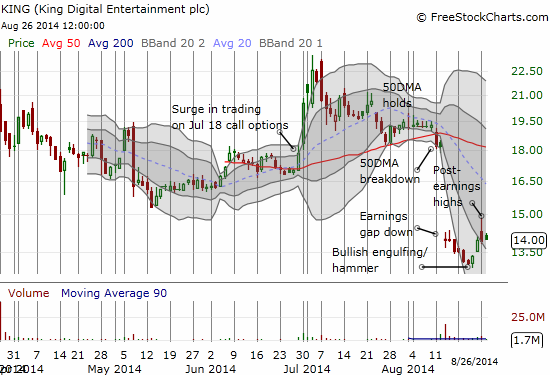

Do not count out King Digital (NYSE:KING) just yet? Almost two weeks after a post-earnings implosion, KING is showing some signs of life. The stock may even be scratching its way to a (short-term?) sustainable bottom.

King Digital struggles t carve out a bottom

The chart above shows that buyers finally showed up in KING as it punched through the $13 level. The resulting positive close on the day formed a bullish engulfing pattern that can often signal a bottom under these conditions. The bullish turn was confirmed the next day with more buying on volume. On the third day, the stock even temporarily broke through to new post-earnings highs – a sign that buyers are slowly but surely taking over control. For aggressive traders that dare to play this bottom there should be plenty of churn going forward to buy the stock at slightly lower prices. This setup benefits from a very clear stop at fresh all-time lows. I estimate upside potential first to the previous all-time low around $15.20 and then the 50DMA around $17.75.

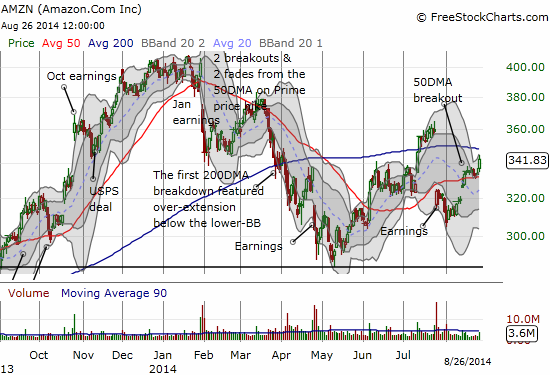

Amazon.com (NASDAQ:AMZN) continues to live up to its AMaZiNg stock symbol. Just as I was counting out the stock based on bearish post-earnings performance, the stock made a 180 degree turn and returned to my initial bullish read (frustrating whiplash!). It took less than two weeks for a fresh 50-day moving average (DMA) breakout. A 3.1% surge off the 50DMA as support in the wake of news that AMZN paid about $975M for Twitch seems to all but confirm the buyers are back and firmly supporting the stock once again.

Amazon.com turns up sharply on a post-earnings recovery

I now have to assume that as long as the stock market is on a bullish march, AMZN will follow.

Full disclosure: no positions