New Zealand dollar recovers today on comments from RBNZ governor Graeme Wheeler and positive job data. Wheeler noted that "the RBNZ is not seriously contemplating cutting the cash rate at this point, despite the flurry of moves in other countries." And he noted that "a period of cash rate stability is the most prudent option." Though, he also reiterated that the exchange rate of New Zealand dollar remained "unsustainable in terms of New Zealand's long-term economic fundamentals," and would "more likely to undergo a significant downward adjustment" due to narrowing growth differentials with other advanced economies. New Zealand employment rose 1.2% qoq, or 28k jobs in Q4 comparing to expectation if 0.8% qoq. Unemployment rate rose from 5.4% to 5.7% but that's mainly due to jump in participation rate to record 69.7%. That's a record 36k people entered into the job market.

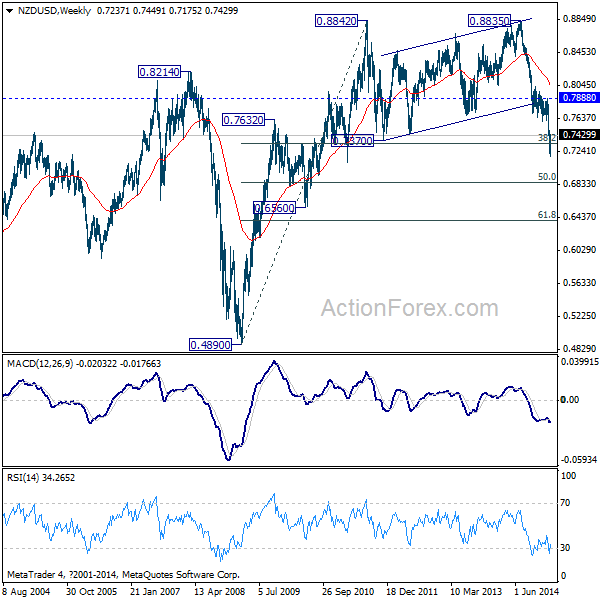

Technically, NZD/USD is trying to draw support from long term fibonacci level of 38.2% retracement of 0.4890 (2009 low) to 0.8842 (2011 high) at 0.7332. Current fall from 0.8835 is viewed as the third leg of the correction pattern from 0.8842. As long as 0.7888 resistance holds, deeper fall is still expected. But strong support should be seen between 50% retracement and 61.8% retracement, that is 06400/6866 to contain downside and complete the pattern. Meanwhile, break of 0.7888 will indicate medium term reversal.

In US, St. Louis Fed president James Bullard called for deleting the word "patient" in FOMC statement regarding timing of the first rate hike. He, as a known hawk, reiterated Fed should raise interest rates sooner and move gradually after that. He noted that recent sharp fall in oil price has distorted market based inflation expectation measures. Meanwhile, Bullard is optimistic that the US economy is "pretty close to normal behavior". On the other hand, Minneapolis Narayana Kocherlakota said that the job market is more likely to stay with the "highly desirable upward trajectory" if Fed "does not tighten monetary policy in 2015". He also noted that "the sluggish behavior of prices over the past few years suggests that there is room for further improvement."

Elsewhere, UK BRC shop price index dropped -1.3% yoy in January. Japan labor cash earnings rose 1.6% yoy in December. China HSBC services PMI dropped to 51.8 in January. Looking ahead, services data is the main focus today. in European session, Italy will release services PMI, Eurozone will release services PMI revision and retail sales. More importantly, US will release services PMI and is expected to improve to 56.6 in January. From US, ADP employment, ISM non-manufacturing will be featured with Canada Ivey PMI.