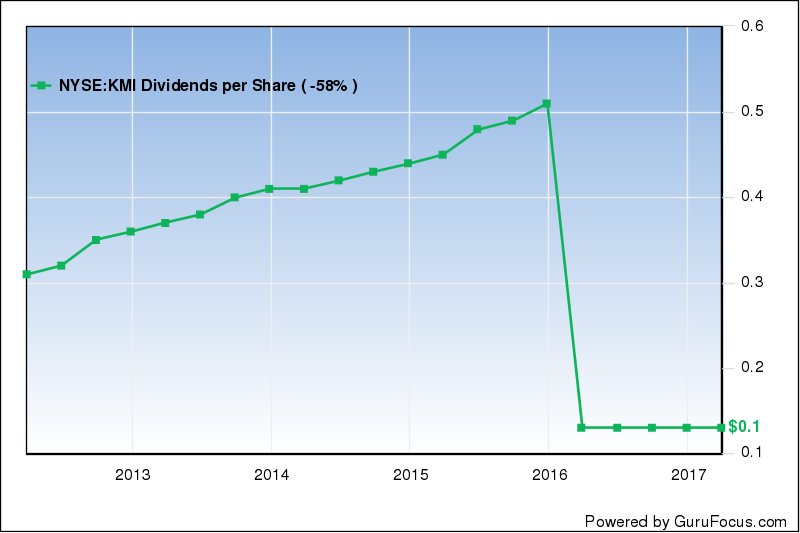

Long-suffering Kinder Morgan (NYSE:KMI) longs got some welcome news this week. After nearly two years of reduced payouts, Kinder Morgan will be aggressively hiking its dividend next year. Kinder boost its annual payout from $0.50 to $0.80 next year and plans to push it to $1.25 per share by 2020. That amounts to a 60% increase next year and 25% annual growth for the two following years.

KMI Slashed Dividend In 2015

And it doesn’t stop there. KMI is also undertaking a $2 billion share repurchase, which is equal to about 5% of the company’s market cap at current prices.

And perhaps most importantly, Kinder expects to do all of this — along with funding new growth projects — with current cash flows, without having to tap into the debt markets.

From the press release:

Importantly, these steps to return value to our shareholders will not come at the detriment of our balance sheet. In fact, we expect to continue to fund all growth capital through operating cash flows with no need for external funding for growth capital at KMI,” said Kinder. “As previously announced, we expect to end 2017 at a 5.2 times net debt-to-Adjusted EBITDA ratio, ahead of plan, and remain committed to a leverage target of approximately 5.0 times. We are extremely pleased with the company’s financial strength, and today’s announcement is confirmation of that strength.

I’ve expected this for a while. Facing a hostile market and a prohibitively high cost of capital, Kinder opted to “self fund” its growth projects by slashing its dividend in late 2015. In the nearly two years that have passed, the company has added quality assets while also chipping away at its debt load.

Beyond 2020, KMI may never be the aggressive dividend-raising machine it was prior to its 2015 cut, but that’s OK. The newer, more conservative Kinder Morgan should still be a fantastic cash generator for yield-hungry investors.

Disclosures: Long KMI