The New Zealand Dollar has remained relatively high on the opening of the markets, despite recent comments from the Reserve Bank of New Zealand (RBNZ) that the NZD is currently overvalued in the present climate. While many have been expecting more rate rises, there are more worries on the horizon for the economy.

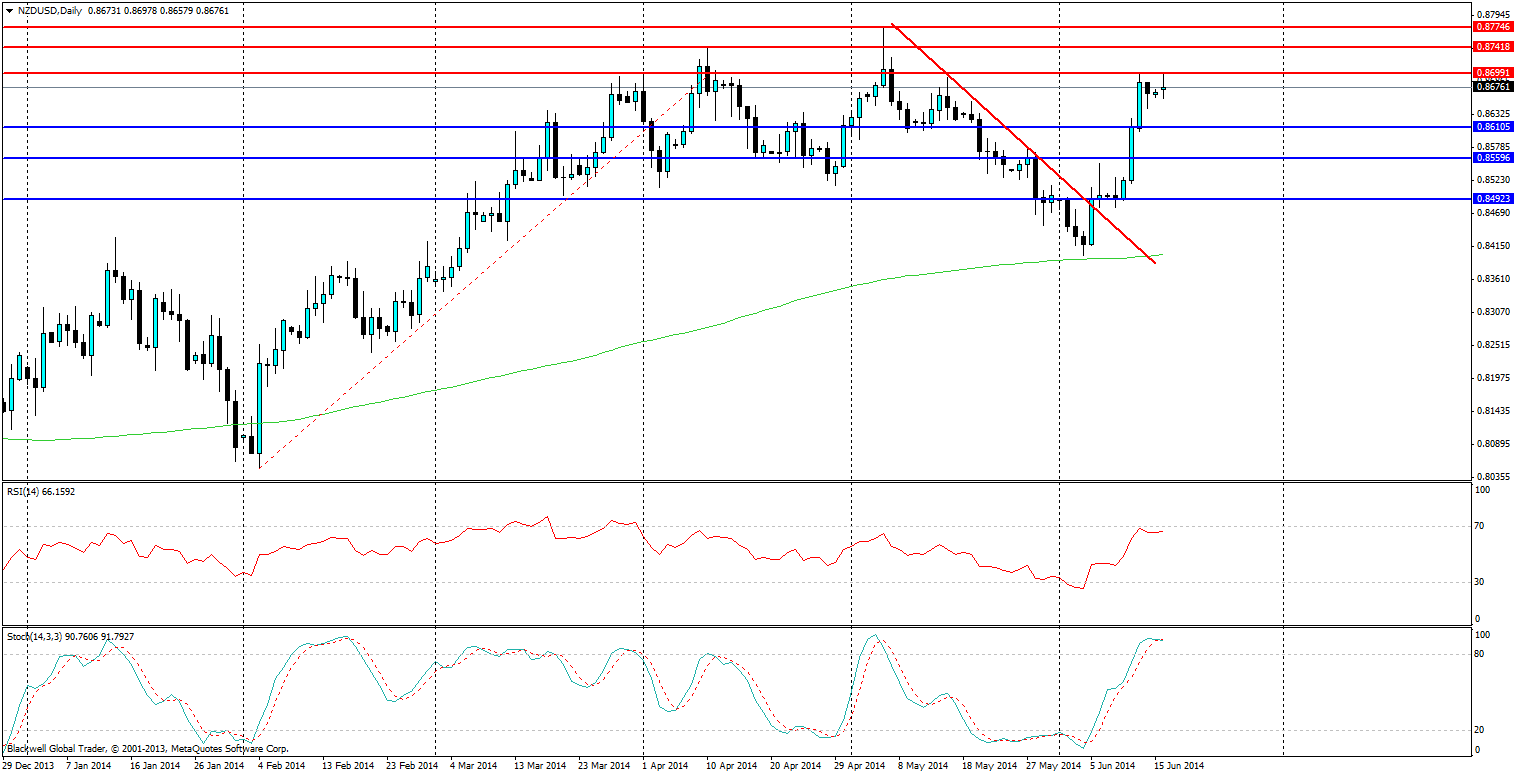

Source: Blackwell Trader (NZDUSD/, D1)

After yesterday's market opening I was expecting the bears to take a swing and smash the price lower, but the market certainly had other ideas as it looked to see if there was still any momentum higher. I didn’t think there was and sure enough the resistance level at 0.8700 held strongly. It seems for the moment that markets don’t believe that 87 can be sustained, but this is of no surprise, as it has acted as a psychological level for some time.

