Kimberly-Clark Corporation (NYSE:KMB) came out with fourth-quarter 2017 results, wherein adjusted earnings of $1.57 a share beat the Zacks Consensus Estimate of $1.54 and surged 8.3% from the prior-year quarter.

Additionally, management projects 2018 earnings in the range of $6.90 and $7.20 per share. The current Zacks Consensus Estimate for 2018 is pegged at $6.56.

Earnings Estimate Revision: The Zacks Consensus Estimate for 2018 has declined by a cent in the last seven days. Nevertheless, in the trailing four quarters, excluding the quarter under review, the company outperformed the Zacks Consensus Estimate by an average of 2%.

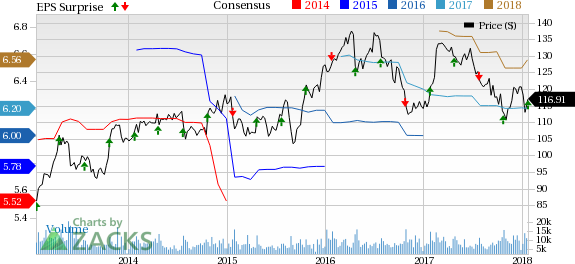

Kimberly-Clark Corporation Price, Consensus and EPS Surprise

Revenues: Kimberly-Clark’s generated total revenue of $4,582 million that increased 1% year over year but missed of the Zacks Consensus Estimate of $4,597 million. Management now forecasts 2018 sales to increase in the range of 1-2%.

Key Events: Kimberly-Clark’s board hiked dividend by 3.1% alongside the quarterly results. The company also announced a new 2018 Global Restructuring Program. Also during the quarter Kimberly-Clark repurchased 0.9 million shares for approximately $100 million.

Zacks Rank: Currently, Kimberly-Clark carries a Zacks Rank #3 (Hold) which is subject to change following the earnings announcement.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Stock Movement: Kimberly-Clark shares are up nearly 1.1% during pre-market trading hours following the earnings release.

Check back later for our full write up on Michael Kors’ earnings report!

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Kimberly-Clark Corporation (KMB): Free Stock Analysis Report

Original post

Zacks Investment Research