Following up on our last article "The Knock-Out Criteria For Rare Earth Element Deposits", there were several comments that were noted from our readers, so I took the opportunity to discuss these with Darren L. Smith, M.Sc., P.Geol., of Dahrouge Geological Consulting Ltd. In Germany, people were even discussing emails that they received from companies that were mentioned in the article. No matter whether these are legit, or legitimately published, they make a good case for discussion nonetheless.

Hence, consider the comments from investors and company representatives, as well as the responses below, as general statements of the rare earth element (REE) space. I present these in an effort to better place and compare these deposits in context for investors; and further, to understand why I am a supporter of Commerce Resources Corp. and their Ashram Deposit as being a serious contender in the REE space.

“The article is full of inaccuracies, outdated references and misinformation.”

Anyone confronted with such a statement would very much like to know specifically the inaccuracies, outdated references, and misinformation that are being referred to. If specifics are not given, then such a statement is difficult to respond to. My best recommendation would be to read the article again, and this time with a more open mind. If such a statement as per above is made, it must be backed up with specifics or it is likely unwarranted and without merit (i.e. poor sportsmanship).

If any company feels the article is full of inaccuracies, outdated references, and misinformation, (I assume towards HREE companies) then please contact me and inform me of the specifics in order to be able to address. However, to the author’s knowledge, the information contained in the article “The Knock-Out Criteria for REE Deposits” is accurate, current, and discussed in a clear and fair manner, with all data presented available in the public domain. In addition, Dahrouge Geological Consulting Ltd. has extensive experience in mineral exploration and development with many notable discoveries to their credit, including the Ashram Rare Earth Deposit. Further, Darren L. Smith is a well-known Professional Geologist with significant experience in the REE space. Mr. Smith’s interview is based on his considerable experience and knowledge of the REE space, and his comments should be noted as such.

“Discussing TREO grade without a breakdown of the contained light and heavy rare earth components is misleading information. In this case, only 7% of the total REEs in this deposit are medium or heavy REEs, while lanthanum and cerium (for which is there is little or no demand for new supply) comprise 72% of the TREO.”

For those that are not aware, REE distribution (i.e. the “breakdown” referred to in the comment) is the proportion of each REE relative to all the REEs combined (15 total elements, La through Lu + Y). Often companies with an REE distribution more weighted in the HREEs are considered to have a more favorable REE distribution. This is somewhat of a misleading statement itself as neodymium (Nd) and europium (Eu), light and middle REEs respectively, are also in high demand and short supply, with neodymium specifically having a larger market than all the HREEs combined! I will discuss this further a bit later in this article.

