Key Points:

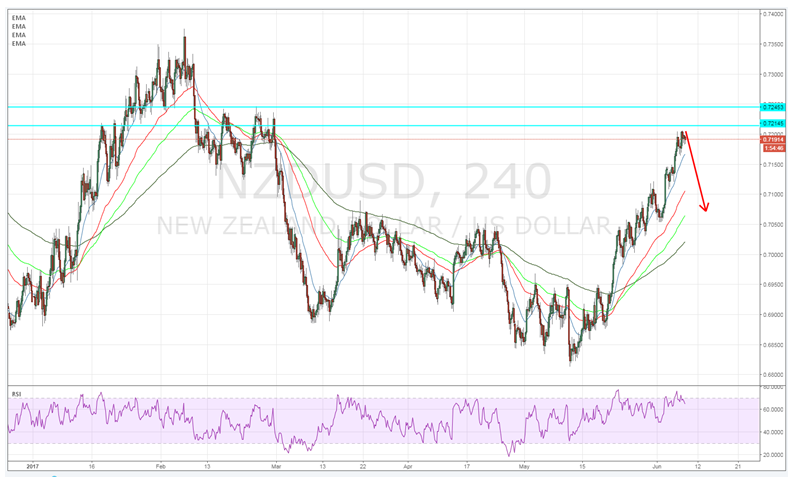

- Price action reaches a key supply zone.

- Watch for momentum to stall and price to decline in the days ahead.

- Downside move back towards 0.7055 likely in the coming week.

The past month has been almost meteoric for the venerable kiwi dollar as the currency has continued to rally to its current position at 0.7190. However, despite the strong bullishness, the various technical indicators are signalling that a change could be in the wind for the pair. In particular, price action is nearing a key reversal/supply zone which could be suggesting that a decline is likely in the coming days.

The most concerning factor is the looming supply zone and its relative historical validity in signalling potential reversals. Subsequently, the looming supply zone (0.7214-0.7245) is likely to result in price action’s rise stalling and a rapid depreciation occurring once the bulls exit the market. Lending additional weight to the bearish contention is the fact that the RSI Oscillator is also within overbought territory which suggests that the price action will need to decline, or at a minimum moderate, to relieve the pressure on the oscillator.

Fundamentally, the New Zealand dollar has benefitted from the ongoing strength in the global dairy markets as well as the recent 3.2% gain in the ANZ Commodity price indicator. However, the kiwi dollar is still relatively at the behest of the U.S. Federal Reserve’s looming rate hike decision. At this stage, it remains unclear whether the central bank will hike rates at its coming FOMC meeting but the reality is that the NZD/USD is likely to be struck with a range of volatility regardless of the outcome. Subsequently, this is likely to result in a change in tack for the pair and, if the central bank hikes rates, will lead to a significant depreciatory period.

Ultimately, the most likely scenario for the pair revolves around a failure to penetrate through the current supply zone starting at 0.7214. This would potentially lead to a sharp decline as the upside momentum falls away and price action starts to move back towards the initial downside target at 0.7055. In addition, any move by the U.S. Federal Reserve to raise rates, or take a hawkish tone in the looming meeting could also cause depreciation for the kiwi dollar. Subsequently, there are plenty of factors to suggest that the pair could be in for a rough week ahead given both the technical and fundamental aspects.