The New Zealand dollar soars in Asian session today after RBNZ raised OCR by 25bps to 2.75% as widely expected. It's the first developed nation to remove massive monetary stimulus after the financial crisis. RBNZ governor Wheeler sounded hawkish in the accompanying statement. He noted that "inflationary pressures are increasing and are expected to continue" over the next two years. He emphasized the need to contain inflation expectation and raise interest rates "towards a level which they are no longer adding to demand". And, today's rate hike is not a one-off event but the start of a tightening cycle. Wheeler said that "the speed and extent to which the OCR will be raised will depend on economic data and our continuing assessment of emerging inflationary pressures."

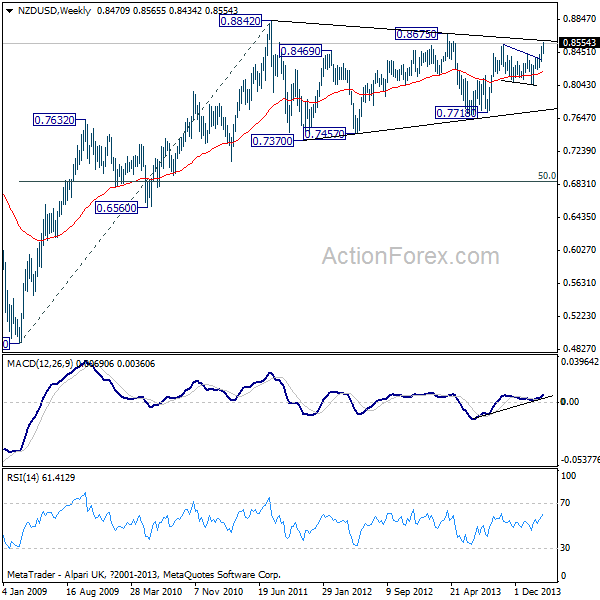

The NZD/USD surges to as high as 0.8565 so far today and took out and important resistance at 0.8543. Further rally is expected towards 0.8675 , 2013 high. But again, we'd like to emphasize again that that pair is still bounded in a long term consolidation pattern from 0.8842 (2011 high). We'd be very cautious on strong resistance near to 0.8675 to bring reversal. We'd prefer to see sustained trading above 0.8675 to confirm underlying bullishness.

NZD/USD Weekly Chart" title="NZD/USD Weekly Chart" width="474" height="242" />

NZD/USD Weekly Chart" title="NZD/USD Weekly Chart" width="474" height="242" />

On the other hand, Aussie also jumps sharply today on stronger than expected employment data. The Australian economy added 47.3k jobs in February, triple of expectation of 15.3k. Also, prior month's figure was revised up from -3.7k contraction to 18k growth. It should be noted also that full time jobs surged by 80k while part-time jobs retreated, which was a healthy sign. Unemployment rate was unchanged at 6.0%. The participation rate also rose from a near 8-year low of 64.6% to 64.8%. The job market outlook will add more bullets for RBA to keep rates unchanged for a period of time. Also released from Australia, consumer inflation expectations rose 2.1% in March.

Elsewhere, Japan machine orders rose 13.4% mom in January. UK RICS house price balance dropped to 45 in February. ECB monthly bulletin will be the main feature in European session. US will release retail sales, jobless claims, import price index and business inventories later today. Canada will release new housing price index.