Markets focus were mostly on equities, as the DOW closed above 15000 level for the first time and the S&P 500 closed at another record high. Risk appetite carried on in the Asian session after China trade data. But volatility in forex markets is relatively limited. The most notable move was found in the New Zealand dollar, which tumbled after comments from RBNZ about intervention. European majors are generally bounded in range against the greenback, while some additional weakness was seen in the Sterling. The Yen recovered mildly as both the USD/JPY and EUR/JPY failed to take out near term resistance, and look set to extend recent consolidations.

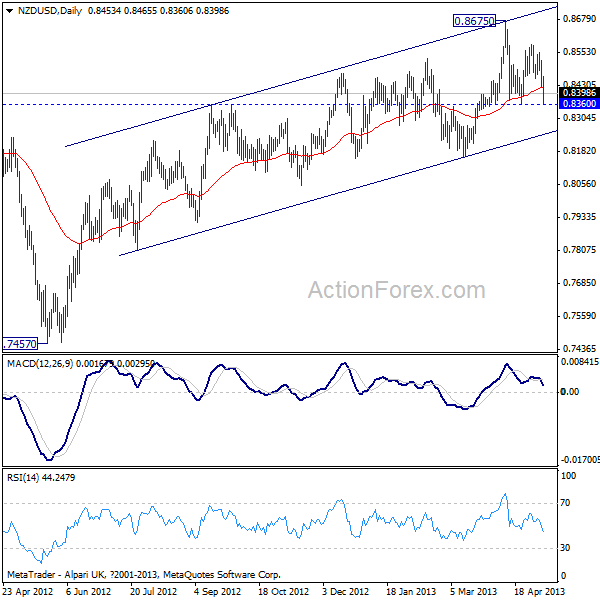

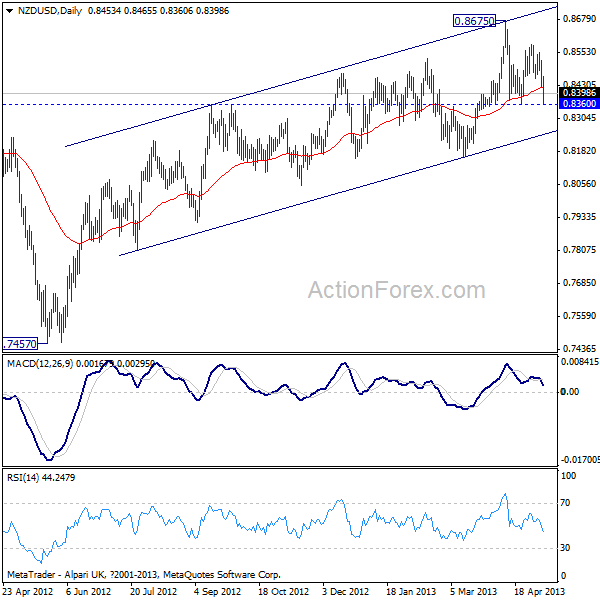

The kiwi dropped sharply after RBNZ governor Wheeler told parliament that "there has been some intervention". He said that the RBNZ is "on-the-record that it is prepared to intervene in the exchange rate". While he said RBNZ didn't expect intervention would "materially change the level of the exchange rate", the central bank could "take potentially the tops off rallies". He said that the NZD is "significantly overvalued".

The NZD/USD dived sharply, as low as 0.8360 so far today. It is trying to draw support from 0.8360, and has recovered since then. Near term outlook isn't bearish yet as long as this support holds, and as the pair is staying comfortably inside the medium term rising channel. We'd expect some buying at the current level to bring rebound. A sustained break of 0.8360 will pave the way for a test on the channel support at around 0.8250.

NZD/USD" title="NZD/USD" width="600" height="600" />

NZD/USD" title="NZD/USD" width="600" height="600" />

Economic data from China showed that trade surplus came in wider than expected at USD 18.2b in April, compared to the consensus of USD 15.5b. Exports jumped sharply by 14.7%, compared to the consensus of c10%. Imports also jumped 16.8% compared to expectations of c14%. However, the data raised some concerns as it differed largely from trends in neighboring countries including South Korea and Taiwan, which reported weak export numbers.

In Europe, German newspaper Die Welt reported that the ECB is considering buying bad loans from Southern Europe to revive asset- backed securities to pass credit risks to investors. Last week, ECB President Draghi said that "the Governing Council decided to start consultations with other European institutions on initiatives to promote a functioning market for asset-backed securities." Separately, executive board member Asmussen warned that "keeping interest rates too low for too long can lead to real costs."

The kiwi dropped sharply after RBNZ governor Wheeler told parliament that "there has been some intervention". He said that the RBNZ is "on-the-record that it is prepared to intervene in the exchange rate". While he said RBNZ didn't expect intervention would "materially change the level of the exchange rate", the central bank could "take potentially the tops off rallies". He said that the NZD is "significantly overvalued".

The NZD/USD dived sharply, as low as 0.8360 so far today. It is trying to draw support from 0.8360, and has recovered since then. Near term outlook isn't bearish yet as long as this support holds, and as the pair is staying comfortably inside the medium term rising channel. We'd expect some buying at the current level to bring rebound. A sustained break of 0.8360 will pave the way for a test on the channel support at around 0.8250.

NZD/USD" title="NZD/USD" width="600" height="600" />

NZD/USD" title="NZD/USD" width="600" height="600" />Economic data from China showed that trade surplus came in wider than expected at USD 18.2b in April, compared to the consensus of USD 15.5b. Exports jumped sharply by 14.7%, compared to the consensus of c10%. Imports also jumped 16.8% compared to expectations of c14%. However, the data raised some concerns as it differed largely from trends in neighboring countries including South Korea and Taiwan, which reported weak export numbers.

In Europe, German newspaper Die Welt reported that the ECB is considering buying bad loans from Southern Europe to revive asset- backed securities to pass credit risks to investors. Last week, ECB President Draghi said that "the Governing Council decided to start consultations with other European institutions on initiatives to promote a functioning market for asset-backed securities." Separately, executive board member Asmussen warned that "keeping interest rates too low for too long can lead to real costs."