Investing.com’s stocks of the week

The New Zealand dollar pares back much of this week's gain after disappointing job data and comments from RBNZ governor Wheeler. The New Zealand employment rose more than expected by 0.9% qoq in Q1 versus consensus of 0.6% qoq while Q4's figure was revised down from 1.1% qoq to 1.0% qoq. However, the unemployment rate was unchanged at 6.0% versus consensus of a fall to 5.8%. That's due to improvement in participation rate, which rose to record of 69.3% in Q1, comparing to Q4's 68.9%. Some economists argued while the job market would continue to grow, the supply of labor would also be growing too. As a result, improvements in the unemployment rate would only be gradual this year.

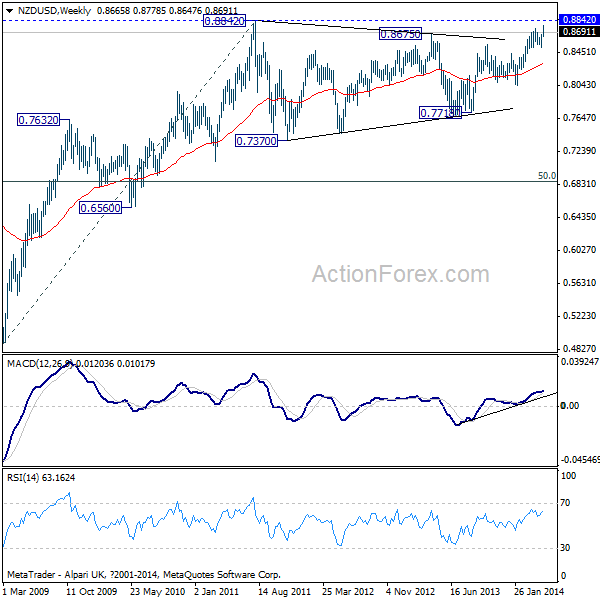

RBNZ governor Wheeler reiterated today that the Kiwi's exchange rate is "overvalued" and the current level is not sustainable. He warned that "if the currency remains high in the face of worsening fundamentals, such as a continued weakening in export prices, it would become more opportune for the Reserve Bank to intervene in the currency market to sell New Zealand dollars." Some analysts believe that with NZD/USD close to record high of 0.8842, RBNZ is also close to intervention.

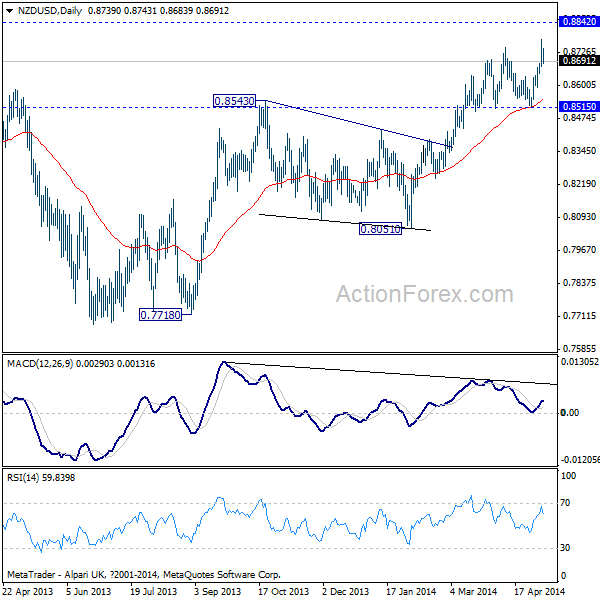

Technically, we'd note that while the NZD/USD's up trend extended further to as high as 0.8669, the pair has been losing upside momentum as seen in bearish divergence condition in daily MACD. Also, it's staying in the multi-year range from 0.8842 historical high made back in 2010. There is not clear sign of a breakout. Based on current momentum, we'd likely see strong resistance from 0.8842 to bring reversal to extend the sideway pattern. And a break of 0.8515 support will indicate near term reversal.

Also. released in the Asian session, the BRC shop price index dropped -1.4% yoy in April, Australia retail sales rose 0.1% mom in March versus expectation of 0.4%. Swiss unemployment and foreign currency reserve, German factory orders will be released in European session. Canada building permits and US non-farm productivity will be released in US session.