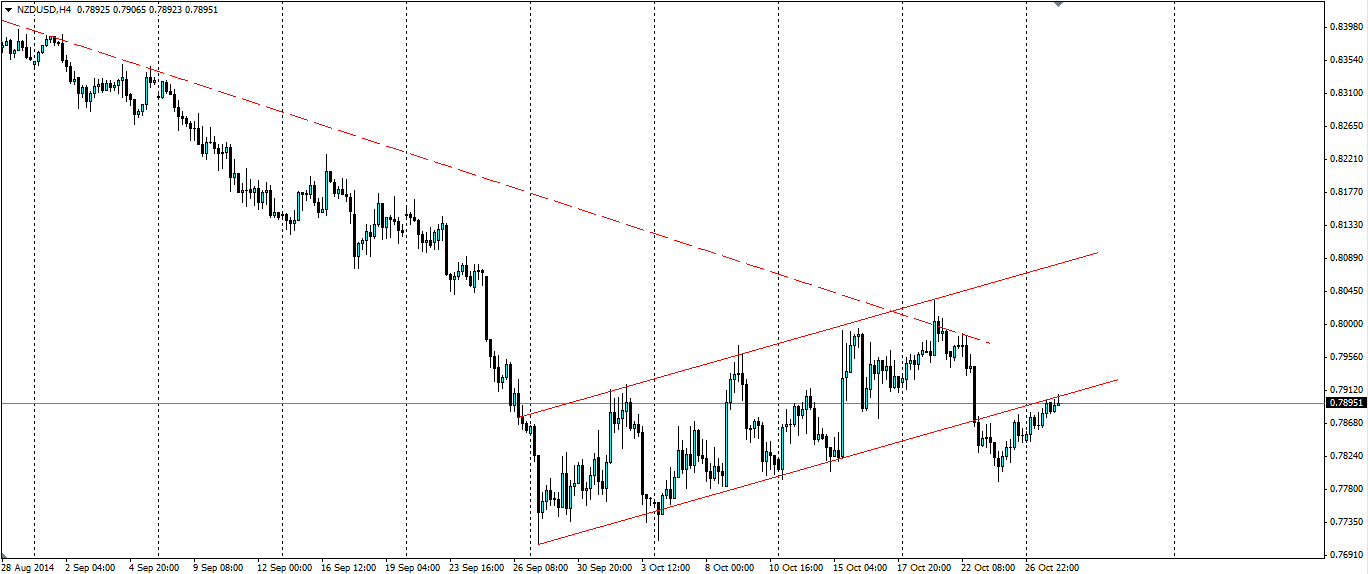

The Kiwi broke out of its upward channel and now looks to use it as resistance before possibly rejecting lower. The interest rate decision later this week could be detrimental for the Kiwi if the RBNZ looks to keep rates on hold for an extended period of time.

The recent data has not been positive for the Kiwi dollar and we could see a continuation of the trend tomorrow when the ANZ Business Confidence is released. Business Confidence has steadily fallen in New Zealand over the course of this year, from a high of 70.8 in February to last month’s low of 13.4.

Inflation has also proved something of a worry, refusing to budge from its current 0.3% quarterly rate. Last week we saw the market predict a rise to 0.5%, however, the result at 0.3% disappointed the market and sent the kiwi lower. The RBNZ will certainly take this into account when it meets to decide interest rates on Thursday (NZ time).

The RBNZ is likely to keep interest rates steady at 3.50% and will point to many factors. Inflation is not posing a threat and does not need to be reined in. The Trade Balance was released last week and was poor to say the least, falling from -$472m to -$1,350m. Home Sales are down 12% from a year ago and Dairy prices have fallen almost 50% since the beginning of the year.

The key will be in the language the RBNZ uses and how long they plan on keeping interest rates on hold. I am guessing something along the lines of “the foreseeable future” or “until the situation improves”. If we see the RBNZ become more dovish and imply that rates are going to stay low longer than the market expects, we will see a fall in the Kiwi dollar.

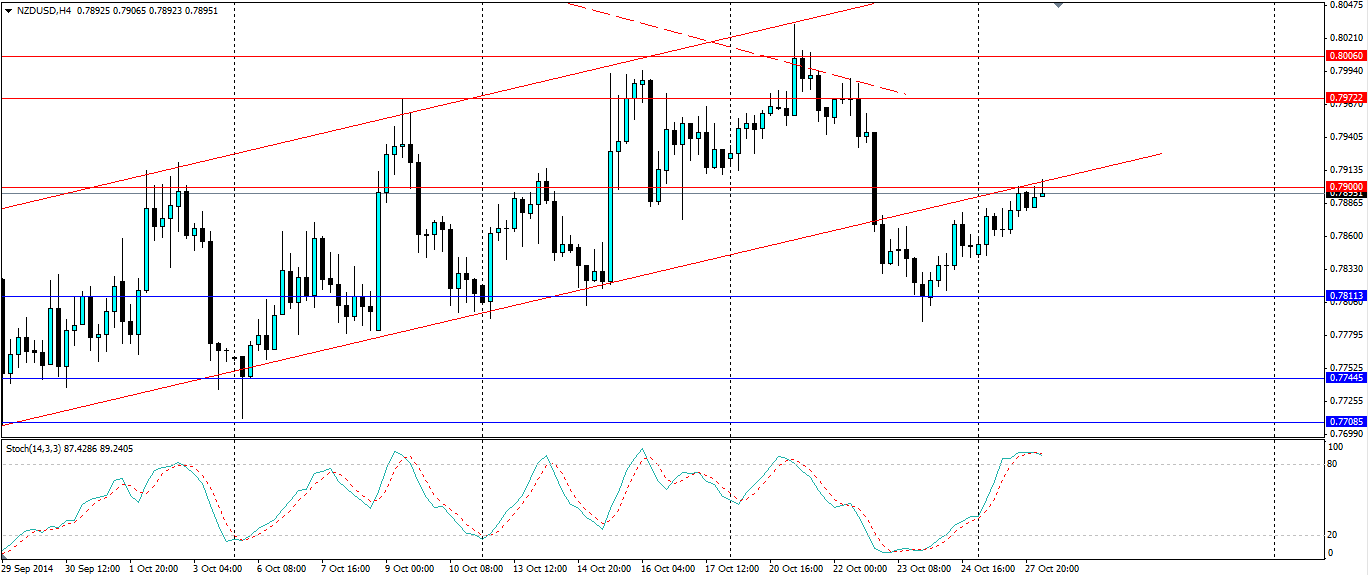

The current technicals point to a fall before the interest rate decision. The price is currently moving up along the bottom of the previous channel and is using it as resistance. It has also just found resistance at the 0.7900 level. The Stochastic Oscillator is currently showing overbought conditions, also pointing a potential fall.

If we see a fall before the interest rate decision, or even as a result, look for support to be found at 0.7811, 0.7744 and 0.7708. If we see a breakout of the current resistance at 0.7900, look for further resistance to be found at 0.7972 and 0.8006.

The Kiwi is currently looking bearish from a technical perspective. The interest rate decision later this week could pile on the bearish sentiment if the RBNZ turns more dovish.