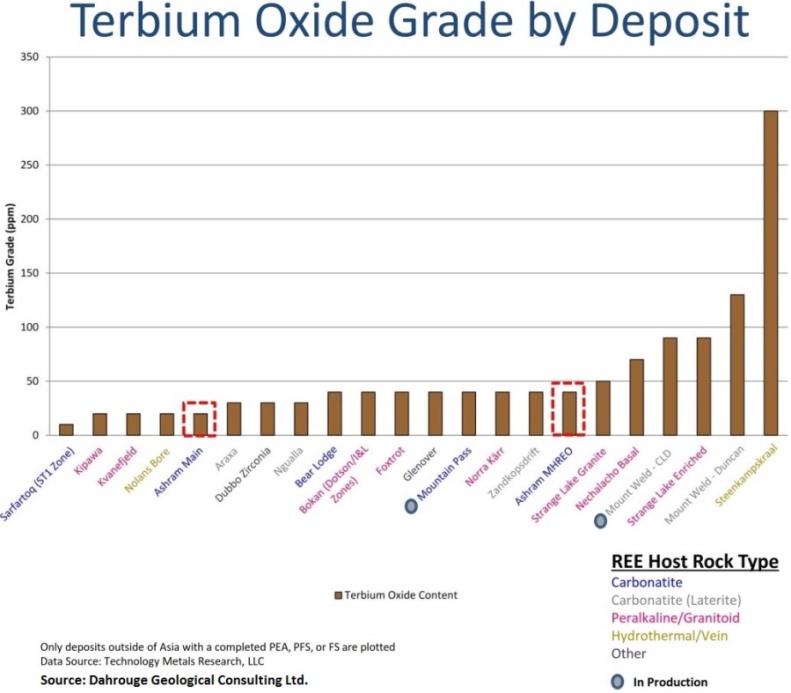

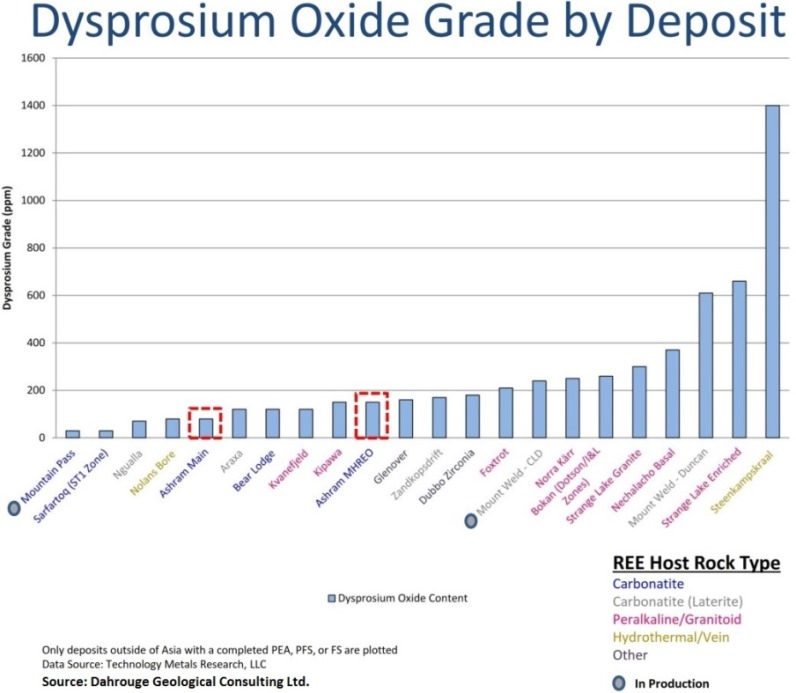

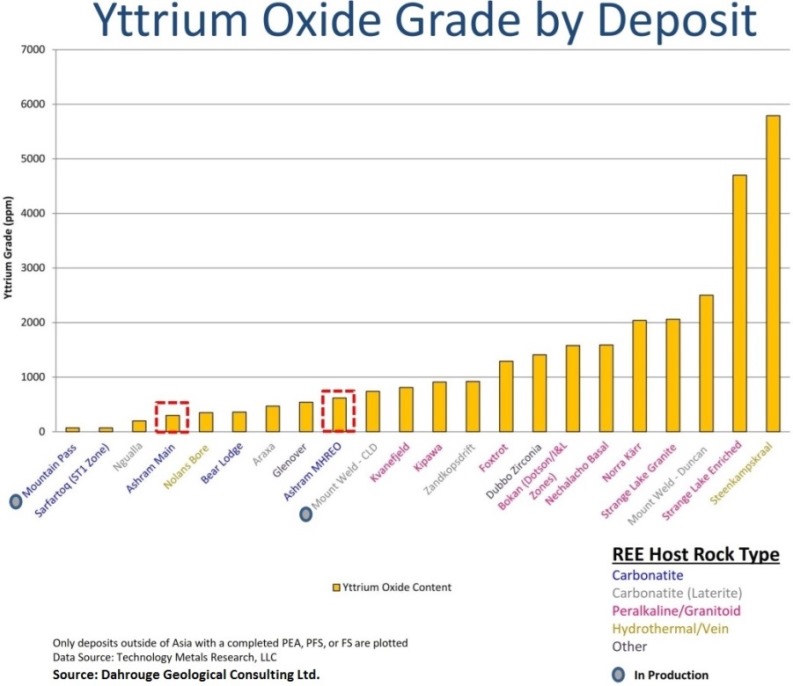

One may expect this sort of comment from HREE plays. It is sometimes the only thing they can promote on as most other REE companies do not have what they have, namely an REE distribution more weighted in the valuable high demand and short supply HREEs; terbium (Tb), dysprosium (Dy), and yttrium (Y). The article “The Knock-Out Criteria for REE Deposits” was absolutely not misleading by not discussing mineral distribution in detail. Here is why:

Anyone could make the same argument on jurisdiction, CAPEX, OPEX, native issues (social acceptability), logistics, by-products/co-products etc. The previous article was not focusing the discussion on distribution, or any other project aspect for that matter, but on metallurgy. This is because too often cost of metallurgical recovery is ignored by the HREE companies when discussing their projects as it is inherently the most difficult aspect nearly every time. A discussion on metallurgy does not require an equal discussion on REE distribution. Quest Rare Minerals Ltd. (Quest) and Avalon Rare Metals Inc. (Avalon) were mentioned because both are very well-known in the REE space for having poor mineralogy/metallurgy, yet both are often cited as the “most advanced” deposits in development. The article was solely focusing on economics – pure and simple - from a metallurgical point of view. At the end of day, the REE distribution is irrelevant if one cannot get the commodity (REEs) out of the rock! That is the point.

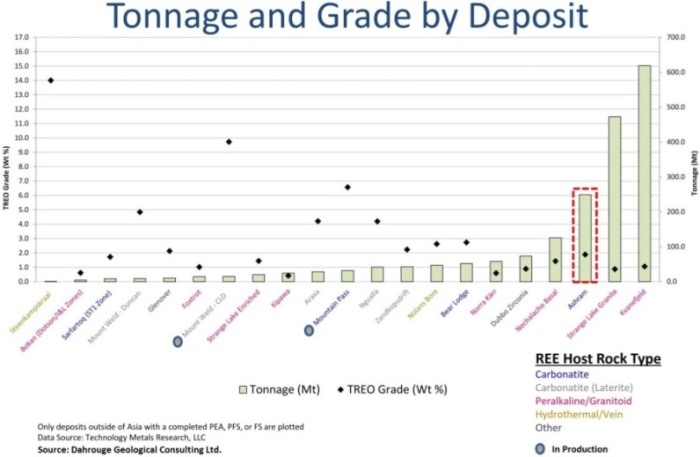

Further, I would like to note that a typical granite rock, for which you may have as a countertop, may have a better distribution than most HREE deposits, albeit its grade is trace. Thus, in my opinion, it would be very misleading to discuss REE distribution without mentioning grade specifically because those two factors are intimately intertwined. To this effect, you may notice how many HREE deposits rarely discuss grade when discussing REE distribution; because they occupy the lower grade spectrum in the REE space.

Lastly, I consider the comments on supply/demand the pot calling the kettle black. Only three HREEs have ready markets, that being terbium (Tb), dysprosium (Dy), and yttrium (Y). The remaining five (Er, Ho, Tm, Yb, and Lu) have very tiny markets in comparison and may not sell for some time after being processed, if at all. For these reasons, those five elements are typically not included in an economic evaluation; however, many HREE companies will include several (or all) of them for some reason. I expect it is because they have more appreciable amounts than an LREE company; however, if the market is not there for these elements, it is not there. Therefore, assigning these five HREEs a value in an economic assessment may be “wishful thinking”, and certainly not a conservative approach.

