New Zealand dollar tumbles sharply as RBNZ surprised markets by announcing 25bps cut in the Official Cash Rate today. Markets originally expected the central bank to hold and cut later in June. RBNZ noted in the statement that "outlook for global growth has deteriorated since the December Monetary Policy Statement, due to weaker growth in China and other emerging markets, and slower growth in Europe." And it highlighted downside risk to outlook due to China and global financial markets. Domestic risks included dairy sector, declining inflation expectation and pressures in housing markets. Also, the central noted that "there has been a material decline in in range of inflation expectations measures". RBNZ also maintained easing bias and noted that "further policy easing may be required to ensure that future average inflation settles near the middle of the target range."

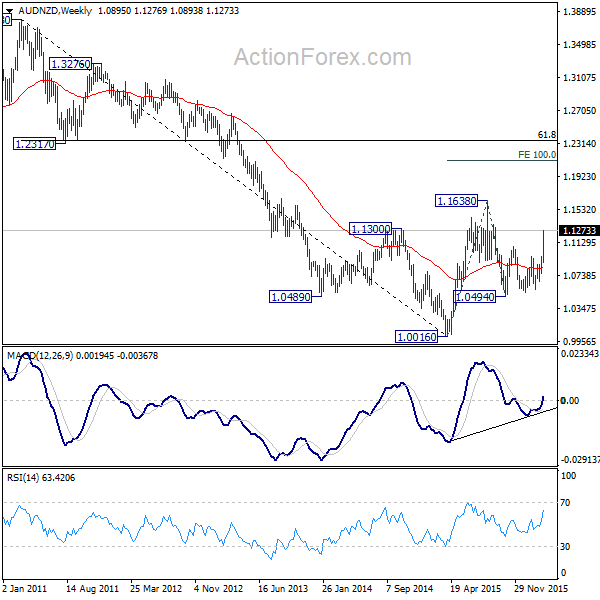

NZD/USD dips to as low as 0.6617 so far, comparing to this week's high of 0.6814. Focus is back on 0.6543 near term support and break will open the way lower to 0.6346 support. The fortune between Aussie and Kiwi are drastically different as seen in AUD/NZD. The cross surges to as high as 1.1276 today. The development indicates that the rebound from long term bottom at 1.0016 is possibly resuming. Near term outlook is turned bullish for a test on 1.1638 first. Break there will target 100% projection of 1.0016 to 1.1638 from 1.0494 at 1.2116 in medium term.

Canadian dollar strengthened overnight as BoC kept main interest rate unchanged at 0.50% as widely expected. In the accompany statement, BoC noted that economic outlook is broadly the same as the January MPR. Neutral stance was maintained on monetary policy. But the impact of the upcoming federal budget's fiscal measures will be incorporated into next projection to be published in April.

ECB rate decision and press conference is the main focus today. The central bank is widely expected to launch extra stimulus measures. The deposit rate could be lowered deeper into negative territory, by at least -0.1% to -0.4%. The size of the asset purchase program could also be raised by EUR 10b to EUR 70b per month. Meanwhile, it should be noted that ECB president Mario Draghi disappointed last December with smaller than expected stimulus. That pushed EUR/USD from near to 1.05 to above 1.13 in February. Given that the expectation is again rather high for this ECB meeting, we'd be cautious on another disappointment from Draghi again.

On the data front, China CPI rose to 2.3% yoy in February versus expectation of 1.8% yoy. PPI rose to -4.9% yoy. Australia consumer inflation expectation rose 3.4% in March. Japan domestic CGPI dropped -3.4% yoy in February. UK RICS house price balance rose to 50 in February. German trade balance will be released in European session. US will release jobless claims and Canada will release new housing price index.