The Australian Bureau of Statistics released the January jobs report, which on the headline showed the unemployment rate falling to 5.7% from 5.8% in December. The economy was seen adding 13.5k jobs, beating estimates of 9.7k with an upward revision to the previous month's numbers as well. Despite the upbeat print, most of the jobs continued to come through the part-time employment offsetting the decline in full-time workers which led to a weaker Australian dollar.

The US dollar was looking mixed as the greenback pulled back from posting a fresh one-month high yesterday. Better than expected inflation data and retail sales stoked expectations of a March rate hike, but the dollar failed to capitalize on the gains inching lower by yesterday's close.

The economic calendar today is light, with the ECB due to release the monetary policy meeting accounts from the January ECB meeting while the US session will see the building permits and weekly unemployment claims.

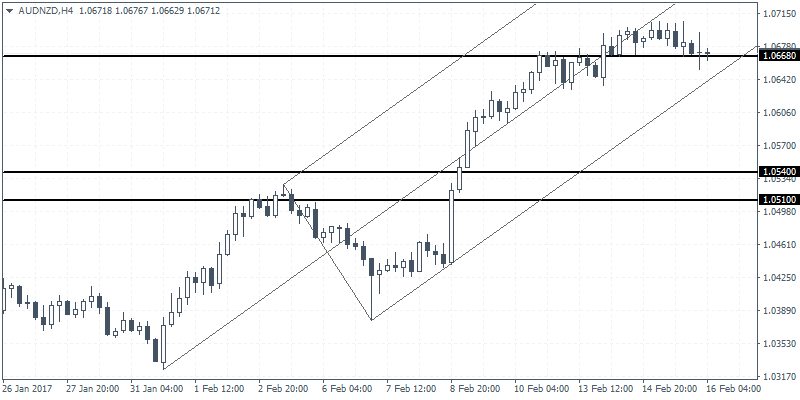

AUD/NZD intra-day analysis

AUD/NZD (1.0671): The price action in AUD/NZD is showing signs of stalling after the rally from late January this year sent the currency pair rising to a 4-month high. Price briefly touched the highs of 1.0705 yesterday before retreating lower to close on a bearish note. A follow-through is required, preferably with a daily bearish close below 1.0668 to confirm the declines to the downside.

The correction that is likely to happen could see AUD/NZD correct back to test the lower support level at 1.0540 - 1.0510, which remains untested after this level initially served as resistance. Alternately, failure to break down below 1.0668 could see AUD/NZD remain range bound at the current levels with further gains coming only on support being established at 1.0668.

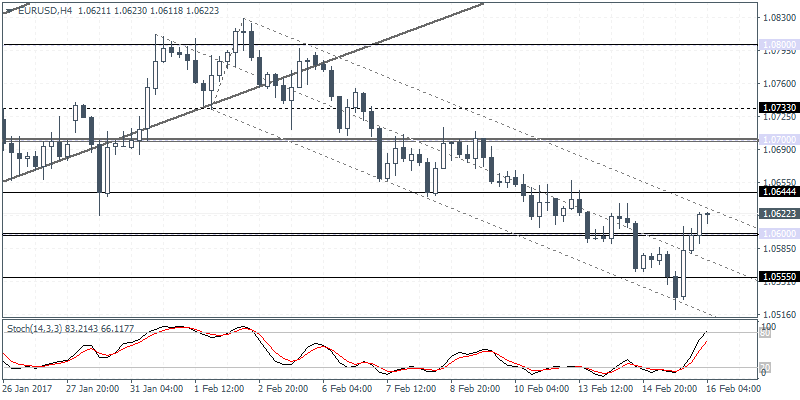

EUR/USD intra-day analysis

EUR/USD (1.0622) posted a strong reversal from the 1.0555 support level yesterday and cleared the price level at 1.0600. Any declines could be seen limited to 1.0600 where support can be established. A higher low is required in EUR/USD which will confirm the bottom ahead of a rally that will see EUR/USD test 1.0700 which forms the next resistance level. The 4-hour Stochastics shows a hidden bearish divergence at the current level which suggests a short-term pullback in prices. As long as 1.0555 is not breached, EUR/USD could remain a buy the dips towards 1.0700.

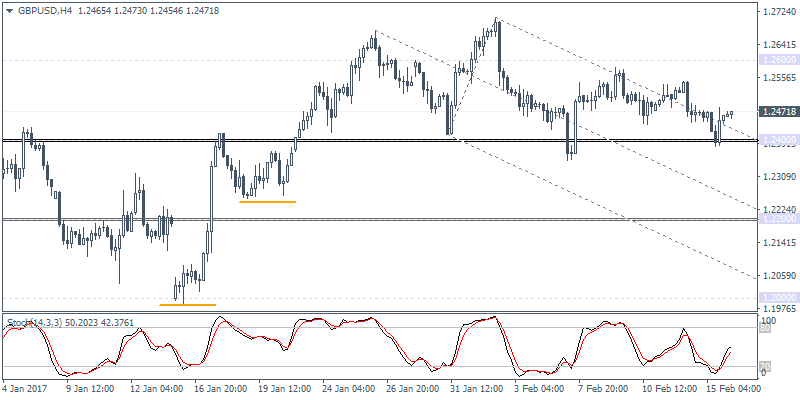

GBP/USD intra-day analysis

GBP/USD (1.2471) fell to the support level 1.2400 yesterday, but price bounced off this level by yesterday's close. The declines came as the monthly jobs report showed that the pace of wages increased only 2.6%, slower than 2.8% registered the month before. Combined with slower than expected inflation print earlier this week saw the GBP come under pressure sending the cable down to 1.2400 level. However, the bounce off this level was rapid just as it was in early February. A continuation to the upside could be seen with 1.2600 coming in as the initial target.