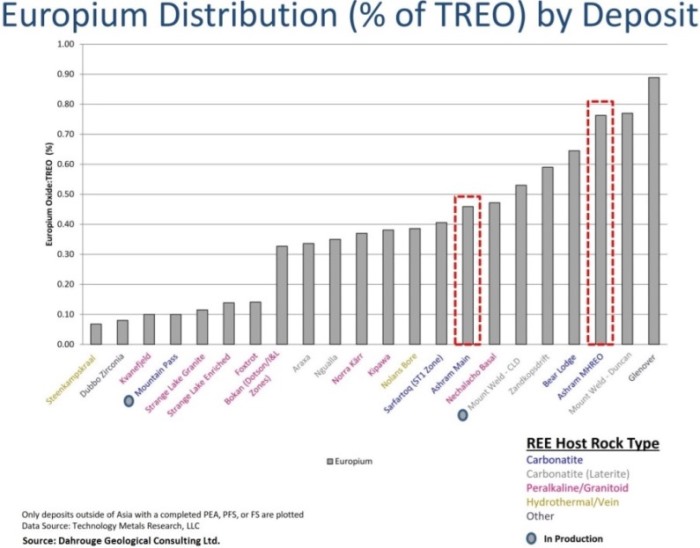

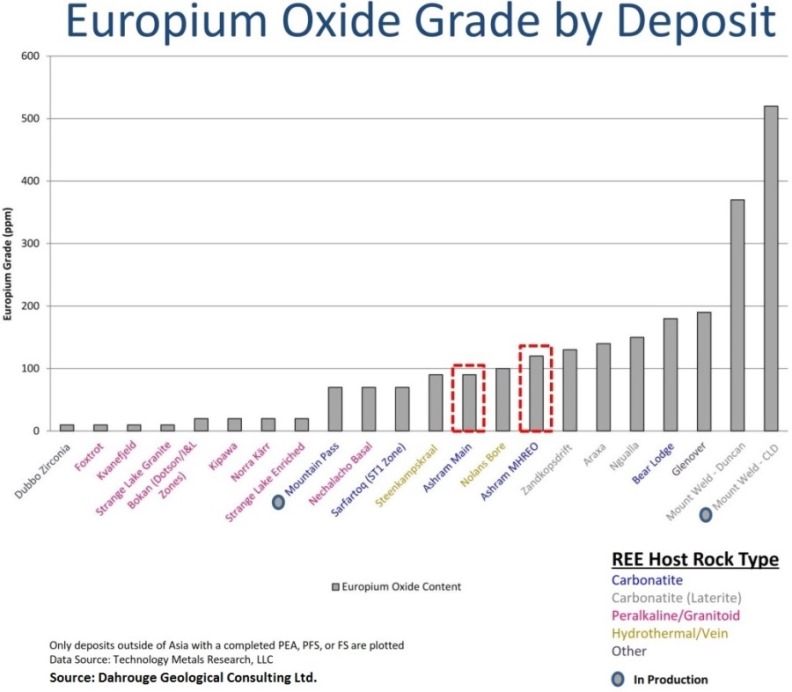

Further, europium (Eu) is not an HREE and any HREE company that is claiming they have appreciable amounts is in error. Europium is preferentially removed from granitic hosted HREE deposits (dominant HREE deposit host rock type) due to the chemical composition of the magma and mechanisms involved that form such deposits. This is done through a process of substitution whereby Eu2+ will substitute for Ca2+ in the early forming feldspar minerals (plagioclase) during solidification of the magma; thus, removing Eu from the magma that still contains all the other REEs in their normal proportions. The remaining magma then solidifies, containing far less Eu, which is expressed as a ‘negative europium anomaly’ in relation to the other un-affected REEs. Therefore, most HREE deposits are depleted in this highest priced, critical element (e.g. Avalon – Nechalacho Deposit, Quest – B Zone Deposit, Ucore – Bokan Mountain Deposit, Tasman – Norra Kärr Deposit, Matamec - Kipawa Deposit etc.). This process does not occur during the formation of carbonatites as feldspar is very rare in that source magma, and thus, those deposits maintain their levels of europium throughout their formation (e.g. Commerce – Ashram Deposit). In fact, in terms of europium, Commerce’s MHREO Zone (part of the Ashram Deposit) hosts among the best grade and distribution (relative to the other REEs) in the world. See below chart on europium REE distribution as listed by Technology Metals Research:

However, all this being said, let’s discuss this comment in a bit more detail.

To fully discuss distribution, one needs to discuss the critical rare earth oxides (CREOs); neodymium (Nd), europium (Eu), terbium (Tb), dysprosium (Dy), and yttrium (Y). That is, the REEs in the shortest supply relative to demand. Simply put, the more promising REE deposits will have the highest percentage of the CREOs, and ideally a well-balanced distribution among them (the CREOs) to act as a hedge against inevitable price fluctuations of any of the individual elements.

As alluded to above, many people will tell you that HREE deposits are essentially a “two trick pony”. That meaning, these deposits are relatively enriched in dysprosium (Dy) and yttrium (Y), and maybe appreciable terbium (Tb), but very little of the other critical REEs. Thus, if you own an HREE deposit, you are likely going to be held hostage to just three REEs and their respective markets and price fluctuations. The Norra Kärr Deposit (Tasman Metals Ltd.) and the Kipawa Deposit (Matamec Exploration Inc.) are good examples as both are essentially dysprosium-yttrium deposits, with low TREO grade, and potentially a zirconium (Zr) by-product/co-product. Thus, if the dysprosium or yttrium price drops they may have considerable difficulty remaining economic. These deposits basically lack the hedge that a well-balanced distribution would give them. It’s like putting your entire stock portfolio into gold and then trying to survive when the gold price plummets. Whereas, if you diversified into financials, uranium, utilities, oil, and gold for example, your portfolio would be much healthier and would be able to sustain a price drop in any one sector while the other sectors keep you financially healthy.

This same hedge argument cannot be extended to by-products like tantalum and niobium that many HREE deposits host. This is because those products require an entirely different circuit/flowsheet of processing and metallurgy than the REEs, since they dominantly reside in non-REE minerals. Zirconium may reside in an REE mineral (e.g. eudialyte); however, once freed into solution, it must be separated from the REEs resulting in an additional flowsheet scenario. Alternatively, when one processes for REEs, you get all of them since they all occur in the same mineral, and thus, all the CREEs cost essentially the same to process whether you get one out of the rock, or all of them out.

Consider Avalon as a good example: Avalon arguably must rely on credits from niobium, tantalum, and zirconium to remain economic. Co-products such as these complicate the metallurgical flowsheet and the subsequent economic picture, and if their prices were to drop significantly it may have serious implications for the company.

