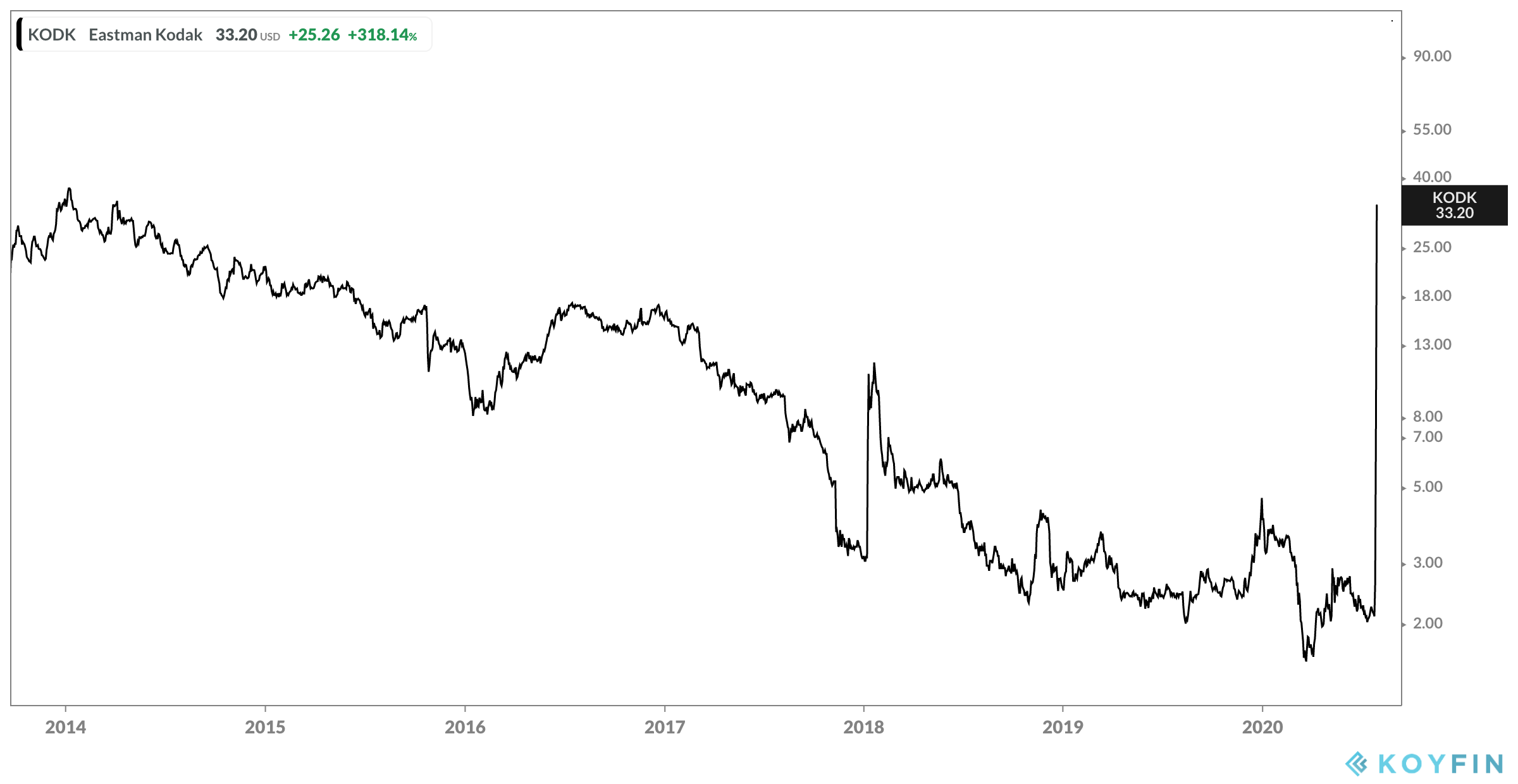

Ever since, Kodak has slowly drifted further into irrelevancy. Shares of Kodak fell all the way from a high near $40 per share a few months after it emerged from bankruptcy to the $2 per share range over the last few months.

As 2020 has consistently proven anything can happen, Kodak validated that theory this week as it has now become the latest hot stock. The U.S. government is giving Kodak a $765 million loan to produce drug ingredients under the Defense Production Act.

The loan is the first of its kind provided by the U.S. International Development Finance Corp., which is working with the Department of Defense to rebuild the national stockpile of medical supplies using American companies.

"With this new agreement, my administration is using the Defense Production Act to provide a $765 million loan to support the launch of Kodak Pharmaceuticals," U.S. President Donald Trump said. "Kodak will now produce generic active pharmaceutical ingredients, which is a big deal. Using advanced manufacturing techniques, Kodak will also make the key starting materials that are the building blocks for many drugs in a manner that is both cost-competitive and environmentally safe."

"Kodak is proud to be a part of strengthening America's self-sufficiency in producing the key pharmaceutical ingredients we need to keep our citizens safe," Kodak CEO Jim Continenza said.

"By leveraging our vast infrastructure, deep expertise in chemicals manufacturing, and heritage of innovation and quality, Kodak will play a critical role in the return of a reliable American pharmaceutical supply chain."

Shares of Kodak jumped more than 200% on Tuesday, marking the stock's best one-day performance. Yesterday, investors continued to bid up Kodak as it reached a high of $60.00 per share before closing at $33.20, finishing with a gain of more than 300%. Shares of Kodak, which has now seen its market capitalization go from just over $100 million on Monday to $1.5 billion yesterday, were halted more than 15 times throughout the day due to volatility.

However, as is usually the case, it appears some investors may have been given the tip of a lifetime as Kodak shares jumped more than 25% on Monday when it was still just the irrelevant camera company.

Continenza was asked about the heavy volume in the stock on Monday, which at more than 1.5 million shares traded was well above the average of less than 100,000 shares traded per day over the previous few days. "This has been a pretty tight kept secret," Continenza said before laughing when told it didn't appear to be a well kept secret.

Just a few days ago Jay Clayton, Chairman of the U.S. Securities and Exchange Commission, said he's worried about retail investors turning to short-term trading as opposed to long-term investing. With more than 100,000 Robinhood users adding Kodak to their portfolio over the last three days, it's almost certain this will not end well.