One thing that failing companies like Twitter Inc (NYSE:TWTR) do to scare the bejesus out of sweet bears like me is to yammer on about how they’re going to sell themselves to the top bidder. This causes most bears to break out in a cold sweat about the giant premiums that other companies will pay.

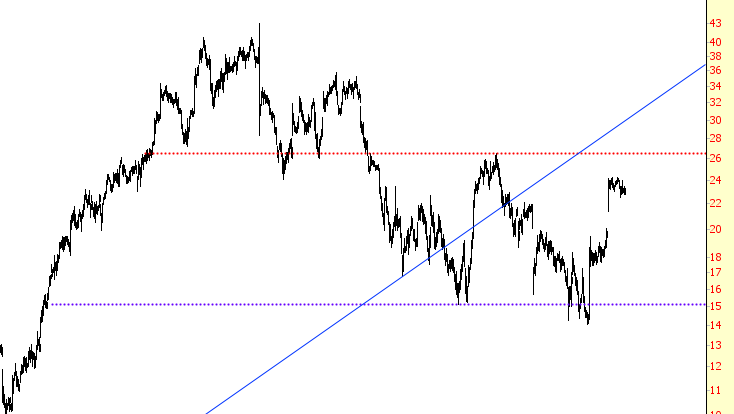

I’ve learned to get over this fear. For instance, one of my 75 short positions is Kate Spade & Co (NYSE:KATE), shown below. Word on the street is that Coach Inc (NYSE:COH) is going to buy them (who else but a seller of overpriced handbags would want to buy another seller of overpriced handbags?)

However, the chart screams “sell” to me, and so I am short it. I would also point out that, as I am typing this, the stock is down about 8% after hours, even though the whole COH/KATE thing is well known.

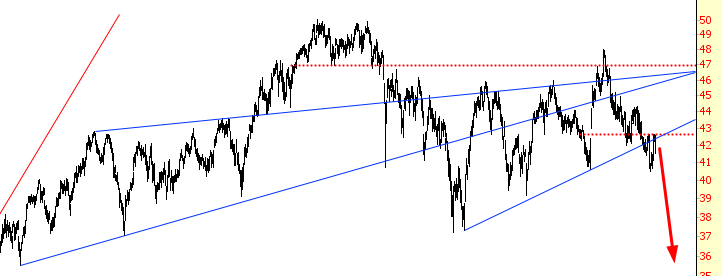

All I can say is that I’m very bearish retail in general, including SPDR S&P Retail (NYSE:XRT), which I am massively short and whose chart is shown below. My view is that retail is (a) screwed and (b) tattooed.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.