Further, I would like to note here Commerce’s recent comments regarding a potential high-grade fluorite concentrate product it may produce in addition to the REE products (see news release dated December 4th, 2013). This fluorite concentrate (a near acid-spar grade of 94% CaF2) does not require any additional processing to produce as it is part of the same flowsheet used to concentrate the REE minerals. The ability to create such a product with solid supply/demand metrics, without any additional cost to the REE mineral processing flowsheet, is a highly advantageous hedge to REE price fluctuations.

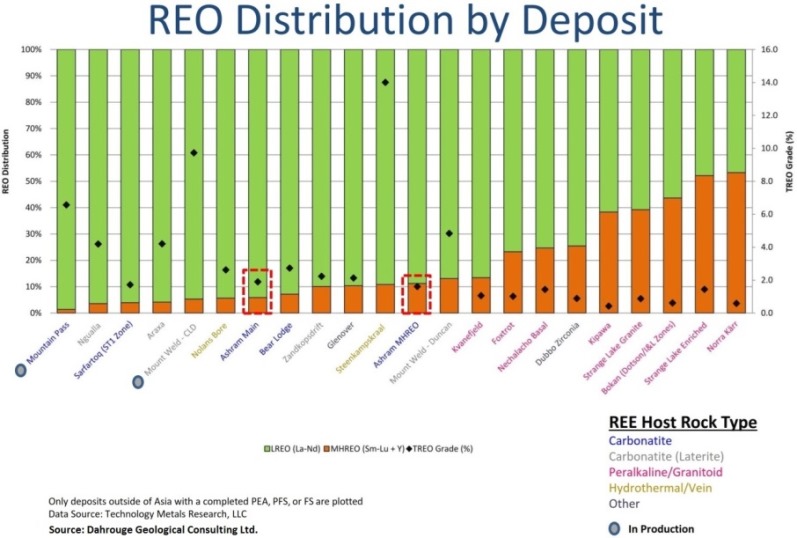

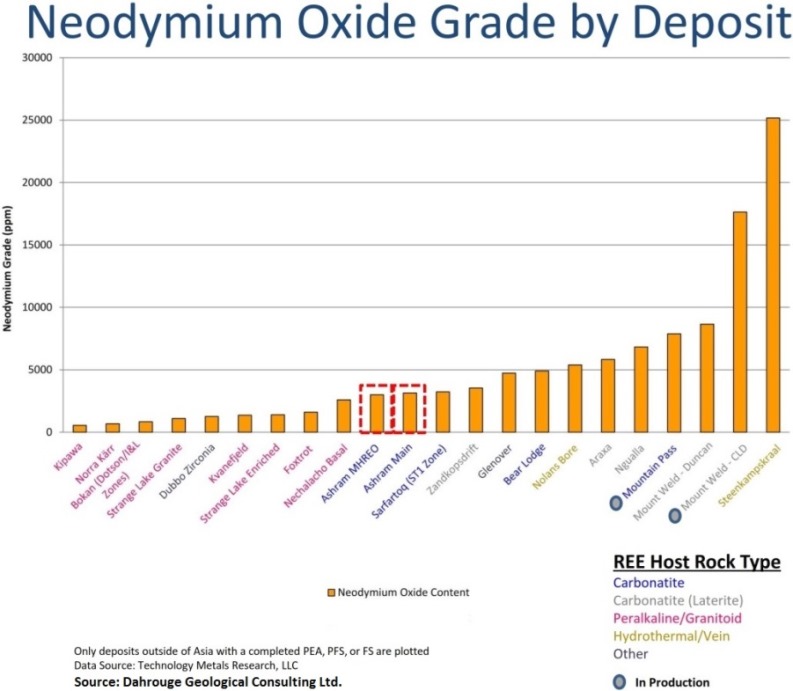

Commerce does not claim to be an HREE deposit; however, they are also not a pure LREE deposit as the comment infers. Commerce is in the middle of the pack, boasting a well-balanced distribution, namely appreciable amounts of all the CREOs (Nd, Eu, Tb, Dy, and Y). Hence, Commerce is not held hostage to only a couple of the more valuable REEs. So, if the dysprosium price drops, for example, Commerce has a much better chance of staying economic thanks to the fundamentals of the other CREOs. Even this being said, Commerce’s Ashram MHREO Zone boasts a higher dysprosium grade (155 ppm Dy2O3 measured + indicated resources) than Matamec’s Kipawa Deposit Mineral Reserves (147 ppm Dy2O3), a well-known HREE deposit. Charts outlining REE distribution with TREO grade, as well as CREO deposit grades, as noted by Technology Metals Research, are shown below:

Avalon’s Nechalacho Deposit does boast a REE deposit with a very respectable REE distribution with appreciable amounts of the CREEs. They sit typically between Ashram MHREO and deposits like B Zone, Kipawa, and Norra Kärr (see chart above). However, Nechalacho’s economics have a significantly high CAPEX and OPEX, a direct result of complex mineralogy and metallurgy, and as discussed in the previous article: metallurgy is what will typically make or break a REE project’s economics. So, with respect to Avalon’s Nechalacho Deposit and Quest’s B Zone, and all the other HREE deposits for that matter, having a respectable distribution is a great thing, but that does not make you the best deposit out there or very economic for that matter either. The cost of metallurgical recovery is absolutely essential in the REE space, and without it, REE distribution means nothing.

So the point is: you can have the best REE distribution in the world, but if you don’t have the grade, tonnage, and the crucial mineralogy/metallurgy, it is irrelevant. Case in point is Matamec (Kipawa Deposit), Ucore (Bokan Mountain Deposit), and Namibia (Lofdal Deposit), all of which are HREE deposits that have very limited tonnage and/or grade, and thus, limited mine-life and/or higher OPEX. Quest and Avalon have the tonnage and a good REE distribution; however, they suffer from complicated mineralogy/metallurgy, and thus, are facing much difficulty on the road to production resulting in exacerbated costs and a higher potential to result in failure.

