KLA-Tencor Corporation (NASDAQ:KLAC) is set to report second-quarter fiscal 2018 results on Jan 25.

Notably, the company has beaten the Zacks Consensus Estimates for earnings in each of the trailing four quarters, with an average surprise of 6.64%. Last quarter, the company delivered a positive earnings surprise of 10.43%.

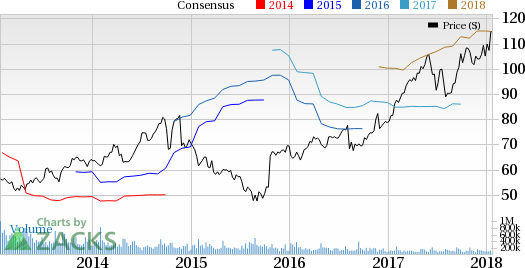

Notably, on a 12-month basis, KLA’s shares have returned 39.5%, underperforming the industry’s growth of 68.2%.

Let’s find out what KLA has to offer investors in this quarter.

Expanding Product Portfolio to Drive Top Line

We expect KLA’s top-line growth to benefit from an expanding product portfolio. The company is well poised to gain from strong demand for more efficient manufacturing processes.

Moreover, the technical complexity of manufacturing semiconductors and increasingly challenging yield issues are anticipated to drive growth from the company’s process control and yield management solutions.

We believe solid customer demand for products across the four end-markets — Wafer Inspection (46% of shipments), Service (21%), Non-semi (3%) and Patterning (30%) — is anticipated to drive order growth in the upcoming quarter.

For second-quarter fiscal 2018, KLA expects shipments of $945-$1.025 billion. Foundry orders are expected to be approximately 20% of shipments. Memory shipments are anticipated to be 60%, with NAND representing 55% of the mix. Logic is currently projected to be 14% of the shipment.

KLA forecasts revenues between $930 million and $990 million. The Zacks Consensus Estimate for revenues is currently pegged at $960.2 million.

Moreover, the Zacks Consensus Estimate for revenues for the Product segment is currently pegged at $759 million.

Services Growth & China: Key Factors

Services have become a key-growth driver in recent times. Last quarter, services revenues increased 10.5% from the year-ago quarter to $208.8 million, which was also better than the consensus estimate of $202 million. The growth was driven by expanded installed base and increasing demand for the upgrade and maintenance of legacy nodes.

The Zacks Consensus Estimate for revenues for the Service is currently pegged at $208 million.

Why a Likely Positive Surprise?

Moreover, our proven model shows that KLA is likely to beat earnings due to the favorable combination of a Zacks Rank #2 (Buy) and +0.35% Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Note that stocks with a Zacks Rank #1 or 2 (Buy) or 3 (Hold) have a significantly higher chance of beating earnings estimates. You can see the complete list of today’s Zacks #1 Rank stocks here.

Conversely, Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

Stocks to Consider

Here are a few stocks which you may also consider, as our model shows that they too have the right combination of elements to post an earnings beat this quarter.

Applied Materials, Inc. (NASDAQ:AMAT) , with an Earnings ESP of +0.57% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Western Digital Corporation (NASDAQ:WDC) with an Earnings ESP of +0.83% and a Zacks Rank #2.

Advanced Energy Industries, Inc. (NASDAQ:AEIS) with an Earnings ESP of +0.41% and a Zacks Rank #3.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Western Digital Corporation (WDC): Free Stock Analysis Report

KLA-Tencor Corporation (KLAC): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS): Free Stock Analysis Report

Original post