So why do I believe it will shift lower? I think tonight's milk auction will have a big impact on dairy prices and as such will adversely affect the New Zealand economy. It’s no secret that Fonterra is the country's largest exporter, and is a global business with a large footprint on the New Zealand economy. However, its pay-out structure can have long reaching effects on the economy and I believe that the global trend is starting to shift as supply increases and as markets start to feel a little nervous.

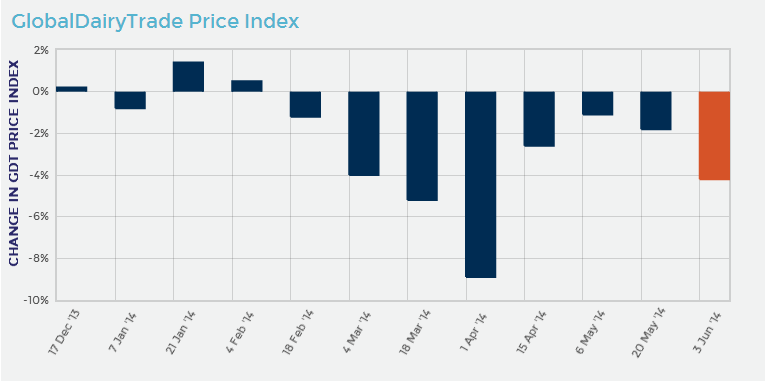

Source: Global Dairy Trade

Current patterns have shown weaker results for dairy products, even if the decrease in the price index is not as heavy, it’s still likely to be negative. Long term trends tend to be sustained in the dairy market (see chart below).

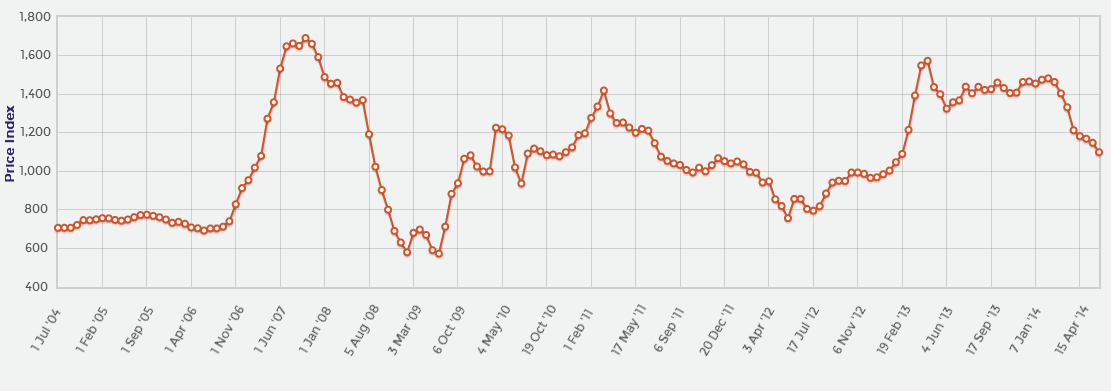

Source: Global Dairy Trade

The long term outlook has shown dairy prices falling off for some time. After rapid growth, we could perhaps be seeing a reality check for the market which has been looking to trend lower after the start of this year.

So with falling commodity prices (especially milk) I expect to see further selling for the NZD. Likely it will look for areas of support and 0.8610, 0.8559 and 0.8492 are likely to be the key levels, which it will look for as it finds points to hold on. Further drops seem unlikely given the NZD’s patterns of ranging, which happen fairly frequently once it comes off the end of a trend.

Going forward, I will be looking to catch momentum as the dairy trade starts at 12:00 GMT on the 17th of June. Markets will be expecting a fall and any chance to strike and I believe they will. In terms of trading look to catch momentum lower, but don’t expect massive drops unless we have a change of more than -5%.