The New Zealand dollar had a relatively mixed week as the pair saw a negative sentiment from the sharp decline in NZD CPI to -0.5% as well as some buoyancy from the poor US Jobless Claims figures. Ultimately, the kiwi dollar ended the week gaining around 50 pips. Moving forward, the NZD appears to be faltering and could challenge the supportive 64 cent handle in the coming days as the RBNZ’s OCR decision falls due.

The week ahead is likely to be critical for the pair as it faces a slew of US economic data as well as the important Reserve Bank of New Zealand decision upon interest rates. Given the recent fall in NZ CPI the meeting is likely to be a live one where a 25bps cut may be considered. Given the recent sharp fall in CPI, the RBNZ is under pressure to act to support the economy. Subsequently, look for plenty of volatility around the decision especially if there is an easing bias inherent in the minutes.

As the prices of crude oil and dairy products continue to tumble there has been renewed pressure upon New Zealand inflation. The recent fall in the NZ CPI is largely down to the recent cheap oil and dairy prices, however there are some concerning signs of a slowing NZ domestic economy. Subsequently, the upcoming Reserve Bank meeting is likely to be lively with plenty of sentiment changing material contained within the minutes. Therefore, expect to see lots of swing within NZD/USD prices as the market digests the latest round of jawboning from the RBNZ Governor.

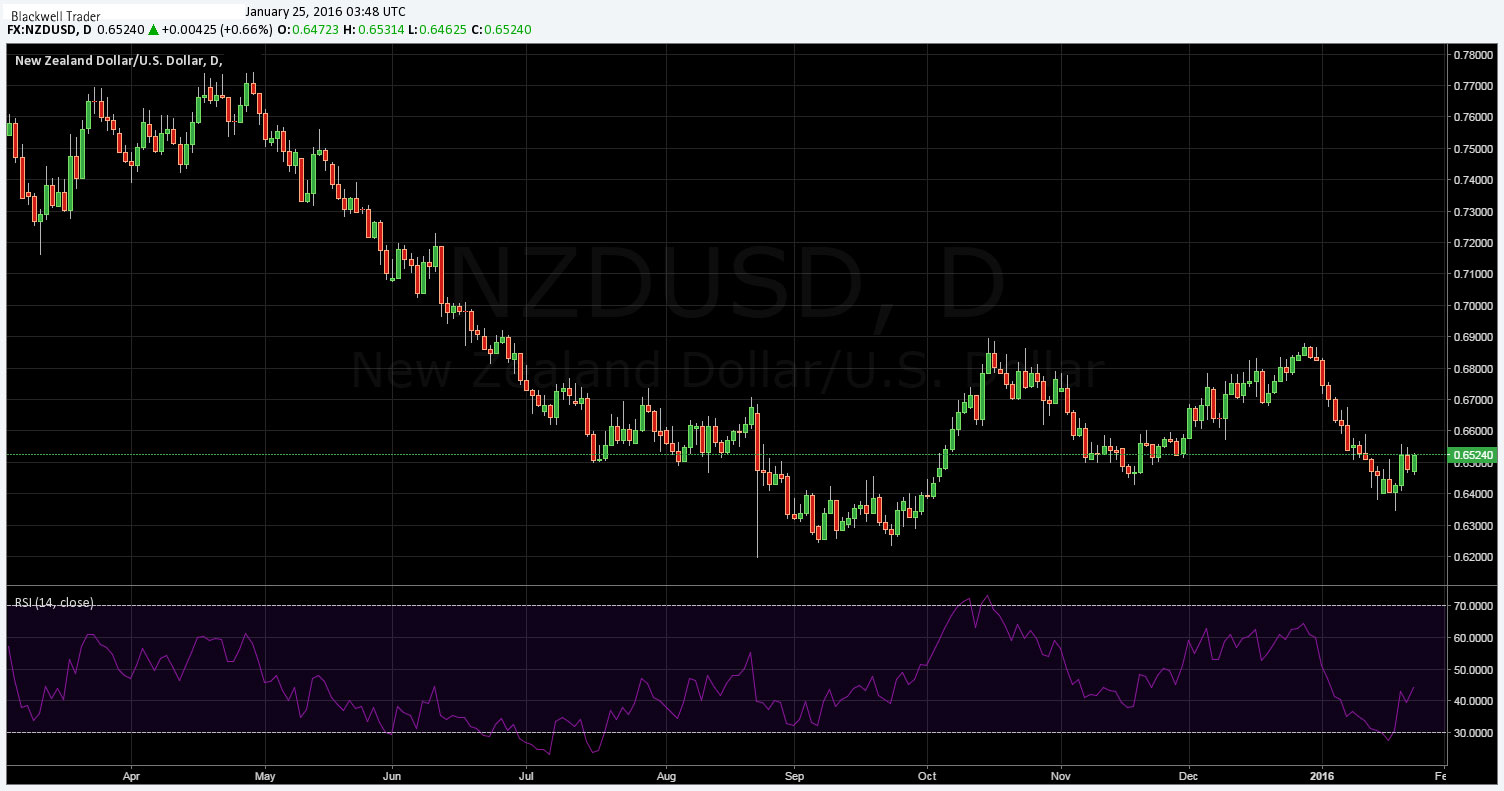

From a technical perspective, the NZD’s price action remains capped within a relatively wide consolidation channel. The moving averages also remain relatively bearish whilst RSI appears to have dipped slightly within neutral territory. It’s likely that the pair will challenge the key supportive zone around the 64 cent handle in the coming days but the current position of the pair lends itself more to a neutral bias until a strong trend is observed. Support is found at 0.6400 and 0.6234. Resistance is found at 0.6557, 0.6706, and 0.6898.

Ultimately, predicting Central Bank monetary policy action requires a deft understanding of their mandate along with some significant skill in crystal ball analysis. Subsequently, monitor your positions closely with a particular view to the short side.