New Zealand dollar was knocked down in Asian session sharply by weaker than expected inflation data. CPI rose 0.3% qoq in Q3 while the annual rate slowed to 1.0% yoy, missing expectation of 1.3% yoy and compared with expectation of 1.6% yoy. That's also lower than RBNZ's expectation of 1.3% and could prolong the central bank's pause in the tightening cycle. According to swaps data, markets are pricing 80% chance that RBNZ would keep OCR unchanged at the current 3.50% by the end of first half next year. There were also talks that RBNZ could delay the next hike till as late as September 2015.

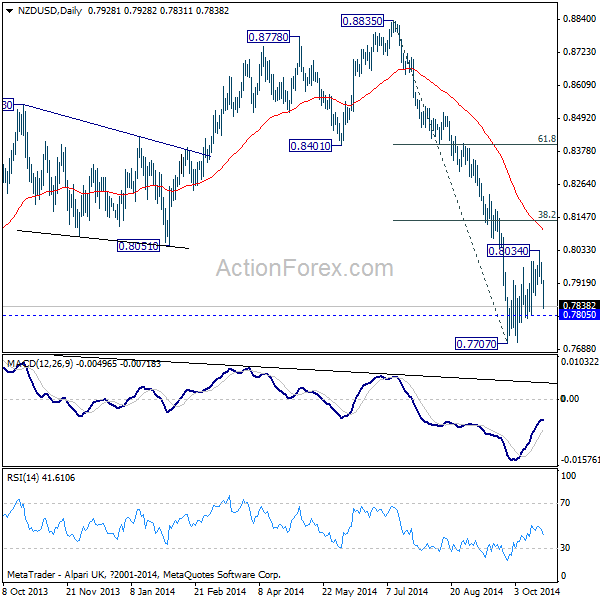

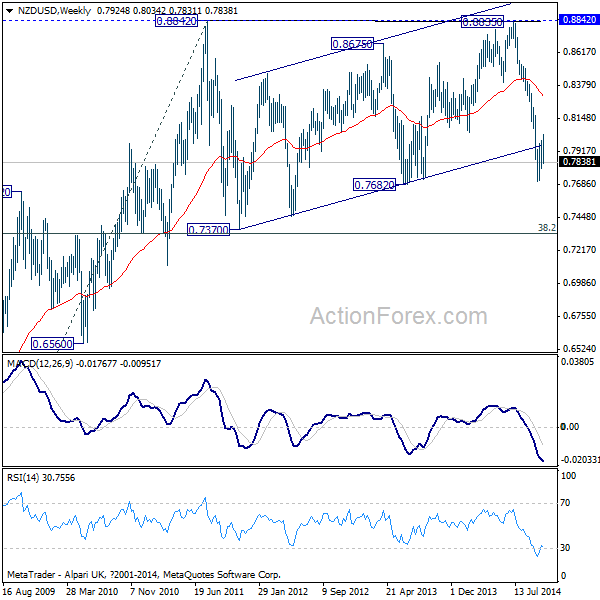

Today's downside acceleration in NZD/USD argues that recent consolidation from 0.7707 is possibly completed at 0.8034 already. Focus is now back on 0.7805 minor support. Break will indicate that fall from 0.8835 is likely resuming. Also, note that such decline is viewed as the third leg of the pattern from 0.8842 high. Break of 0.7707 will target long term fibonacci level of 38.2% retracement of 0.4890 to 0.8842 at 0.7332.

Elsewhere, dollar is maintaining yesterday's gain and is possibly gathering momentum for further rally. In particular, focus is on 1.2624 minor support in EUR/USD and 0.9561 minor resistance in USD/CHF. Break there will trigger further rise in the greenback through recent high. Sterling stays soft against the greenback after BoE minutes but is firm against Euro. Canadian dollar had a brief rise after BoC kept rates unchanged yesterday but is quickly back into established range. Further dip in EUR/USD could help push USD/CAD back towards 1.1385 resistance.

Considering that, the PMI data from Eurozone would be closely watched today. Eurozone manufacturing PMI is expected to drop to 50.0 in October while services PMI is expected to drop to 52.0. German manufacturing and services PMI are also expected to drop slightly. From UK, retail sales, Mortgage approvals and CBI trends total orders will be released. US will release jobless claims, house price index and leading indicators.