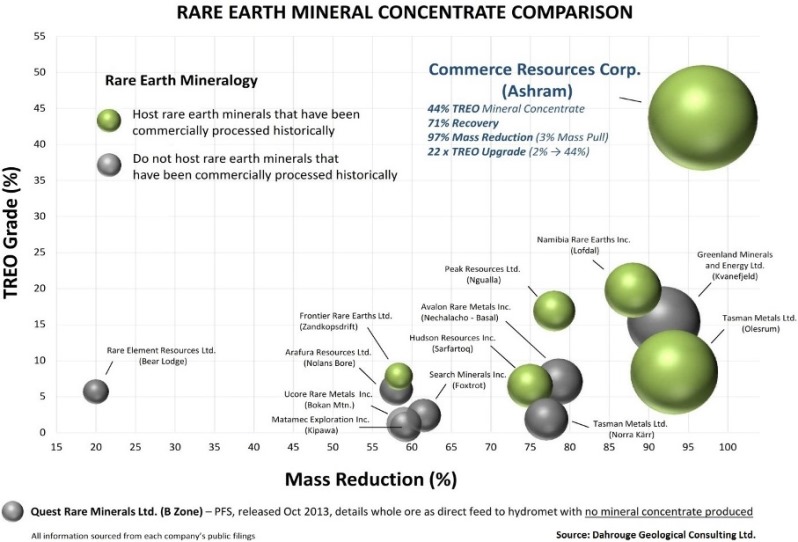

So at the end of the day, what REE company should someone invest in? I would argue this should be one with a well-balanced distribution (over all five of the CREOs) so they can weather price fluctuations better, because REE supply and demand is a constant flux over the life of a mine. Also, I would look for companies with sufficient tonnage so that the typical high CAPEX can make sense, as well as one with mineralogy/metallurgy that is simple and demonstrated so that management does not need to tiptoe around for a decade updating Preliminary Economic Assessments (PEA), Pre-Feasibility Studies (PFS), and Feasibility Studies (FS). Moreover, if I am betting on a REE deposit to be put into production, I am looking for one with rock types and REE minerals that have been commercially processed historically, given how mineralogy/metallurgy can make or break development. Commerce boasts all of these aforementioned attributes, placing it at the forefront in its peer group.

As stated in the previous article, only four REE minerals have ever been commercially processed; monazite, bastnaesite, xenotime, and loparite. Below is the Mineral Concentrate Comparison Chart edited to highlight those deposits hosting minerals that have been commercially processed historically:

As becomes clearly evident, those deposits that host REE minerals that have been commercially processed historically have an inherent metallurgical advantage over those that do not.

“At 1.9% TREO, it is very low-grade for a light REE dominant deposit. For comparison, Molycorp’s Mountain Pass Deposit, with a similar light to heavy distribution, has a grade of over 9% TREO.”

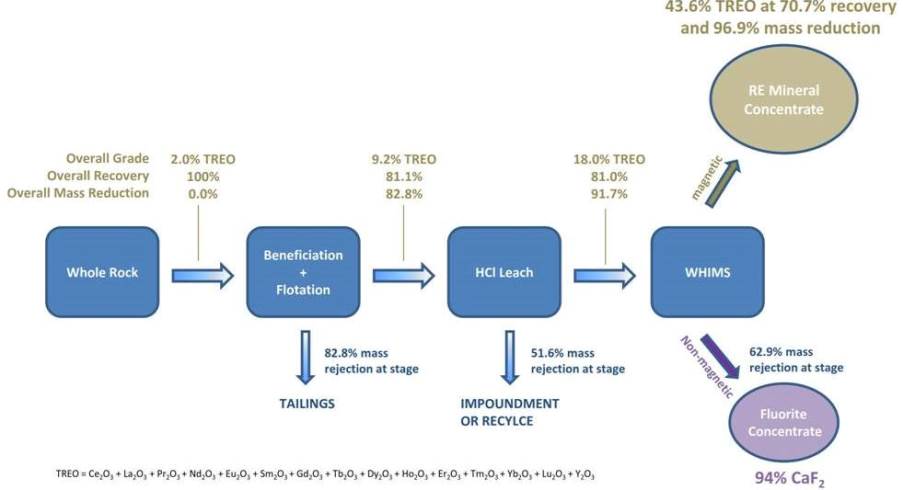

Such a statement is quite outdated and incorrect. Firstly, Molycorp’s Mountain Pass Deposit is ~6.6% TREO, not 9% as commented, yet it is still among the highest grade deposits in the world. Further, Commerce’s Ashram Deposit has a higher grade then Mountain Pass for three out of the five CREOs (Eu, Dy, and Y) and nearly equal for terbium. Second, the world’s +5% TREO deposits have all been discovered as recent exploration strongly indicates, totaling less than 10 overall in the world it would appear. A quick review of the REE space makes this quite apparent with any deposits over 3% a rarity, and very LREE enriched. Therefore, consider 2-3% as the new high-grade. Moreover, read the previous article again and find out how grade becomes irrelevant when you can easily upgrade to a mineral concentrate of +40% TREO, as Commerce does. This is how low-grade beach sands were able to be mined economically.

Commerce’s Ashram Deposit has a very respectable grade relative to its peers, and is higher than its well-known HREE peers. Commerce actually has one of the highest grades of the large tonnage, advanced stage REE deposits in development. This is illustrated in the chart below, as noted by Technology Metals Research.

Regarding the comment on the REE distribution of Commerce’s Ashram Deposit being similar to Molycorp’s Mountain Pass Deposit, this is simply not true. Commerce does not have a similar REE distribution to Molycorp, as Commerce is much more HREE enriched in comparison. Ashram’s MHREO Zone has 11.2% middle+heavy REE, while Mountain Pass has 1.4%. This means Ashram is eight times higher than Mountain Pass in this regard, for that particular zone, and still five times higher based on total resource. For carbonatite hosted deposits, Ashram MHREO has one of the best REE distributions in the world. This is due to the highly unusual presence of xenotime, the most preferred HREE mineral on the planet.

