Kimberly-Clark Corporation (NYSE:KMB) is set to report second-quarter 2017 results before the opening bell on Jul 25. Investors want to know whether the company will deliver a positive earnings surprise in the to-be-reported quarter. The company’s earnings exceeded the Zacks Consensus Estimate in three of the trailing four quarters, with an average beat of 1.5%.

A look into Kimberly-Clark’s stock performance, reveals that its shares have been underperforming the Zacks categorized Consumer Products–Staples industry in the past three months. In the said time frame, stocks of the company went down 4.6%, compared with the industry’s decline of 0.6%.

Let’s see how things are shaping up prior to this announcement.

Which Way are Estimates Trending

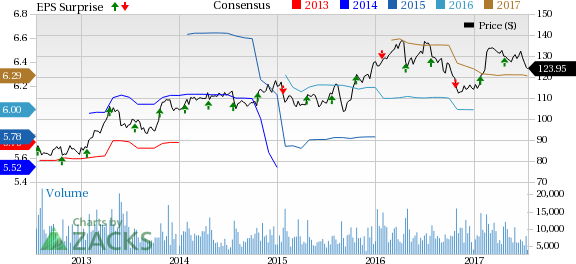

A look at the estimate revision would give us an idea regarding analyst’s expectations right before the company releases its earnings. The Zacks Consensus Estimate for second quarter decreased by a penny in the past 30 days while the same has remained stable for fiscal 2017 at $6.29. However, the Zacks Consensus Estimate of $1.50 per share for the second quarter reflects a year-over-year decrease of 2%. Further, analysts polled by Zacks expect revenues of $4.58 billion for the said quarter, a 0.2% decline from the year-ago period, while the same for fiscal 2017 is pegged at $18.5 billion.

.jpg)

What Does the Zacks Model Unveil?

Our proven model does not conclusively show that Kimberly-Clark is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Kimberly-Clark has an Earnings ESP of 0.00% as the Most Accurate estimate and the Zacks Consensus Estimate are pegged at $1.50. The company carries a Zacks Rank #3, which increases the predictive power of ESP. However, its ESP of 0.00% makes surprise prediction difficult.

Kimberly-Clark Corporation Price, Consensus and EPS Surprise

Factors Influencing the Quarter

Kimberly-Clark has been dealing with decelerated organic sales growth, especially in developing and emerging markets over the past few quarters. The decline in sales growth is primarily due to lower volumes and a difficult economic scenario. Moreover, the company’s diaper segment is witnessing lower market share and higher competitive promotional activity as consumers are seen to shift to either premium or less expensive diaper offerings.

Nonetheless, the company is focused on improving its performance through regular innovation. In the near term, it has a number of innovations lined up for launch in North America. The company has been aggressively cutting costs through its FORCE program that has been generating higher cost savings each year. The program generated costs savings of $435 million in 2016 and expects savings of at least $400 million in 2017. Evidently, it already achieved $110 million of cost savings in the first quarter.

Kimberly-Clark is well positioned in the overseas and has been regularly expanding in diverse regions. Though the company has strong long-term growth prospects in developing and emerging markets, it expects only modest improvement in the overall environment in 2017, particularly in the second half.

Still Interested in Consumer Staples Stocks? Check these

Here are some companies in the Consumer Staple sector you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Tyson Foods, Inc. (NYSE:TSN) has an Earnings ESP of +1.64% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Newell Brands Inc. (NYSE:NWL) has an Earnings ESP of +1.18% and carries a Zacks Rank # 2.

Energizer Holdings, Inc. (NYSE:ENR) has an Earnings ESP of +8.33% and carries a Zacks Rank # 2.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Kimberly-Clark Corporation (KMB): Free Stock Analysis Report

Newell Brands Inc. (NWL): Free Stock Analysis Report

Energizer Holdings, Inc. (ENR): Get Free Report

Tyson Foods, Inc. (TSN): Free Stock Analysis Report

Original post