The kiwi dollar has been trending lower in a non-volatile bearish channel that could send it towards the recent four year lows.

The latest dairy auction highlights the situation New Zealand is in. Dairy makes up a substantial amount of New Zealand’s exports (around 29%) and prices have just fallen another 10.8% on top of a fall of 8.8% two weeks ago. All of the gains for the year have now been wiped out which is a huge blow to New Zealand’s export sector. The RBNZ will have a tough time trying to raise interest rates when commodity prices, and indeed inflation are so low.

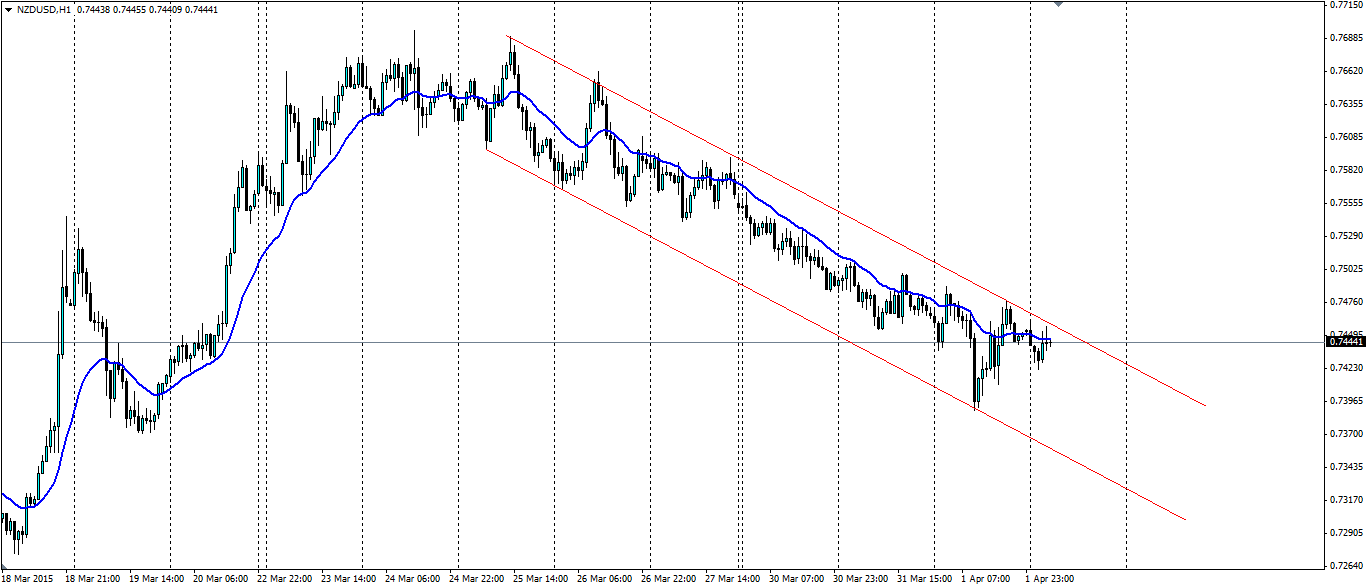

With the lack of news over the next 24 hours for the kwi, we are likely to see technicals play their part for the NZD/USD pair. The Kiwi dollar has been stuck in a non-volatile bearish channel that has taken it from a relative high of 0.7690, down to the current level at 0.7446. If the trend holds or we see a sharp downside breakout, we could see the Kiwi hit the four year lows down at 0.7186.

The 20EMA on the Hourly chart above has been acting as dynamic resistance as the trends lower. There have been a couple of attempts to push through but each time is met with resistance along the channel and a push back below the 20EMA.

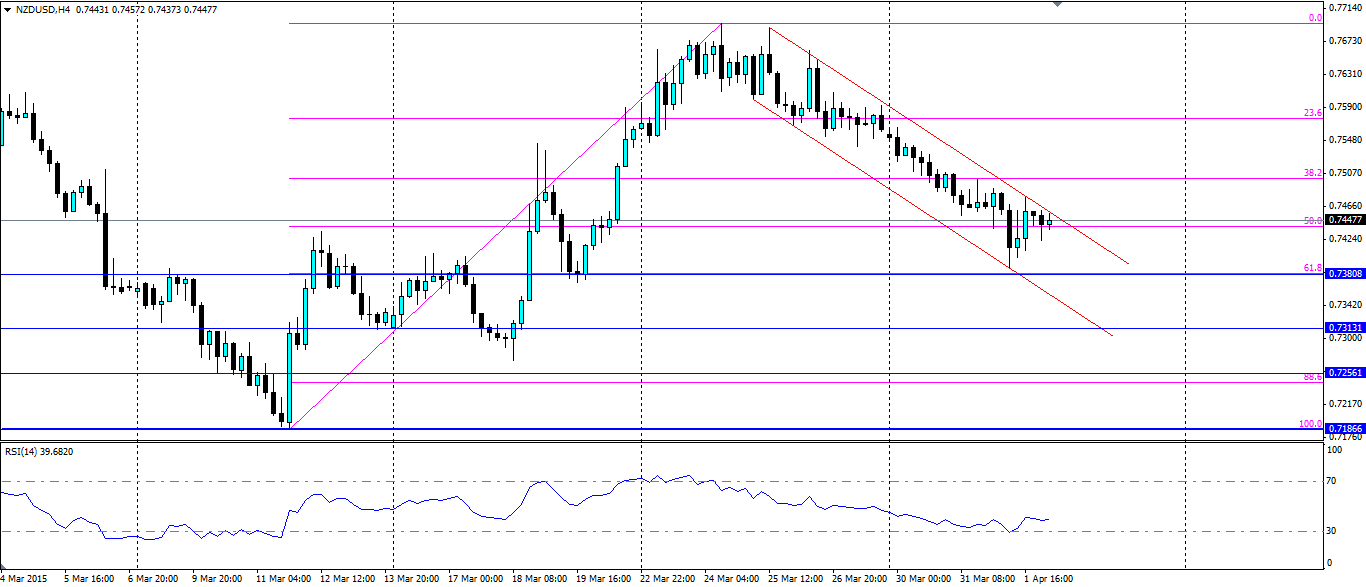

On the H4 chart below we can see a push down towards the 61.8% Fib retracement level and a rejection off the bottom of the channel. The price is now using the 50.0% level a support but is consolidating under the channel. If we see the channel hold we are likely to see a serious attack on the support at the 61.8% level at 0.7380. Further support is found at 0.7313, 0.7256 and of course the recent low at 0.7186.

Disappointing data from New Zealand including the latest dairy auction have seen the kiwi follow a non-volatile bearish channel. Little news in the next 24 hours for NZ could see a continuation of that trend.