Take a look at the above chart on REE distribution and note the position of Mountain Pass and Ashram MHREO deposits in relation to each other. There is only one carbonatite hosted REE deposit to the right of Ashram MHREO, that being the lateritic Mount Weld - Duncan Deposit. This is very significant as nearly all REE deposits in production or that have historically produced, that are not beach sands or ion-absorbed clays, are carbonatite.

“The construction of a REE project is not cheap. Companies within the rare earth sector, even as they graduate from Preliminary Economic Assessment phase, to Pre-Feasibility Study, are finding out that this is an expensive proposition. Avalon was the first rare earth company to complete a Feasibility Study, so they are aware of the costs, and are taking steps to either reduce costs, further increase the profitability, or both. The other rare earth companies are still far behind and have much to learn yet.”

According to my understanding, Commerce is no newbie to the REE space and has put together and developed a team that get the game. It is all about costs and that is the fundamental point of our last article. PEAs commonly underestimate costs and Commerce identified early that simple metallurgy is the best manner to keep them in check going forward. The previous article had two main points: 1) a mineral concentrate is the best means of reducing downstream costs; 2) Commerce can make among the best – if not the best – mineral concentrate of all REE deposits in development. Commerce knows, and has known since having started in the REE space, that the best way to cut those costs is front-end concentration to a mineral concentrate. Comments like the above go straight to the notion that such companies tiptoe around their complicated mineralogy/metallurgy. My impression is Commerce understands costs very well and it is why they focus their efforts on metallurgy. Same applies for the producers Molycorp and Lynas, both of which generate mineral concentrates well in excess of 30% TREO for their operations.

Simply put, Avalon’s costs are high because their mineralogy is complex and metallurgy difficult, they will be mining underground as opposed to open-pit, and are choosing to produce separated oxides. Basically, this means Avalon’s costs are likely to be high at every stage of the game and they will have much difficulty in getting around it based on their FS.Alternatively, Commerce has simple mineralogy, excellent metallurgy, open-pit with very low strip-ratio (I believe industry lowest strip-ratio), and is advancing to a simple end-product of mixed REO, or partial separation. I bet that their PFS results will be pleasantly surprising.

“Avalon’s discussions with prospective customers are on-going. As you may know, Avalon has several Memorandums of Understanding with end-users. Is/as/when these discussions advance to Off-Take Agreements, the results will be announced. Those Off-Take Agreements are an important condition for financing. As well, the equity markets are challenging for all resource companies at this time. Fortunately, Avalon was well-financed to advance to where it is today – the most advanced predominantly heavy rare earth project in development outside of China – with a completed Feasibility Study, Environmental Assessment approval, and Government approval in place, allowing it to proceed to the permitting stage.”

First of all, a Memorandum of Understanding (MOU) means nothing if not binding. With public exploration and development companies, it is typically used as a marketing technique to keep shareholders more or less up-to-date, and thus, somewhat happy by hinting of a possible future Off-Take Agreement. However, until an Off-Take Agreement is announced, it does not exist. One of Avalon’s MOUs (see Avalon news release dated January 29th, 2013) was on its Enriched Zirconium Concentrate (EZC) product which at that time included Ta, Nb, and some REE. However, with the new metalurgical process, Avalon produces a zirconium sulphate product and not an EZC (see Avalon news release dated December 12th, 2013). Thus, that particular MOU seems a little outdated now, I would argue.

If a company holds MOUs for long time and no material developments can be seen in that respect, you better take yourself to the other side of the table: the party, who signed a MOU with the exploration and development company, is eagerly waiting on metallurgy results for comfort. The longer it takes, the more displeased a potential off-taker becomes, eventually pulling out (this circumstance commonly results in negative effects on the share price of an REE company). So, in essence, announcing an MOU prematurely can do more harm than good.

To this notion, Avalon’s metallurgical process is not finalized and still undergoing radical changes as seen from their recent news releases. This means they may very well be required to complete another economic update. Additionally, the company started talking about moving the hydromet plant from Pine Point to another locality – right after the FS was released. Avalon had an updated PFS and they look like they will have to do an updated FS as well. The current FS costs $60 million mind you. Good thing the company has the money to keep spending on it, and during this period of “delay-tactics” as some shareholders have commented already. If a company is so well financed, you may ask yourself why they are not farther along with more certainty, especially in their metallurgy.

“There is no ready market for a REE mineral concentrate outside of China, especially a radioactive one (which any xenotime-rich resource would be).”

This is an irrelavant comment. Commerce is not selling a mineral concentrate, but using it as a feed for their hydromet plant in order for them to produce simple REE products that do have markets. The above statement indicates a lack of understanding.

Firstly: yes, xenotime can have thorium, and thus, be radioactive. Our bodies are naturally radioactive remember. However, no one (with any knowledge of the REE industry) would ever knock a deposit for hosting xenotime. Such a statement loses all credibility for the speaker. Xenotime is the one REE mineral that all companies wish they had. It is the best HREE bearing mineral on the planet. No one has ever claimed Commerce to be xenotime-rich. They simply have enough that it matters.

Secondly: every hard rock REE deposit has some appreciable levels of radioactivity (U or Th) as those elements are typically concentrated with the REEs. Avalon, Quest, Ucore etc. are no different. More importantly, it is largely irrelevant due to Commerce’s simple mineralogy. Commerce will not sell a product with thorium (Th) in it as they are processing their mineral concentrate themselves in their hydromet plant and removing the thorium during that process, in the end selling thorium-free products. Further, they demonstrated early on in their metallurgical work that they can remove all the thorium. Note that the uranium content of the Ashram Deposit is nil.

Thirdly: as noted above, xenotime hosts the highest amount of HREEs out of any known mineral, and is therefore the most in-demand REE mineral in the world. Companies hosting minerals such as xenotime and monazite have the ability to produce a mineral concentrate of +30% TREO and, in turn, produce downstream products of value. These are exactly what China is looking for to increase imports because even they – the Chinese – are short of these, which of course they – the Chinese – know how to process through to the separated oxides that they vitally need for their domestic industries. The more HREEs the better, but remember: neodymium and europium are also in short supply and high demand and are very important REEs to have in the mix.

