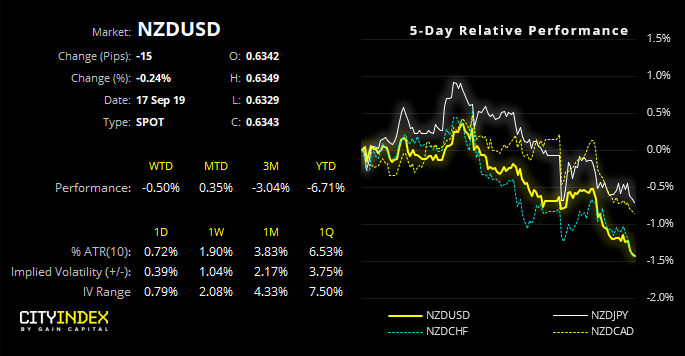

NZD crosses are falling in tandem which suggests broader weakness awaits.

NZD/USD remains in a clear downtrend, and the retracement from the 0.6269 low appears to have had its day. The correction failed to retest the 38.2% Fibonacci level and, after a few days of consolidation, printed a bearish pinbar which was also a bearish outside day. Bearish momentum is clearly back with prices back beneath the 2016 low. The bias is for a re-test of 0.6294 and break lower, whist 0.6451 holds as resistance.

NZD/JPY is sensitive to risk appetite, although it may have topped without risk-off being required. For example, USD/JPY and AUD/JPY are holding up well (considering yesterday’s explosive move on oil markets) and with NZD/JPY suggesting a swing-high is in place, bears may want to keep an eye on this in case risk appetite sours.

GBP/NZD broke out of compression on the back of a stronger British pound on Friday. Over the near-term we’d prefer to see some more consolidation, given that range expansion paused at the upper Keltner band ahead of yesterday’s doji with a slight bearish divergence.

NZD/CAD's short swing-trade idea finally appears to be playing out. A bearish wedge has formed during a strong downtrend, and the retracement respected 0.8500 resistance before rolling over yesterday. The underlying analysis remains unchanged; bearish below 0.8500 with potential to target (or even break below) the 2018 low.