It was a rather dire week for the NZD last week, which saw the pair freefall from 0.7016 all the way down to 0.6835. The collapse in price came as the nation’s largest trading partner, Australia, cut interest rates and the Global Dairy Price Index contracted. Furthermore, an unexpected increase in the NZ Unemployment rate hammered the kiwi Dollar as the week came to a close. As the new trading week begins, the NZDUSD will hopefully capitalise on the weak US Non-Farm Employment Change result.

The NZDUSD closed the week well south of where it started after a perfect storm of indicator releases sent the pair spiralling. Early on in the week, the surprise RBA Cash Rate cut to 1.75% caused not only a slip for the AUD but for the kiwi dollar as well. The slip in the NZD came as a result of the market pricing in a future reactionary cut from the RBNZ. A future cut is now highly probable in order to offset any loss of NZ export competitiveness to its largest export market. The pair was not finished falling yet however, a subsequent 1.4% contraction in the GDT Price Index extended the kiwi’s losses as the week continued. In a final blow, a surprise jump in NZ Unemployment from 5.3% to 5.7% kept the NZD tumbling until the week came to a close.

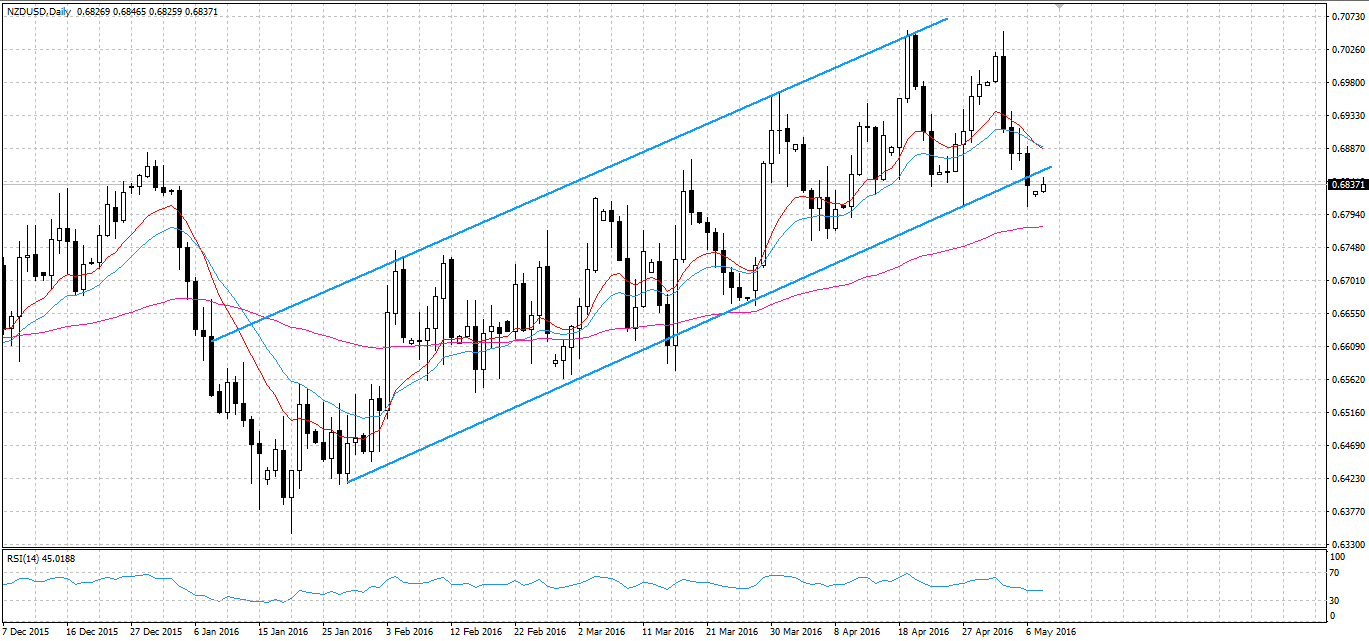

Looking at the technical data, the kiwi dollar broke free from the bullish channel, pushing past the downside constraint as Fridays session closed. Consequently, the 12 and 20 day EMAs have now crossed which could signal the end of the recent uptrend. However, a strongly oversold stochastic oscillator should help to prop up the NZD as the trading week opens. Moreover, the 100 day EMA is now flattening out which could be heralding the commencement of a ranging phase for the currency.

In the coming week, the movement of the NZDUSD will be largely be determined by a handful of NZ results early in the week and the US Unemployment claims result due Friday. Additionally, the exceptionally weak US Non-Farm Employment Change result, which was released over the weekend, should help the pair to find support as the week begins. Moreover, the RBNZ Financial Stability report is likely to cause some sentiment trading to predominate mid-week. However, any upside potential of this sentiment trading will be capped by market uncertainty generated by the breaking of the bullish channel.

Ultimately, the NZD is likely to be confined to a ranging motion for some time. However, as has been seen recently, the pair has seen some large swings which will be good news for range traders. Additionally, as the market has priced in much of the risk of the RBNZ cutting the OCR in June, some of the downside risk will be diminished. However, keep a close watch on fundamental indicators as they are released as they could see the Kiwi extend losses in the short-term.