Below is Commerce’s simple flowsheet to produce a 44% TREO mineral concentrate from a 2% TREO feed material from its Ashram Deposit. This process is simple (very few steps), utilizes common and historically proven techniques, requires minimal consumables, and thus, is very likely an effective, realistic, and economic process as I expect to be confirmed easily by the forthcoming PFS.

“How much of Ashram deposit is Critical Rare Earths/HREE's, and what is the breakdown.Europium is considered LREE's to which there is an abundance. China and ROW. Surely Critical and Heavies are the most valuable rare earths right now. So to compare Quest's Critical rare earths portfolio, with LREE's, Is like comparing Gold to Silver.”

Of the TREO, approximately 19% of the Ashram Resource and 24% of the Ashram MHREO Zone are comprised of CREO. This equates to roughly 65% and 72% of the value per tonne of ore. Quest by comparison has a CREO distribution of 40% for the Strange Lake Granite and 48% for the Strange Lake Enriched Zone with approximately two-thirds of the CREO consisting of yttrium. For the europium distribution (percentage of TREO), the total Ashram Resource has 0.46% and the MHREO Zone 0.76% with the Strange Lake Granite and Enriched Zone being 0.14% and 0.12% respectively.

However, as explained earlier in this follow-up article, it is not as simple as comparing gold to silver. The demand for Neodymium, an LREE and also a CREE, is estimated at more than twice that of all the HREEs combined! Further: europium, geologically and scientifically an LREE (also a CREE), is the most valuable, from a price per kg perspective, than any other REE, with no substitutes known for it. Too often all the LREEs and HREEs are grouped together when in reality each element has its very own supply/demand fundamentals. Having a well-balanced distribution over all the CREEs I think is more important than being too weighted in the HREEs, and is why I believe Commerce is at the top of the pack. Further, and perhaps most importantly, Commerce has demonstrated that they have mineralogy and metallurgy that works.

“I have the same critique of this article. Nothing on the breakdown of TREO. Price difference between materials in this space is of major importance, especially to leave out a chart of HREE comparisons and to not even make them part of the article.”

This was not the point of the article as metallurgy was, which is as important, if not more important, than REE distribution I would argue. However, I do agree that no complete evaluation of a REE deposit can be done without a discussion of the REE distribution and is something this follow-up article sought to address for our readers.

“Jack Lifton arguments/propagates at the moment that the COMPOSITION of a deposit is the most important aspect. And then he also has an interesting list of 4 other criterias. This is what we should consider for ASHRAM as well: ".... the choice of ... deposits ... should be made on the basis of the distribution of the TREEs contained. The other key factors to be considered are: 1. Grade and the extent of the deposit,2. Radionuclides contained, 3. Ease (cost, safety, and containment) of extraction of the desired REEs from the radionuclides, and 4. Cost of separation/purification of the desired REEs from all of the contained REEs and non radionuclide contaminants (Fe, Al, F, etc). Note well that factors 2 and 3, and, lately, 4 more and more are coming to trump factor 1 due to advances in our understanding of the chemistries of: (A) Ore leaching (called the “metallurgy” in mining engineering), and of (B) Mineral beneficiation (concentration), and of (C) Rare earths’ separation from each other as well as of the chemical engineering issues arising from scaling up such chemistries to production levels.“

Jack is well-regarded in the industry; however, I would argue that a low-grade can be solved with economic upgrading to a mineral concentrate via good mineralogy/metallurgy, as long as the tonnage is supportive. Also, essentially all REE deposits will have the presence of radionuclides, and thus, it is not overly relevant to evaluating a REE deposit, assuming they can demonstrate those radionuclides can be removed. All comments on costs of beneficiation, metallurgy, and separation are all valid and go back to one fundamental attribute of any deposit: the mineralogy. Simple equals lower costs, and complex equals higher costs. REE distribution is a factor as well for sure; however, it must be economic to get out of the rock and too often this aspect is ignored. It all starts at the front end, that being the REE minerals present. Hence, Commerce as my top pick in the space.

“Quest’s OPEX is far more than that of CCE. But they also want to produce a lot of by-products what can be supportive if the costs are serious.Quest only plans to mine 180 days per year. CCE plans to mine all year around, 350 days. Waste strip ratio is 5.2:1 with Quest and 0.19:1 with CCE. That means Quest must mine 5 times as much mass as CCE, to get the same amount of ore for the mill. And that is with half of the mining days per year. Thus, they would need 10 times of the mine equipment to accomplish that. Not bad. They will have calculated that already. Less deteriotation (of mine equipment) if they do not operate in deepest winter. Other advantages. However, the ore for the mill must then be transported completely over land to the port. Quest calculates with 168 km of road, whereas CCE as per their PEA with 185 km. Quest wants to transport 1.44 million tons per year and calculates an OPEX with $114 million for the complete transport and logistics in one single year. There will be a lot more to the transportation of ore. However, the lion’s share will be on the transportation of ore. CCE calculates in its PEA with 21.000 tons of concentrate per year that must be brought to the port and calculates for this position $5 million. For 70 times as much quantity, Quest only has 23 times the costs. Maximum. Respect. This is probably a quantity discount from the logistics companies. However, Quest in their PEA only calculated $35 million CAPEX for the construction of the road. Now in the PFS they are already at $258 million. And the ore should be processed as slurry and then pumped through pipelines to the port. If there are mistakes in my calculations, please inform me.”

