The venerable kiwi dollar has been one of the largest beneficiaries of the volatility flooding the global markets over the past week as capital has sought a safe haven.

Subsequently, the currency has rallied from a low of 0.6970, in late June, to its current level around the 0.7269 mark.

However, despite the convincing rally, price action has entered a key reversal zone that could see it trending sharply lower in the coming week.

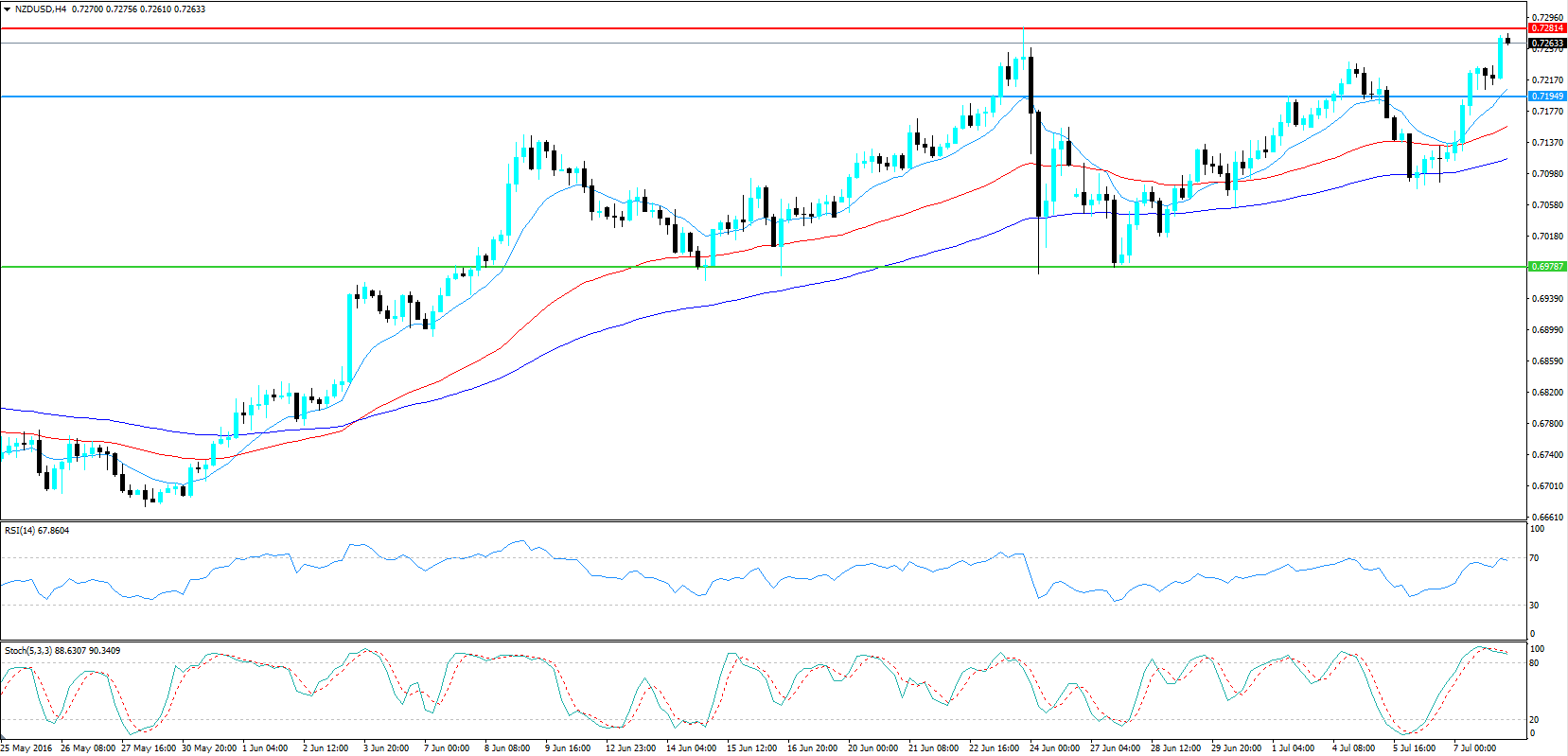

In fact, a cursory review of the 4-hour chart yields some interesting technical signals that seem to support a short term reversal. In particular, the RSI Oscillator is flirting with over-bought levels, which have typically brought about a retracement from the pair.

The Stochastic Oscillator also seems to confirm this view with the indicator seemingly starting to trend lower from reversal territory. In addition, a 5 wave motive phase has also just completed which predisposes the pair to a 3-wave corrective pattern.

Subsequently, there are plenty of reasons to see a pullback for the kiwi dollar in the coming week given the range of technical indicators that support the assertion.

However, there have also been some fundamentals at play in the current setup as the RBNZ continues to spar with the New Zealand Government over the need for additional macro-prudential intervention. Much of this rhetoric has actually helped the pair to retain its current level and delayed the necessary pullback.

Ultimately, the most likely scenario for the NZD/USD is a move towards the 0.7285 mark and then the entry of a 3-wave corrective pullback until this pattern completes near the support structure just below the 70 cent handle.

Subsequently, a reversal of this nature would provide plenty of opportunities and a tradable 300 pip range. However, watch out for the US Non-Farm Payroll figures, due shortly, as there could be some very sharp volatility seen if a surprise is present.