A month has gone by since the last earnings report for Kinder Morgan, Inc. (NYSE:KMI) . Shares have lost about 10.5% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Second-Quarter 2017 Results

Kinder Morgan reported second-quarter 2017 earnings of $0.14 per share from continuing operations in-line with the Zacks Consensus Estimate but decreased 6.7% from $0.15 reported a year ago.

Total revenue for the quarter jumped 7.1% year over year to $3,368 million. Moreover, the top line surpassed the Zacks Consensus Estimate of $3,122 million.

Higher contribution from Elba Express pipeline along with improved CO2 volumes supported the second quarter results. Increased contribution from the liquid terminals and successful initial public offering of its Canadian business, together with the Elba, Utopia and SNG joint ventures also contributed to the growth. It was partially offset by higher expenses and the negative impact on tariff rates of Colorado Interstate Gas Company pipeline following the rate case settlement in 2016.

Dividend

Kinder Morgan maintained its quarterly dividend at $0.125 per share ($0.50 per share annualized).

Segment Analysis

Natural Gas Pipelines: Operating income from this segment was $907 million, down 6.2% from $967 million in the year-ago comparable quarter. The downside was due to divestment of 50% interest in its SNG during the third quarter of 2016along with lower volumes that impacted most of its midstream gathering and processing assets. Further, an adverse impact on the tariff rates of Colorado Interstate Gas Company pipeline following the rate case settlement in2016 contributed to lower income.

The negatives were partially offset by improved contributions from Tennessee Gas Pipeline (TGP) owing to incremental short-term capacity sales and projects commissioned. Higher results from the Elba Express pipeline and better performances by the Texas Intrastate pipelines are favorable factors as well.

CO2: The segment reported earnings of $221 million, which increased 8% from $204 million in second-quarter 2016. Higher volumes owing to considerable demand from third parties supported the improvement. However, the upside was partially limited by lower commodity prices.

Terminals: This business unit reported profit of $304 million, which improved 1%from $302 million in the April–June quarter of 2016, mainly due to significant contributions from the liquid terminals.

Products Pipelines: This segment recorded earnings of $324 million, up 11% year over year. Higher refined products volumes were responsible for the improvement and were partially offset by higher expenses.

Kinder Morgan Canada: The segment reported earnings of $43 million, which decreased 7% from $46 million in second-quarter 2016. Lower income was attributable to higher expenses and a 21% decrease in volumes to Washington state, owing to a shift in deliveries from Washington to British Columbia destinations.

Operational Highlights

Total expenses in the quarter were $2,446 million, up 11% from $2,204 million spent in the second quarter of 2016.

Operating income of $922 million went down nearly 2% from $940 million in the year-ago quarter.

Second-quarter net income of $337 million increased from $333 million in the comparable quarter in 2016.

Financials

The company reported second-quarter distributable cash flow of $1,022 million compared with $1,050 million in the prior-year quarter. The company had a project backlog of $12.2 billion at the end of the quarter as against $11.7 billion at the end of prior year quarter.

As of Jun 30, Kinder Morgan had cash and cash equivalents of $452 million. The company’s long-term debt amounted to $33,900 million at the end of the quarter. Total debt-to-capitalization ratio at the end of second-quarter 2017 was 48.4%.

Outlook

Kinder Morgan reaffirmed its dividend guidance. The company is likely to pay dividends of $0.50 per share in 2017. For 2018, Kinder Morgan projects a yearly dividend of $0.80 per share, reflecting a 60% rise from the projected dividend level for 2017. On top of that, for 2019 and 2020, the company projects a 25% increase in dividend.

It continues to expect EBITDA and distributable cash flow of about $7.2 billion and $4.46 billion, respectively.

For 2017, Kinder Morgan anticipates the capital expenditure projection at about $3.2 billion for growth projects. The company will likely finance the investment through cash flow that are generated internally.

How Have Estimates Been Moving Since Then?

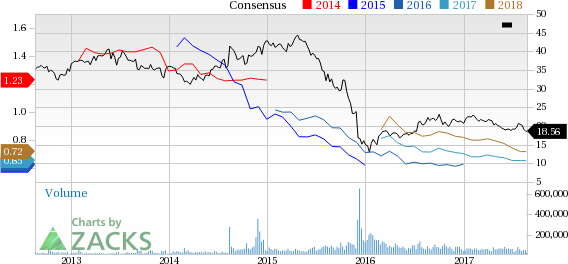

It turns out, fresh estimates flatlined during the past month. There has been one revision higher for the current quarter compared to one lower.

VGM Scores

At this time, Kinder Morgan's stock has a subpar Growth Score of D, a grade with the same score on the momentum front.The stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is suitable solely for value investors.

Outlook

The stock has a Zacks Rank #4 (Sell). We are expecting below average return from the stock in the next few months.

Kinder Morgan, Inc. (KMI): Free Stock Analysis Report

Original post

Zacks Investment Research