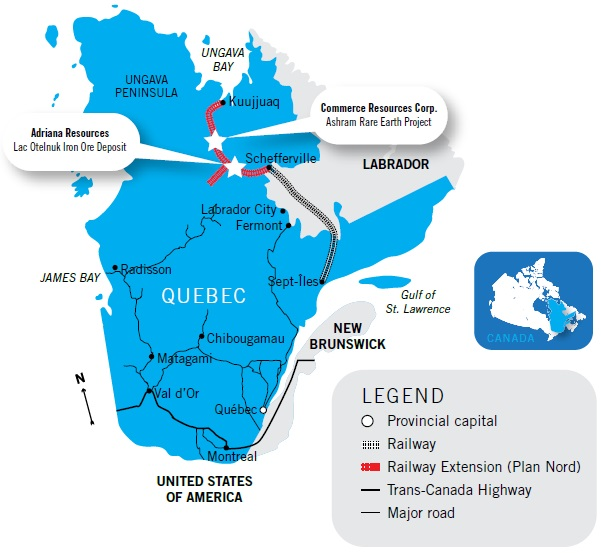

Quest vastly underestimated that cost in their PEA, as is evidenced by their PFS. A pipeline slurry may be an option, but is not so simple. It requires pumping stations, heating, and access still for maintenance. Like Quest, Commerce prefers a road route; however, unlike Commerce, Quest must build across the grain of the terrain, arguably making construction more difficult. Further, they must deal with two jurisdictions, being Quebec, and Labrador where native issues also persist. This affects permitting and environmental assessments. So, all this being said, both companies appear to prefer the road route option; however, I would argue that Commerce resides logistically, and socially, in a far better position.

Regarding the disparities in the costs of transport, I cannot really comment without a more in-depth look into the economics of that particular facet. Given Commerce’s significant advancements in metallurgy since the release of their PEA, it may make more sense to wait for their PFS to compare directly with the level of Quest’s study.

“I once counted how many large bridges it would take to connect Shefferfield and Kuujiag: I calculated 6. According to my understanding, the best way would be along the Caniapiscu River. Total length around 500 km. But if there will be production of oil up north in the Bay ofKuujiuag? Much more bridges were also not calculated in the PEA?”

The Commerce Ashram PEA identified three crossings that will be needed, all being relatively simple structures. The ongoing PFS has confirmed only three crossings are needed, and even shortened their length. Regarding a route to Schefferville, I understand this is a much more difficult route to take as it becomes more rugged terrain as one progresses south. I would expect more crossings, and difficult ones, would be required if a road were pushed south as opposed to north. Commerce’s road route also has the added advantage of potentially forming part of the land-link proposed by the Provincial Government as part of Plan Nord.

I am not familiar with oil exploration potential in Ungava Bay.

“It must be 7 bridges. In earnest, this summer Commerce talked about optimization of the route plan and a total of 3 bridges.The road route from the mine-site to a northern docking facility has been significantly optimized and improved from the initial route evaluated in the PEA. Although the length cannot be finalized until an exact docking facility location is confirmed, the length has been reduced considerably by 25 km (from 185 km to 160 km) when compared to the PEA. Further, the three crossings noted in the PEA (40 m, 50 m and 60 m) have also been significantly reduced in size (22 m, 28 m and 42 m) due to the newly optimized route. See CCE Press-Release of June 19, 2013.”

Yes, Commerce has reported that the road route has been optimized and indicates it will be shorter with smaller crossings and, perhaps most importantly, cheaper to build. I think this adds weight that Commerce did a good job being conservative in the PEA and we should not expect such a wide swing in costs as that of the Quest PEA-PFS transition, especially for the road.

“Given the latest breakthrough in Commerce Resources’s metallurgy, the construction and transportation costs could be substantially reduced. So what is the revised CAPEX? Typically the largest OPEX cost for a REE project is the mineral processing and subsequent hydromet. The fundamental way to reduce this cost, for any project, is to create a mineral concentrate. What is the OPEX cost per kg?”

There is no revised CAPEX as the PFS has yet to be finalized. However, typically the largest cost to any REE mine is the mineral processing and metallurgy and this is what Commerce has put the most focus on. The PEA used a 10% TREO mineral concentrate as a base case. The current flowsheet just produced a 44% TREO mineral concentrate. Thus, the possibility of a lowered CAPEX and OPEX exists. The OPEX per kg outlined in the PEA is ~$8/kg of REO produced (~$95 per tonne of ore treated). Note that to properly compare OPEX per kg of REO produced or OPEX per tonne of ore, one has to take into account the end-product to be produced.

“I dont believe the revised estimates on CAPEX and OPEX have been incorporated into a revised PEA. However, on the CAPEX it is interesting to note that Ashram has considerable (I believe it is nearly ~$200-$250M) costs incorporated into the current PEA for infrastructure. However, that cost will not be entirely left with CCE. There is a considerable provincial push on building out infrastructure in Quebec and other significant mining deposits of base metals in the area which means this ~$200M cost will be shared by several interested parties. CCE's portion could be closer to ~$50M (so a ~25%-~35% reduction in their overall CAPEX presented in the current PEA). IMPORTANT: This reduction in CAPEX will significantly improve the positive economics that are in the current PEA. I am not as clear on the OPEX savings. If anyone else has anything to add or comment on here please do.”

Commerce has not released a revised PEA and is still focused on completing the PFS I assume. Regarding the PEA, Commerce was conservative and opted to include the entire cost of the road CAPEX and OPEX in their economics. In reality, I would agree: it is very possible, perhaps likely, that the Provincial Government would chip in to help build the road, with other companies in the area paying for maintenance since they will undoubtedly use the road. However, this can now only be considered as a bonus and would likely be commented further in the PFS, I would expect.

In addition, Commerce’s road route has the added advantage of potentially forming part of the land link between Kuujjuaq and the South as planned and studied at the PFS level by the Provincial Government and outlined in Plan Nord announced in 2011.

One of Commerce Resources Corp.'s Project Camps in Canada:

The above is a follow-up article of “The Knock-Out Criteria For Rare Earth Element Deposits: Cutting the Wheat from the Chaff” which can be read with the following link.

DISCLAIMER:

The author holds shares Commerce Resources Corp. and may sell those any time without notice, whereas neither Rockstone Research Ltd. nor the author was remunerated by any of the companies mentioned herein to produce or publish this content. Please read the full disclaimer at www.rockstone-research.com as none of this content is to be construed as an "investment advice".