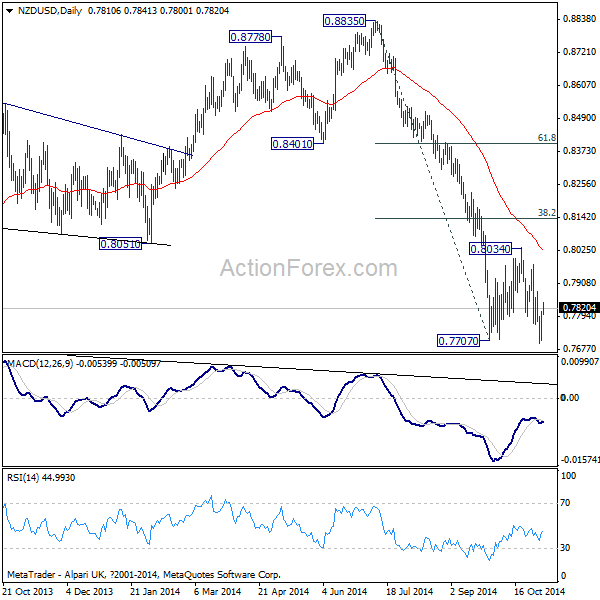

New Zealand recovers today as lifted by better than expected job data. The employment market grew 0.8% qoq in Q3, faster than Q2's 0.5% qoq and beat expectation of 0.6% qoq. Unemployment rate dropped to 5.4% versus expectation of 5.5%, the lowest level since Q1 of 2009. Economists are divided on the timing of RBNZ's next hike, ranging from next June to September. But after all, RBNZ did drop the hawkish bias in last statement and it will take a string of strong data to turn the tide. Despite a breach of 0.7707 to 0.7697, NZD/USD quickly recovered. The development suggested that consolidation from 0.7707 is possibly still in progress. Now the bias is mildly on recovery back to 0.8034 resistance. Overall, a downside breakout is anticipated after the consolidation completes.

Elsewhere, Japan monetary base rose 36.9% yoy in October versus expectation of 36.2% yoy, labor cash earnings rose 0.8% yoy in September. UK BRC shop prices dropped -1/9% yoy in October. Swiss will release CPI in European session. Eurozone will release services PMI final and retail sales. But main focus will be UK services PMI, which is expected to drop to 58.5 in October. Sterling was lifted against Euro by stronger than expected PMI manufacturing earlier this week. But the momentum quickly faded. The pound will need some extra inspiration to extend the rise again.

In US, St Louis Fed James Bullard, a known dove, expressed his support for Fed's decision to end the bond purchase program. He noted that global markets seemed to be expecting a global recision in early October. But, "as it turned out, that all kind of evaporated." And, he said Fed "did a very sensible thing" in ending QE. ADP employment is expected to show 210k growth in October. ISM non-manufacturing is expected to drop to 57.8 in October.