The US Dollar has had its ups and downs. But since June it really has not done much. A sideways pattern for nearly 5 months. This has been in what has been historically a 7 year uptrend for the greenback. Really a move higher in 2014 and then nothing for 4 years. Is it resuming now?

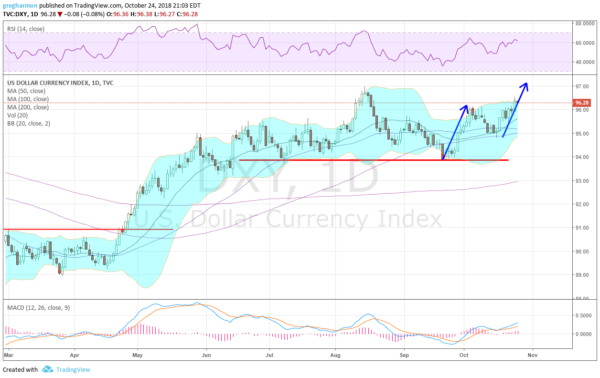

The chart below shows why it might be. After a bounce off of 6 month support, the Dollar Index rose back towards 96. This was short of the August high, but a good move higher with a 7 day record of positive closes. The pullback that followed found support at a higher low, at the confluence of the 20, 50 and 100 day SMA’s.

Since then it has been moving higher and Tuesday made a higher high. This establishes a target to just over 97 on this leg up. That would be a nearly 2 year high and continue the reversal from the bottom earlier this year. With interest rates projected to continue higher, and earnings reports continuing to come in strong, it seems like the US Dollar is ready to rally.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.