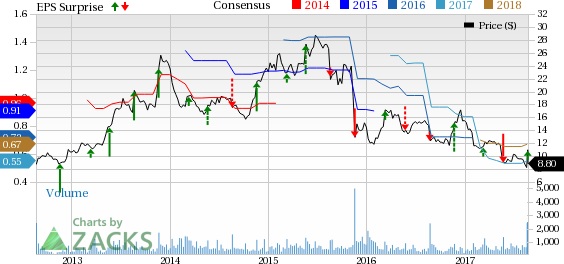

After delivering a disappointing first quarter, Kirkland's, Inc. (NASDAQ:KIRK) posted narrower-than-expected loss and better-than-expected revenues in second-quarter fiscal 2017 following which its share price rose more than 31.0% on Aug 22. In fact, the company’s earnings have beat the Zacks Consensus Estimate in three of the last four quarters, including the reported quarter. The company maintained its fiscal year guidance.

This Brentwood, TN-based company reported adjusted loss of 24 cents which was narrower than the Zacks Consensus Estimate of a loss of 28 cents. However, the reported figure was wider than the adjusted loss of 22 cents in the prior-year quarter. We note that the quarter was impacted by lower gross margins amid a higher promotional environment.

Quarter in Detail

Kirkland's recorded net sales of $131.7 million that increased 7.0% year over year, due to increase in store count as well as comparable store sales (comps) growth. Sales were also driven by improved trends in existing stores, new store productivity, and continued momentum in online activities. Sales also exceeded the Zacks Consensus Estimate of $126.0 million by 4.5%. Further, e-Commerce revenues surged 40% year over year and contributed $14.7 million to total sales in the quarter, up from $13 million in the preceding quarter, driven by a combination of strong increases in website traffic, conversion and average order value.

Including online sales, comps grew 1.2% in comparison with the prior-year quarter, which registered a decline of 4.3%, owing to improvements in conversion and average ticket. We also note that Kirkland’s has been able to effectively market its products, despite persistent decline in traffic amid a tough retail environment. In fact, the company had a positive conversion rate for the fourth consecutive quarter and the higher average ticket, which helped to offset the negative traffic. However, the company continued to witness sluggish sales in Texas.

The home decor retailer’s gross profit expanded 6.4% to $44.9 million in the quarter on the back of higher revenues. However, gross margin declined 20 basis points to 34.2%, due to promotional retail environment which led to a decline in merchandise margins. Also, the company recorded operating loss of $5.7 million, lower than the prior-year loss of $5.9 million.

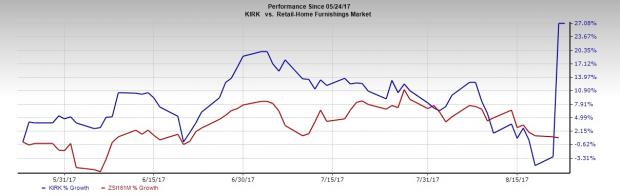

Share Price Performance

We note that shares of Kirkland’s have been declining for last few quarters. However, for the last three months, the company has shown impressive growth on the back of its planned initiatives to drive sales. In fact, the stock surged 27.1% in the last three months compared with the industry, which inched up 0.8%.

Store Updates

The company introduced eight stores while shuttered 3 stores in the quarter, taking the total store count to 406 at the end of the quarter.

In first-quarter fiscal 2017, the company intended to inaugurate 25 to 30 new stores and forecasted to close 20 stores in fiscal 2017. Additionally, it targets to achieve 2-3% square footage during the year.

Other Financial Details

Kirkland's exited the quarter with cash and cash equivalents of $48.7 million compared with $59.8 million in the preceding quarter. Deferred rent and other long-term liabilities were $63.1 million compared with $62.4 million in the previous quarter. Further, net shareholders' equity as of Jul 29, came in at $129.8 million versus $133.3 million as of Apr 29.

Kirkland’s board also authorized a share buyback plan to repurchase up to $10 million of the company's outstanding stock. As of Jul 29, 2017, the company had 16.0 million common shares outstanding.

Fiscal 2017 Guidance

Kirkland’s reiterated its fiscal 2017 earnings outlook (issued on Mar 10) and continues to expect the same in the band of 50-65 cents per share. The guidance is lower than the year-ago earnings per share of 68 cents, however, the Zacks Consensus Estimate of 53 cents for fiscal 2017 is pegged within the guided range. Moreover, the company expects earnings to be higher in the second half of the fiscal year.

Further, management predicts revenues to grow in the range of approximately $10-$11 million over 2016 sales. In fact, the guidance reflects the additional week in the retail calendar for the full year.

Kirkland’s currently carries a Zacks Rank #2 (Buy).

Interested in Retail? Check these 2 Trending Picks

Other well-positioned stocks in the retail space include Tempur Sealy International Inc. (NYSE:TPX) , The Children’s Place, Inc. (NASDAQ:PLCE) and Canada Goose Holdings Inc. (NYSE:GOOS) . All of them carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

While The Children’s Place has an expected long-term earnings growth of 9.0%, Canada Goose and Tempur Sealy have expected earnings growth of 34.1% and 13.6%, respectively, for the next three to five years.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Tempur Sealy International, Inc. (TPX): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Canada Goose Holdings Inc. (GOOS): Free Stock Analysis Report

Kirkland's, Inc. (KIRK): Free Stock Analysis Report

Original post

Zacks Investment Research