I think we have all been there at some time in our lives. That feeling of euphoria, having a wave at the beach lift you off your feet towards the heavens, only to discover that what goes up must come down, and the feeling of abject terror as you realise you are now hurtling towards the bottom, without a lifeguard in sight. That’s the conundrum that kiwi FX traders feel looking at their charts today.

New Zealand’s economy is closely tied to dairy demand in China and as we all know, China is feeling the pinch of late. Softening Chinese trade and inflation figures, released in April, have demonstrated the cooling off that is occurring in the Asian power house. In response, the PBOC loosened their monetary policy and Reserve Ratio Requirements, in an attempt to soften the landing and maybe stimulate the economy. Unfortunately, such stimulus is yet to flow through to the New Zealand in the form of increased demand, and would likely be too late to protect the kiwi dollar from significant depreciation anyway.

Subsequently, New Zealand’s macroeconomic data is starting to soften and this is indicated by the uptick in the unemployment rate from 5.7% to 5.8%. Even the RBNZ is coming to the conclusion that a rate cut in the near term is a likely possibility with Governor Wheeler taking a dovish tone. I firmly expect retail sales figures and CPI to reflect this softness in the coming reporting periods, strengthening the case for the RBNZ to act decisively. Also, China’s industrial production numbers, due out on Thursday, are likely to further compound slackening demand on New Zealand Exporters. Subsequently, the kiwi dollar is likely to be in for a rough ride in the coming days.

Technical Perspective

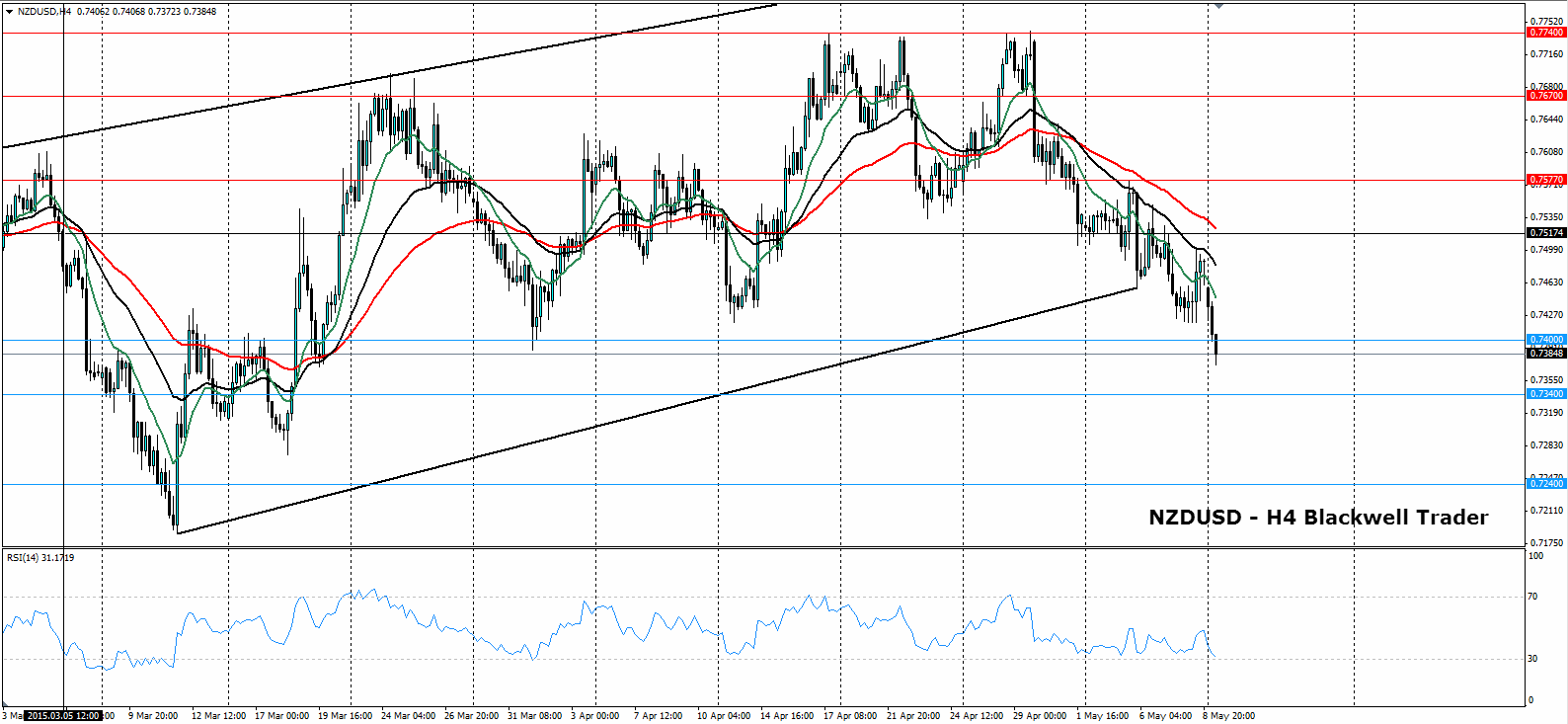

The kiwi dollar has traded within a bullish channel, since the middle of March, which has supported its retracement back from the years low at 0.7174. Despite the market testing support within the key 0.7400 range, the pair continued to climb, and many analysts had predicted that it would test resistance at 0.7740 in the near term. Despite this bullish bias, the trend-line support has failed to hold and the pair has tumbled under the key 0.7400 level to trade at 0.7384. The 30 and 60 period moving averages tell the story as price action remains firmly below these dynamic support/resistance levels.

In the coming days the kiwi dollar is likely to fall under a wave of more selling as the Chinese Industrial Production, and US Unemployment Claims data hit the airwaves. Expect to see the pair decline to support at 0.7340 this week as Short sellers ride the wave lower.

Ultimately, the only silver lining in this cloud is likely to be New Zealand exporters who are set to benefit from the depreciating Kiwi Dollar. For the rest of us, we can expect a bumpy run through softening NZ economic conditions. So maybe it’s time I grabbed my surf board to ride a few waves of New Zealand’s finest waters, and to forget about the crashing wave that is the kiwi dollar.