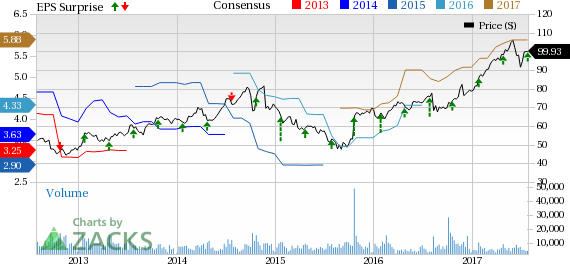

KLA-Tencor Corporation (NASDAQ:KLAC) reported fourth-quarter fiscal 2017 earnings of $1.64 a share, surpassing the Zacks Consensus Estimate of $1.59. Also, earnings increased 1.2% sequentially decreased 7.3% year over year.

KLA-Tencor's shares have returned only 27.1% year to date, underperforming the industry’s gain of 43.5%.

Let’s take a quick look at the numbers.

Revenues

KLA reported revenues of $939.0 million, increasing 2.7% sequentially and 2.1% from the year-ago quarter.Revenues were above the Zacks Consensus Estimate of $920.0 million and within management’s guidance range of $890–$970 million, courtesy of strong customer acceptance for the company’s new products.

Products generated 79% of total revenue, increasing 0.9% year over year. Services revenue comprised the remaining 21%, reflecting an increase of 7% year over year.

Orders

Shipments in the fourth quarter were $971 million, up 23.5% sequentially and above the guided range of $890–$970 million.

Order contribution by wafer front-end was as follows:

Foundry customers accounted for 64% of new semiconductor system orders, memory 32% and logic 4%.

Margins

KLA’s gross margin was up 50 bps sequentially but shrank 40 basis points (bps) year over year to 62.9%. The better-than-expected sequential gross margin was backed by a favorable mix of products and services.

Operating expenses of $241.7 million were up 4.5% from the year ago-quarter. As a percentage of sales, both research & development expenses increased from the year-ago quarter, while selling, general & administrative expenses decreased. Therefore, adjusted operating margin of 34.6% was down 70 bps year over year.

Pro forma net income was $259.0 million compared with $256.0 million in the previous quarter and $276.8 million in the year-ago quarter. Including restructuring and merger-related charges, GAAP net income was $256.2 million compared with $253.6 million in the previous quarter and $271.5 million in the year-ago quarter.

Balance Sheet

KLA ended the quarter with cash and short-term investments balance of $3.02 billion against $2.70 billion million in the previous quarter. Cash from operations was $462.6 million in the quarter.

Guidance

For first-quarter fiscal 2018, KLA expects shipments of $945–$1.025 billion. Revenues are expected between $910 million and $970 million, while the Zacks Consensus Estimate is pegged at $934.5 million. Non-GAAP EPS is expected in the range of $1.50–$1.74, the mid-point above the Zacks Consensus Estimate of $1.58.

For the first quarter, KLA expects gross margin to be in the range of 62.5–63.5%, flat at the midpoint on a sequential basis, and operating expenses to be around $250 million.

Zacks Rank & Other Key Picks

Currently, KLA-Tencor carries a Zacks Rank #1 (Strong Buy). Some better-ranked stocks in the same space are Lam Research Corporation (NASDAQ:LRCX) , carrying a Zacks Rank #1 and Applied Materials (NASDAQ:AMAT) and Fortive Corporation (NYSE:FTV) , carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Lam Research delivered a positive earnings surprise of 4.44%, on average, in the trailing four quarters.

Applied Materials delivered a positive earnings surprise of 3.35%, on average, in the trailing four quarters.

Fortive Corporation delivered a positive earnings surprise of 5.90%, on average, in the trailing four quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaries,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

KLA-Tencor Corporation (KLAC): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Fortive Corporation (FTV): Free Stock Analysis Report

Original post

Zacks Investment Research